Budget 2022: ‘We have turned the corner thanks to stronger recovery’

A $103bn improvement in the budget bottom line over five years has set the commonwealth deficit on course to dwindle to just 0.7 per cent of GDP in a decade’s time.

A $103bn improvement in the budget bottom line over five years thanks to a booming economy and record commodity prices has set the commonwealth deficit on course to dwindle to just 0.7 per cent of GDP in a decade’s time.

Josh Frydenberg on Tuesday said “in this budget we are banking the dividend of a stronger recovery”.

“Our budget has turned the corner,” the Treasurer said.

The federal budget for 2022-23 revealed a substantial improvement in the country’s fiscal outlook, as iron and coal export earnings alongside rapid employment growth provide a $142.9bn jump in expected tax receipts, net of payments, over the five years to 2025-26.

With the cost of policy decisions made since MYEFO estimated at $30.4bn, the government was able to boast of a $100bn improvement in deficits over the five years.

The deficits in this and the next financial years are now anticipated to come in at $79.8bn and $78bn, respectively – in both cases, about $20bn less than expected at the December mid-year update.

The underlying cash deficit as a share of the economy will drop from 3.4 per cent in 2022-23, to 1.6 per cent of GDP in 2025-26, equivalent to a deficit of $43.1bn.

The massive upgrade over the forward estimates leaves the deficit on course to fall to 0.7 per cent by 2032-33.

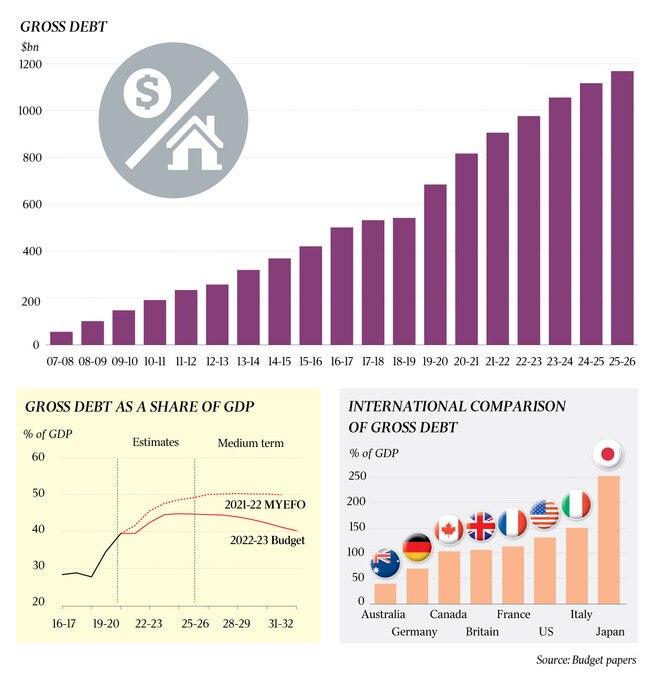

Lower deficits mean debt will peak earlier and lower than predicted in December’s mid-year economic and fiscal update.

The nation’s gross debt will still surpass $1 trillion, but a year later in 2023-24, and is just shy of $1.2 trillion by mid-2026. Net debt as a share of the economy peaks at 33.1 per cent in 2024-25, and falls to 26.9 per cent by 2033.

Despite climbing interest rates around the world, the nation’s interest bill is expected to remain steady at 0.7 per cent of GDP, before inching up to 0.9 per cent by 2025-26.

Treasury’s vastly improved jobs outlook – which has unemployment falling to 3.75 per cent by September, the lowest level since 1974 – alongside the record terms of trade each account for roughly half of the jump in government receipts in this and the next financial year.

After that, a tight labour market will keep income tax receipts elevated over the forward estimates and beyond.

KPMG chief economist Brendan Rynne said the long-term budget projections would likely prove overly optimistic.

“Compared to where we were, this is a remarkable outcome,” Dr Rynne said. “The real challenge is going to be is that the revenue forecasts will be whittled down by slower growth at some point over the economic cycle.”

Dr Rynne also pointed to the need for tough choices at some stage in coming years if the government hopes to bring the budget back to balance.

“I think you do have to factor in higher than expected spending on the NDIS, ageing, and defence: all are structural challenges to the budget over time,” he said.

The budget numbers continue to assume a sharp decline in the price of major commodity exports. Iron ore is assumed to drop from $US134 a tonne to $US55, while metallurgical and thermal coal prices will plunge from $US512 a tonne to $US130, and from $US320 to $US60, respectively.

The Treasurer defended these conservative forecasts, saying his government would not make the mistake of baking higher export earnings in to long-term spending commitments.

Treasury estimated that elevated coal and iron ore prices for a further six months would add $29.5bn over the forward estimates.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout