ANZ gives key port the coal shoulder

ANZ has abandoned the world’s largest coal export port at Newcastle under its climate policy that all but bans loans to the sector.

ANZ has abandoned the world’s largest coal export port at Newcastle after refusing to keep funding the mega-facility under its new climate change policy that all but bans loans to the coal sector.

The resources industry is viewing the bank’s move to ditch the major economic hub north of Sydney as a test case of the new anti-coal and net zero emissions policies of the big four banks.

It has also triggered a strategic contest between the major lenders over the future of the coal industry, with the NSW Hunter Valley economy relying heavily on jobs in coal mines and at the Port of Newcastle.

Rival lender National Australia Bank, which has also adopted an aggressive climate change strategy, will now step in to help underwrite the port, which contributes $1.5bn to GDP and supports 9000 jobs, on the promise of a transition program to “diversified” and sustainable operations.

The ramping up of corporate lending threats against high emissions industries comes as the Morrison government is set to consider exempting trade exposed sectors from its net zero emissions goals.

Deputy Prime Minister Michael McCormack told The Australian “coal plays a significant role in Australia’s energy mix and will continue to do so”.

The Nationals leader used ANZ’s decision to exit business with the Port of Newcastle to accuse Labor of staying silent on “corporate activism”.

“Communities across the Hunter region made it clear at the last election that they wanted strong advocacy from their MPs on local jobs – Labor’s silence on this corporate activism shows they haven’t learnt a thing,” Mr McCormack said.

“Labor abandoned the resources industry and the tens of thousands of people who rely on it for their livelihoods long ago. The only job Anthony Albanese is worried about is his own – Labor has no interest in the jobs our Australian coal industry supports.”

Resources Minister Keith Pitt also slammed the decision by ANZ. “You have to question what’s happened to rational economic thinking when an organisation like the Port of Newcastle falls victim to corporate activism,” Mr Pitt said.

“The Port of Newcastle is not a just a legitimate business, but is also a highly valued one that’s been the backbone of the Hunter region’s economic success.

“The bank is effectively saying to the 9 thousand people working at the Port and their families that they’re not valued and we don’t want you to keep your jobs.

“I will always stand up for the men and women in the resources sector against this kind of activism. I note that Anthony Albanese was in the Hunter last week but went nowhere near a coal mine.’’

Nationals Senator Matt Canavan accused ANZ of deserting Australian workers.

“What’s going on in this country? We’re not supporting our own assets, our own infrastructure, Senator Canavan told Sky News. “What I’m most concerned about is the desertion by Australian banks which will only drive that infrastructure into the hands of overseas investors, possibly Chinese investors, and that’s especially short-sighted.

“Whatever you think the policy of emissions should be by 2050, the much much bigger and more pressing task for us now is responding to the rising Chinese aggression in our region and why would we walk away from one of our nation’s biggest ports in the context of that environment?”

Although the port could have gone to its Chinese backers — which co-own the facility — sources said this might have triggered national security concerns around the ownership of critical infrastructure. The Port of Newcastle on Monday warned that without “competitive funding” to support its diversification plans, the resilience of the Hunter Valley economy would be damaged.

The refinancing, which will involve NAB and other lenders, is part of a long-term process to support the rollout of the port’s environmental social and governance strategy and long-term shift into non-coal operations, including an automated, multipurpose deepwater container terminal.

A Port of Newcastle spokesman said it was working with “responsible lenders … interested in helping businesses become more sustainable and diversify”.

“Implementing the diversification plans requires competitive financing — without it, the port’s ability to invest in projects that support the long-term resilience of the Hunter economy will be impaired or take longer — meaning opportunities may be missed or the required diversification comes too late. That is a poor outcome for everyone,” he said. “Port and economic diversification are incredibly important to future regional resilience. Decisions made today have an impact on people, their families and their communities for decades to come.

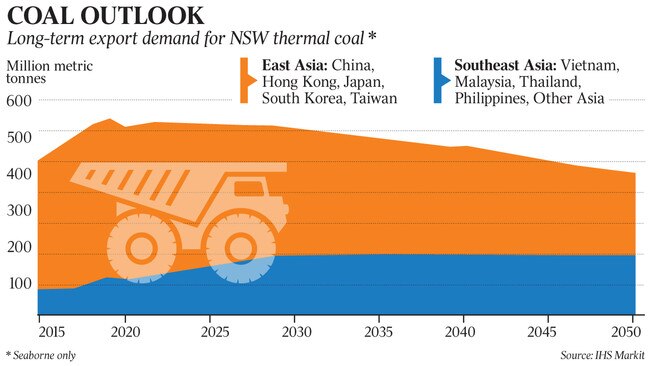

“While international demand for coal is expected to remain strong for some time, diversification needs to happen now so the economy is ready to absorb whatever the future brings.”

The ANZ last year released the most ambitious zero net emissions action plan of the big four banks, adopting climate change as a condition of lending. Its climate change statement, pledging support for existing customers to put in place diversification strategies, said it would impose low-carbon deadlines for the agriculture, food and beverage, building, energy and transport sectors as it ramps up support for the Paris Agreement goal of shifting to net zero emissions by 2050.

An ANZ spokesman said on Monday the bank, which will retain some debt but exit as a major lender, would not publicly discuss specific details of its customers.

“Last year we released an updated climate change statement that outlined how we will support our customers’ transition to net zero emissions by 2050, including engaging with our largest emitting business customers on their low carbon transition plans,” the spokesman said.

In a briefing last September, ANZ chief executive Shayne Elliott said the bank would consider exiting business with customers “if we really don’t see an alignment of values”.

NSW Nationals senator Perin Davey said the growing “propensity of Australian financial institutions to prioritise climate risk-based financing practices over reasonable and legal business” was against the national interest.

“The risk is that if our financial institutions move away from investing in higher-emitting industries that those industries will just seek finance offshore,” Senator Davey said.

“And the fear on the ground is that this practice will not stop at large, coal-dependent industry. First coal, then mining contractors, then transport, then agriculture. Where does it end? Banks are sending signals to the market to make it more difficult for Australian business right when we are trying to reinvigorate it and bring things like manufacturing back on shore.”

In 2018, the Port of Newcastle, co-owned by The Infrastructure Fund and China Merchants Port Holdings Company, secured funding support from a domestic and global banking syndicate, of which ANZ was a leading lender for refinancing its $950m debt pile. In November, the port initiated a new refinancing process with about $888m in external loans, including a reported $515m tranche due to mature in July.

The resources sector, booming during the COVID-19 pandemic, considers the Port of Newcastle refinancing a test case. “What happens in another two years when companies associated with fossil fuels go back to the banks?” an industry insider said. “Even with all of the best climate-change strategies in place, is it going to be good enough for them? We don’t want to have to go offshore.”

An NAB spokeswoman said the bank was focused on “serving customers well and helping communities to prosper”, which required a “long-term sustainable approach to decision making”.

Last November, NAB pledged to support customers in an “orderly and just transition aligned with the Paris Agreement goals”. It also released a report, Just Transition: Implications for the Corporate Sector and Financial Institutions in Australia, which highlighted the roles of lenders in supporting the transition from “high emissions electricity generation to a low carbon world”.

The report flagged the importance of avoiding a “disruptive transition” and the need to reduce the risk of a “patchwork approach to transition” across coal communities in central Queensland, Hunter Valley and the Latrobe Valley in Victoria.

The Port of Newcastle has adopted an ambitious climate change strategy, moving to 100 per cent renewable energy by the end of this year, shifting to electric vehicles by 2023 and supporting vehicle-charging networks across Newcastle. The port last year became the first in Australia and New Zealand to be accredited under EcoPort’s Ports Environmental Review System after meeting stringent environmental performance criteria.

Analysis by HoustonKemp last year predicted the economic impact of a multipurpose deepwater container terminal, proposed for the former BHP site at Mayfield, would generate 9300 jobs and $1.3bn in the lower Hunter during project design and construction. It would contribute $2.5bn to GDP and 15,000 direct and indirect jobs for Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout