Business baulks at Queensland government’s ability to spend hand over fist

Queensland business has lashed the Palaszczuk government’s management of the economy after a scathing audit.

Queensland business has lashed the Palaszczuk government’s management of the economy, after a damning audit warned that revenue growth was being outstripped by spending, particularly on the expanding bureaucracy.

In his latest assessment of the state’s books, Auditor-General Brendan Worrall found the government risks not being able to meet its operating costs with revenue alone, unless it can increase revenue or stall spending growth.

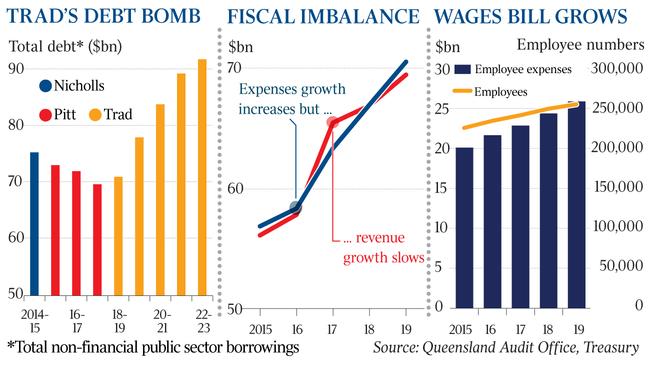

The state’s total debt is increasing — forecast to hit $91.8bn by 2022-23 — and public service growth has exploded, with employee expenses surging $1.5bn (or 6.2 per cent) in 2018-19 alone. The government is borrowing to build $49.5bn in capital infrastructure, including the $5.4bn Cross River Rail public transport project.

Mr Worrall’s report into the 2018-19 results of financial audits found that since 2016-17, the government’s expenses have increased by $7.3bn (11 per cent) but total revenue has increased by only $4bn (6 per cent).

“Unless the Queensland government can increase its revenue or constrain the recent growth in its expenses, it risks not being able to meet the cost of its activities from the revenue it earns going forward,” Mr Worrall said.

“The Queensland government faces several uncertainties around its future revenue, including the level of grant funding provided by the Australian government.”

He warned that further pressure would be put on the budget by “emerging liabilities”, including compensation payouts flowing from the 2011 floods class action, and a landmark native title compensation case.

The federal government cut Queensland’s share of GST revenue by $800m in 2018-19, and this financial year state revenues have been slashed further by the plunging coal price and sluggish land tax and stamp duty returns.

Queensland Treasurer and Deputy Premier Jackie Trad has brought forward her third state budget to April 28, instead of its normal date in June, ahead of the next election on October 31.

The state’s business sector seized on Mr Worrall’s report as further fuel for its concerns about fiscal management and the state of the economy. Marcus Smith, the chief economist for small business lobby the Chamber of Commerce and Industry Queensland, said the assessment was “troubling”.

“It’s particularly troubling that the audit has raised concerns about whether the Queensland government can increase its revenue or constrain its ballooning public administration to be able to meet the costs of its activities in future,” Dr Smith said.

“We currently have the worst business conditions on record in the state. Business continues to be burdened by more bureaucracy and an increased level of compliance that goes with it.”

Ai Group Queensland head Rebecca Andrews said the peak employer organisation was also concerned that expenditure was increasing faster than revenue.

“In the MYFER report (released in December), economic growth for Queensland was 2.5 per cent, which was trending below the 3 per cent forecast,” Ms Andrews said. She said she backed Mr Worrall’s assessment that it could be reasonable for governments to borrow to build infrastructure, “provided an appropriate repayment plan is in place”.

But she said the government should include private sector investment in its debt-repayment plan by reversing its rejection of privatisation.

Both Labor and the LNP in Queensland have ruled out any form of privatisation after both sides of politics were punished at the ballot box over the issue.

A spokesman for Ms Trad said the Queensland Future Fund — announced at the December mid-year fiscal and economic review — would deliver responsible budget management and ensure Queenslanders got access to the services and infrastructure they deserved.

“The creation of the Queensland Future Fund aligns with the guidance of the independent ratings agencies by delivering a measured and responsible plan to address debt,” the spokesman said.

He also pointed to the Treasurer’s razor gang, formed at last year’s budget, which has found $715m in savings this financial year.

Opposition Deputy Leader Tim Mander said the state’s fiscal position was locked in a “downward spiral” under Labor.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout