Federal budget 2023: Business and industry leaders see disadvantage in hard tax cap

Business leaders have endorsed Jim Chalmers’ decision not to put a hard ceiling on tax, after Peter Dutton argued in favour of restoring the 23.9 per cent tax-to-GDP cap.

Business and industry leaders have endorsed Jim Chalmers’ decision not to put a hard ceiling on tax, after Peter Dutton used his budget reply speech to argue in favour of restoring the 23.9 per cent tax-to-GDP cap.

While insisting on the need for a disciplined approach to government spending, business has instead pushed for an urgent shake-up to the tax mix and sounded the alarm on an over reliance on the personal income tax take.

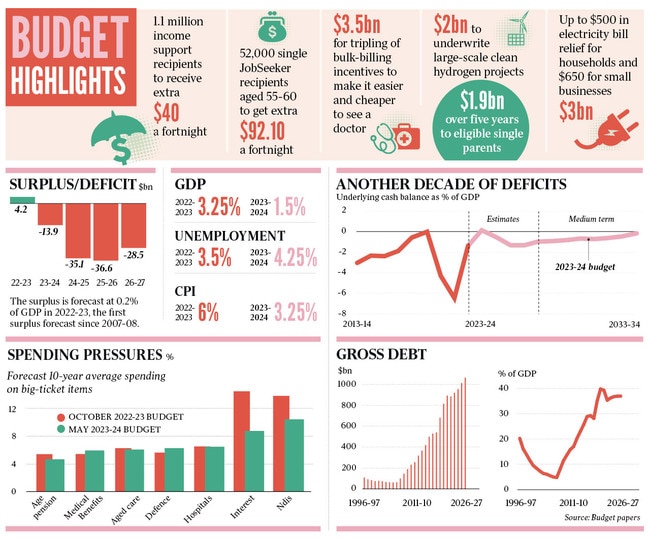

The budget shows tax will grow to 24.4 per cent of GDP over the decade, with the Opposition Leader warning on Thursday night that the tax paid by Australians would increase by more than $300bn over the next five years.

Australian Industry Group chief executive Innes Willox said that “one clear disadvantage of a hard cap relates to the cyclical nature of revenue collections”.

“Particularly when we have an economy with such a large commodity component as ours, we would not want governments to be forced to react to current-year revenue windfalls by weakening the overall tax base just in order to meet the cap … We think there are better ways to improve fiscal discipline by clarifying accountabilities and fearless audit programs.”

Mr Willox said the economic performance between nations was poorly correlated with countries’ tax-to-GDP ratios, and that a more important factor was the structure of tax arrangements.

“We are concerned at Australia’s over-reliance on the taxation of income. We are world-beating in this respect, both in terms of income taxes as a share of total tax collections and as a share of GDP.”

According to budget papers, the rise in employment and wages will grow the share of income tax from 48 per cent of the total tax take last financial year to more than 50 per cent this year. It will then rise to almost 52 per cent in 2023-24, and will remain above half during the forward estimates.

Without the stage-three tax cuts, which begin in July 2024, the share of tax revenue from personal income tax would be 55 per cent in a decade. That’s higher than at any time since the introduction of the GST in 2000, and compares to the low of 45 per cent at the end of the Howard years in 2007-08.

“A high reliance on personal income tax can leave government revenues vulnerable to changes in the composition of the economy,” the PBO warned in November. “For example, the ageing population is expected to result in a decline in net taxpayers as a share of the total population.”

Australian Chamber of Commerce and Industry chief Andrew McKellar also played down the need for an “artificial cap” on tax, arguing there was a more pressing case for “fundamental tax reform.”

“You’ve got to ensure personal income tax is competitive internationally,” he said. “On company tax, you’ve got to extend the scope for reform through to the medium and larger-sized parts of business. You’ve got to get the balance between direct forms of taxation and indirect forms of taxation.”

Economist Chris Richardson said there was “nothing sacred about 23.9 per cent” and it was “fair to say the cost of running Australia is higher than it used to be”.

“Defence now costs more,” he said. “And a whole range of royal commissions and inquiries pointed out that we haven’t properly funded social services.

“Even if the 23.9 per cent was appropriate before, there is a case it is no longer appropriate.”

The IMF and OECD have also warned that the tax system relies too heavily on income tax and may be a threat to fiscal sustainability and a disincentive to work. Even with the stage three cuts, the average income tax rate will rise to a record 26.7 per cent over 10 years.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout