Business urges more focus on growth

Labor’s second budget was a missed opportunity to boost investment and lift Australia’s economy out of its ‘productivity malaise’.

Labor’s second budget was a missed opportunity to boost investment and raise Australia’s speed limit for economic growth, which will put living standards at risk and make it more difficult to pursue fiscal repair, business groups and experts warned.

Chief executive of employer association Ai Group Innes Willox said the budget “lacks the urgency and imagination required to power the economy through a period of anaemic growth”.

“It offers little to kickstart the structural reforms needed to boost productivity, investment, innovation, job creation and sustainable real incomes growth,” Mr Willox said. “The government has used its one-off surplus, driven by elevated commodity prices, the strong labour market and fiscal drag to pay off debt and reduce future interest payments.

“It has prioritised household-based subsidies and handouts rather than focusing on productivity improvements to lift the economy out of its long-term productivity malaise.”

Productivity has been stagnant since 2019, and in the decade preceding the pandemic recorded its worst performance in six decades.

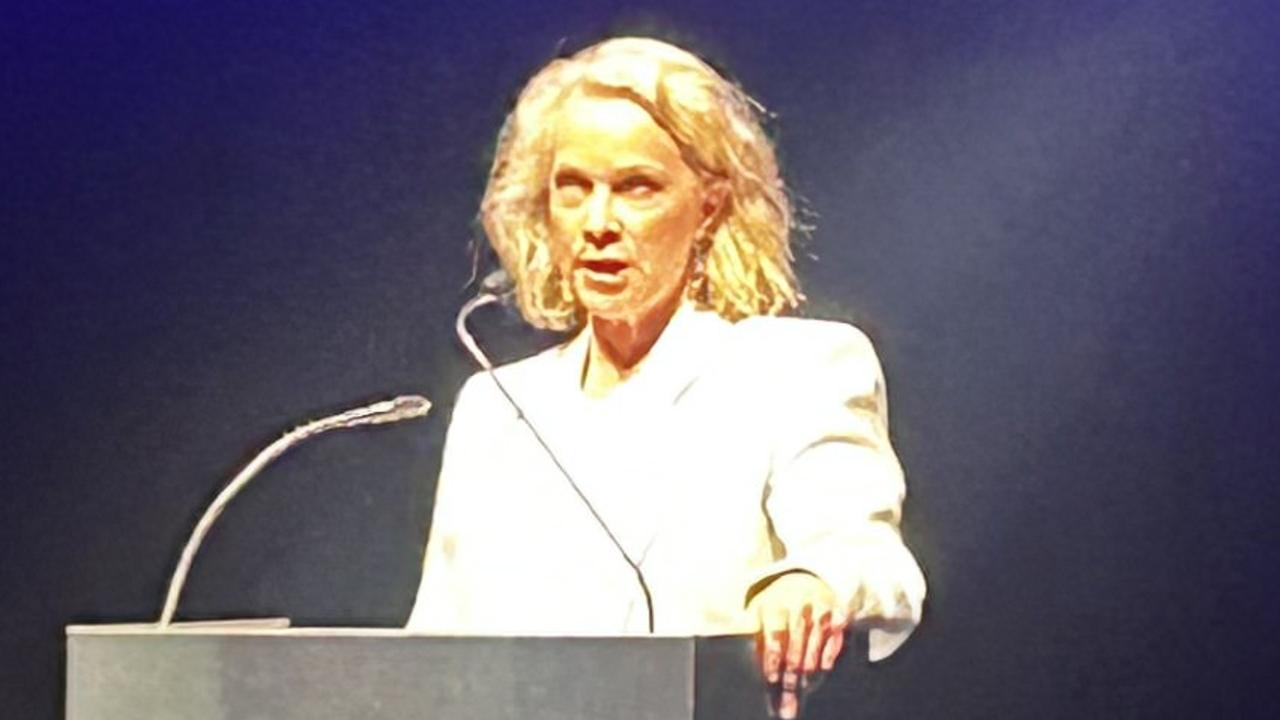

Business Council of Australia chief executive Jennifer Westacott said companies were at the heart of the nation’s employment revival and Canberra’s expected underlying cash surplus of $4.2bn in the current financial year.

“Now is the time to put our foot on the pedal to accelerate growth by unleashing the private sector, reducing red tape, making it easier to do business, and realising the full potential of all Australians,” Ms Westacott said.

“There is a missed opportunity to drive whole-of-economy growth through incentivising investment, which remains the key to lifting productivity, delivering higher wages and ensuring sustainable returns to government.

“Australia cannot continue to turn a blind eye to our investment drought and poor productivity, which risks other countries overtaking us and important projects and new industries going offshore.

“Growing the economy by 3.5 per cent a year over the forward estimates would help deliver a budget surplus,” she said.

In its quarterly Statement on Monetary Policy, published days before the budget, the Reserve Bank warned the productivity slump could entrench high inflation, leading to extra interest rate rises, job losses and stagnant living standards.

RBA governor Philip Lowe has argued raising productivity and boosting the economy’s “supply side” would help the central bank return inflation to its 2 to 3 per cent target while preserving recent employment gains.

“We need to put our shoulder to the wheel here and do what we can to lift productivity growth because that’s the only way we can have faster growth in real wages,” he said in a speech last week.

The budget papers show economic growth slowing to a crawl this year and next, although a record 715,000 net inflow of migrants this year and next would offset weakening consumer demand after 11 cash rate increases in the past year by the RBA.

In his post-budget address to the National Press Club, Jim Chalmers said the government’s goal to raise growth “has always been to engage on the supply side, by investing in people, in productivity, in participation … and in the biggest opportunity of this defining decade – the energy transformation,” the Treasurer said.

“You saw last night that the additional $4bn we dedicated to the energy transformation brought this government’s investment in the industrial and economic opportunities of cleaner and cheaper energy to $40bn – making it a key focus of our growth strategy.”

Deloitte Access Economics lead partner Pradeep Philip said the budget faced “a tough balancing act in an environment of a slowing, volatile global economy”.

“By banking the vast bulk of the cyclical windfalls, budget repair has been a clear priority,” Dr Philip said. “While investment and driving productivity took a back seat to rebalancing the budget, the focus on the energy transition and linking that to the re-industrialisation of the economy is a major signpost for investment and productivity in this budget.

“The budget papers confirm the necessity for economic reforms to lift investment and productivity in the economy as this is the only way to sustainably create jobs and incomes. This is both urgent and critical.”

Ms Westacott said the budget “exposes some inherent risks in our long-term fiscal position”.

“It is therefore crucial we continue to set strong fiscal rules in tandem with important reforms to government services,” she said.

“Accelerating growth is key to sustaining stronger budgets and higher wages; as well as driving big investments in the clean energy sector, infrastructure projects and creating new industries.”