Buying back the battlers

AT A GLANCE | Treasurer targets crucial seats with tax relief and spending.

Josh Frydenberg has targeted crucial suburban and regional seats with personal income-tax relief, improved essential services and $100bn in infrastructure spending over a decade.

“This Budget builds on our plan for a stronger economy. A stronger economy that benefits you — your family, your business, your community, your country,’’ — Treasurer Josh Frydenberg, Budget speech.

-

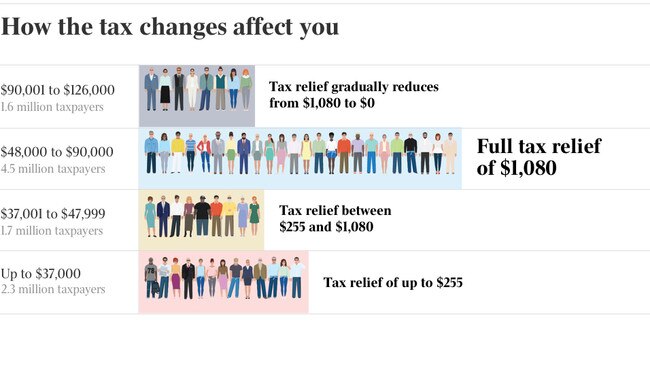

THE TAX CUTS

2.3m people earning up to $37,000 get $255

1.7m people earning $37,000 to $47,999 get between $255 and $1080

4.5m people earning $48,000 to $90,000 get $1080

1.6m people earning $90,000 to $126,000 get between $1080 and $0

-

FUTURE TAX PROMISES

19 per cent tax bracket top threshold to be increased from $41,000 to $45,000 in 2022-23 and the low income tax offset from $645 to $700.

From July 1, 2024, 32.5 per cent tax rate to be lowered to 30 per cent.

-

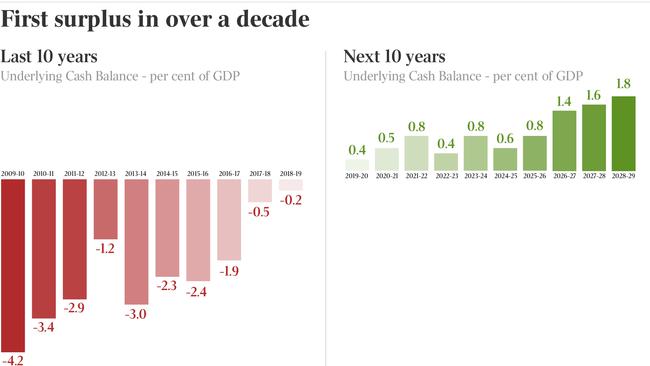

THE SURPLUS

Surplus of $7.1bn, first since Global Financial Crisis in 2007-08 and up from a deficit of $4.2bn in 2018-19.

-

HANDOUTS

Energy Assistance Payment of $75 for singles and $62.50 for each member of a couple costing $284.4m over two years.

-

FAMILY BUSINESS

Instant asset write-off threshold immediately increases from $25,000 to $30,000 per asset. Access expanded from businesses with $10m turnover to businesses with turnover of $50m immediately.

-

TRAINING THE TRADIES

$525.3 million over five years to improve the quality of the Vocational Education and Training system.

80,000 new apprenticeships with $8000 incentive payments for employers to take apprentices and $2000 incentive payment for apprentices.

-

PRE-SCHOOLS

$453m to extend preschool education and allow 350,000 children to receive 15 hours of early learning per week in the year before school.

-

EASING THE SQUEEZE

$500m for a commuter carpark fund to allow more people to park and ride.

Urban congestion fund to be topped up from $1bn to $4bn to target suburban bottlenecks and cut travel times within cities.

Congestion-busting packages worth $7.3bn in NSW, $6.2bn in Victoria, $4bn in Qld, $1.6bn in WA, $2.6bn in SA, $313m in Tasmania $622m in the NT.

-

FAST TRAINS

$2bn to help deliver fast rail between Melbourne and Geelong, cutting the journey to 32 minutes.

$40m for assessments of fast rail from Sydney to Wollongong and Parkes (via Bathurst and Orange); from Melbourne to Albury-Wodonga and Traralgon; from Brisbane to Gold Coast and Sunshine Coast.

-

FAST FREIGHT

$1bn to improve freight routes and access to ports.

-

REGIONS

Upgrade for Townsville hospital.

$543m including $184m to support tourism along the Great Ocean Road and in Geelong; $216m to upgrade visitor facilities in Kakadu.

Deals to boost the Barkly region covering Tennant Creek in the NT, Hinkler covering Bundaberg and Hervey Bay in Qld and Albury-Wodonga on the NSW and Victorian border.

$102m for grants to upgrade regional airports

-

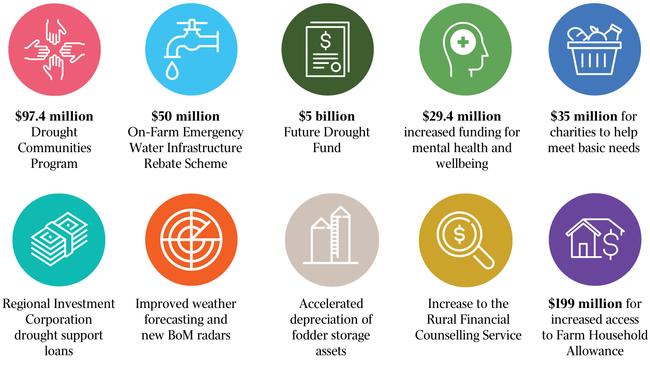

HELPING FARMERS

$6.3bn in drought assistance and concessional loans for farmers.

-

COMMUNITY AND DISABILITY

$527.9m over five years for the Royal Commission into Violence, Abuse, Neglect and Exploitation of People with a Disability.

$84m respite package for carers.

Donations to Men’s and Women’s Sheds to gain tax deductible status for donations from July 1, 2020.

$328m women’s safety package to deal with domestic violence.

-

HEALTH

$331m for new cancer drugs.

$5bn for a 10-year investment under the Medical Research Future Fund to search for breakthroughs.

$736.6m for mental health including 30 new headspace centres to address youth suicide.

$448.3m for GPs to help older patients manage chronic illness.

-

AGED CARE

$5.9bn for Commonwealth home support program to provide in-home help for the elderly.

-

ENVIRONMENT

$3.5bn climate package including $2bn for “practical emissions reduction activities’’.

$100m Environment Restoration Fund to deliver large-scale environmental projects including protecting habitats of endangered species, the nation’s coasts and cleaning up waste.

-

THE BIG STICK

Tax compliance crackdown to see big companies and high wealth individuals pay $3.6bn more over four years.

$2.1bn in savings over five years by upgrading social security income reporting arrangements.

-

CORRUPTION

$104.5m to establish a Commonwealth Integrity Commission.