Big business and blazes put heat on budget surplus

Josh Frydenberg faces pressure to ‘supercharge’ the economy with an investment allowance.

Josh Frydenberg faces pressure from business to “supercharge” the economy with the immediate introduction of an investment allowance, after he softened his stance on delivering a surplus in the May budget following the brutal summer bushfire season.

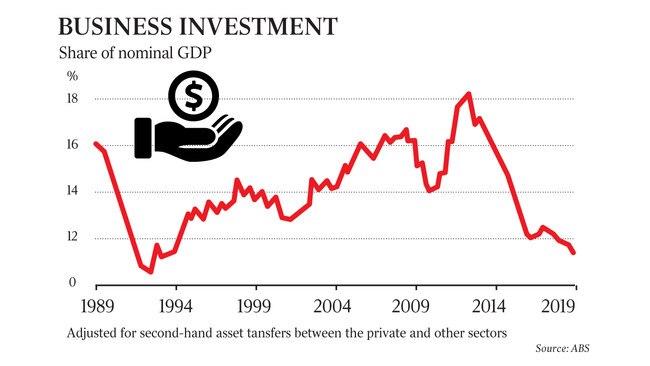

In a bid to combat stagnant productivity growth and stimulate the economy, Australian Industry Group chief executive Innes Willox said the time had come for “fast-acting fiscal policy” headlined by measures to bring forward and increase business investment.

After Scott Morrison said last week the bushfire disaster and drought would have an impact on the Coalition’s estimated $5bn surplus, the Treasurer said on Monday it was too early to determine the full economic impact.

Asked if a budget surplus was unlikely, Mr Frydenberg said: “I’m not in a position to give a firm answer to that question because the full economic impact (of the bushfires) is still uncertain.”

The Treasurer said the mid-year economic and fiscal outlook included an additional $4.2bn for transport infrastructure over the next four years and almost $1.3bn in drought assistance.

“Since MYEFO, we have announced the establishment of the $2bn National Bushfire Recovery Fund that will provide additional funding beyond that which will flow under existing disaster recovery arrangements,” Mr Frydenberg said.

He said there had been encouraging data this month about the Australian economy’s performance towards the end of last year but he warned the “full economic impact of the devastating bushfires is yet to be seen”.

Business Council of Australia president Tim Reed backed the government walking away from the surplus if the bushfire recovery required extra spending.

Writing in The Australian, Mr Willox said a “generous” investment allowance would “supercharge the engine room of the economy”.

“With Australia’s already-decelerating economy savaged by bushfires, the government should act right now to get private sector investment moving to stimulate the broader economy, reignite jobs growth and lift flatlining productivity,” Mr Willox writes.

He says adopting an investment allowance would allow businesses to deduct for tax purposes a “larger proportion of their expenditure on capital equipment in the year of purchase rather than wait till later years to claw back the expenditure”.

The Ai Group proposal, in line with the BCA’s permanent investment allowance detailed in its budget submission last month, would affect the government’s surplus. Mr Willox, who represents the interests of more than 60,000 businesses across the nation, said that for maximum effect the allowance “should be announced as soon as possible”. He called on Mr Frydenberg not to wait until the May budget.

“Otherwise, there would be a strong likelihood that investment — including investment already in the pipeline — would be deferred until after the budget,” Mr Willox said.

“Of course, it would have a budgetary cost — at least at first. However, in later years there would be fewer deductions remaining to be claimed and that would boost the bottom line of future budgets. And, critically the measure would add to employment, income, activity and sales.”

Mr Frydenberg, understood to be weighing up new tax incentives for enterprises in the May budget, said “business needs to back itself and use its balance sheet to invest and grow”.

“The government will continue to engage with the business community about what further reforms can drive even greater investment and further improve our competitiveness,” Mr Frydenberg told The Australian.

Mr Willox said the government needed to be bold and believed the “economy needs to be lifted now”.

The Australian last month reported the centrepiece of the BCA’s budget submission was a broadbased investment allowance to help reboot the economy.

Framed as an “interim measure”, the investment allowance would apply to all investment depreciable under existing tax rules, covering machinery, buildings and energy assets to boost the private-sector economy.

Opposition Treasury spokesman Jim Chalmers said Labor had been calling for a business tax incentive “along these lines” for the past six months as part of a “proportionate and measured stimulus to support the floundering economy”.

A Deloitte Access Economics Business Outlook report released on Monday said that, with global growth easing to under 3 per cent, uncertainty over “truce talks, trade tensions are entrenched”.

“The resultant uncertainty is having an increasingly toxic impact on confidence and investment,” it said.

The report said data showed “investment intentions are getting the wobbles”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout