Budget 2022: Windfall levy and changes to GST ruled out

Jim Chalmers has ruled out changes to the GST or hitting gas exporters with a windfall profits tax as part of a flagged reform package.

Jim Chalmers has ruled out changes to the GST or hitting gas exporters with a windfall profits tax as part of a flagged reform package the government will pursue to lead fiscal repair efforts ahead of the 2025 election.

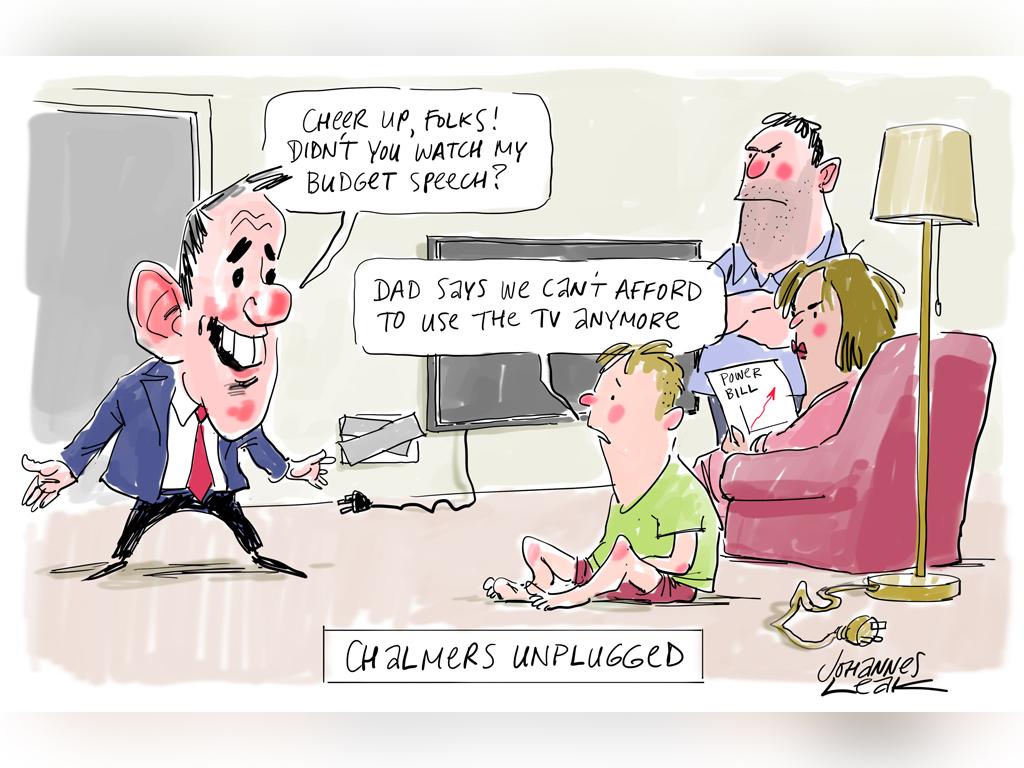

The Treasurer on Wednesday used his National Press Club post-budget address to declare the “days of pretending that we don’t have structural pressures on the budget are over”.

The warning came after Fitch Ratings highlighted “longer-run pressures” on the country’s coveted AAA credit rating from climbing debt and deficits over the coming decade.

Dr Chalmers, who said the multinational tax crackdown was the first in a series of measures to improve the bottom line, did not rule out strengthening the Petroleum Resource Rent Tax, which taxes profits generated from oil and gas commodities.

In November 2018, then-treasurer Josh Frydenberg asked Treasury to review transfer pricing in the PRRT and report back within 18 months.

Dr Chalmers said Treasury’s review into the PRRT, which multiple governments have baulked at overhauling, was recently reactivated after being shelved during the pandemic.

With the government looking at how to increase supply and reliability in the domestic gas market, Dr Chalmers said revisiting the PRRT was “not currently something that we’re focused on” but did not rule out future tweaks to the tax regime.

The budget papers show that the PRRT was forecast to raise $2.6bn in 2022-23, a $200m improvement compared with the pre-election fiscal outlook.

Based on conservative commodity price estimates, the PRRT is down $450m over the four years to 2025-26.

“I do genuinely understand that a lot of people would like to see it (the PRRT take) go up more, but it has tracked up over the course of recent history when gas prices have been high,” he said.

Dr Chalmers said he would listen to Treasury’s advice on any PRRT changes but noted that gas exporters had made contributions to the big increase in the corporate tax take that contributed to the improved deficit estimated in this year and the next.

Facing mammoth debt and deficit levels over the next decade, as the costs of servicing debt and the National Disability Insurance Scheme spiral out of control, Dr Chalmers is preparing deeper cuts in the next “two or three” budgets before the 2025 election.

“(We are) being upfront about the sorts of things that the nation needs to contemplate: how we trim spending, how we show budget restraint, and whether we’ve got the best tax system that we can have and that is fit for purpose for the challenges we confront,” he said.

He said Tuesday’s budget was the “beginning” of a longer fiscal repair job, which will continue in the lead-up to the next two budgets. And he ruled out changes to the GST or introducing a British-style windfall profits tax on gas exporters, who have banked significant revenue as a result of the global energy crunch triggered by Russia’s invasion of Ukraine.

Dr Chalmers said raising or broadening the GST was “not a path that we intend to go down”.

“We’re worried about the distributional impacts of increasing the GST,” he added.

Fitch director of sovereign ratings Jeremy Zook said the budget’s conservative commodity price assumptions suggested scope for better than anticipated deficits in the near term.

But Mr Zook said “the budget did not show further fiscal consolidation in its long-term forecasts, highlighting potential longer-run rating pressures as Australia’s gross general government debt-to-GDP ratio in the high 50 per cent range stands above the 40 per cent AAA median”.

Finance Minister Katy Gallagher, who is leading a rolling government expenditure audit which has already repurposed $22bn in savings, said “we are going to have to do more because we need to repair the budget”.

“We are, with this release of this budget, I think, being very clear about what those challenges are, what it looks like in a fiscal sense, what some of the challenges are managing that deficit going forward,” Senator Gallagher said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout