ALP unrealised gains tax condemned: ‘it’s not good policy’, says economic heavyweights

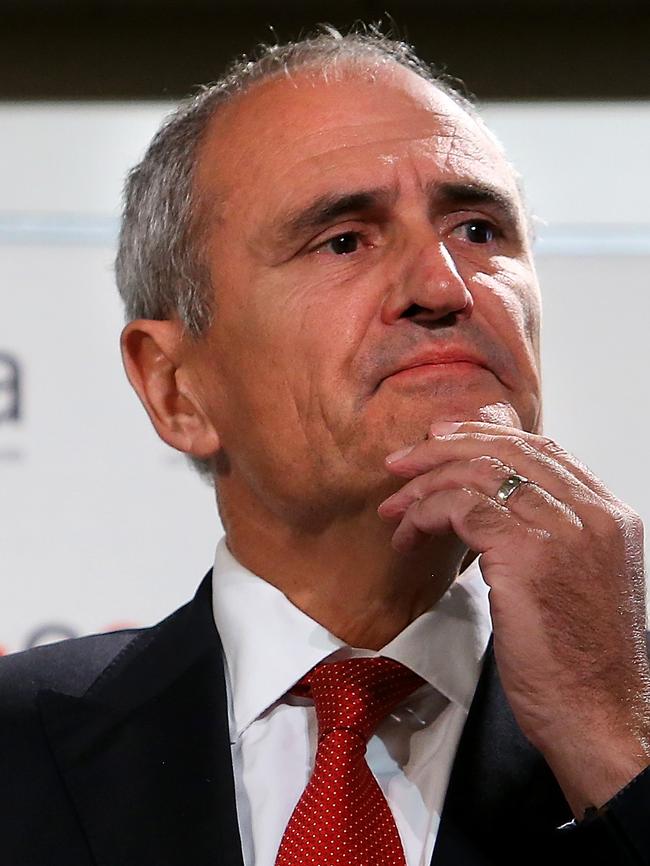

The Reserve Bank’s immediate past governor Philip Lowe and former Treasury secretary Ken Henry have spoken out for the first time against Labor’s planned tax on unrealised capital gains, declaring it’s not good public policy.

The Reserve Bank’s immediate past governor Philip Lowe and former Treasury secretary Ken Henry have spoken out for the first time against Labor’s planned tax on unrealised capital gains, declaring it’s not good public policy and that key recommendations to make the superannuation system fairer have been ignored.

Labor wants to tax people on gains they make on any assets held in their superannuation accounts, starting with those with a balance of $3m or more, without any indexation.

Industry superannuation funds, self-managed funds, investors, business leaders and even former trade unionists have urged Labor to drop the unrealised component of the tax and adjust the concession tax rates on contributions and earnings.

Dr Lowe who has shied away from public statements since stepping down from the central bank role in 2023, spoke out on Wednesday to say Labor should reconsider.

“I am a supporter of good public policy design, but I am not convinced this is an example of it,” Dr Lowe told The Australian.

“We should be exploring other ways to adjust the concessional tax rates on high super balances.”

Dr Lowe and Dr Henry are the two most senior figures from Australia’s top ranks of experienced economic managers to have aired their concerns, bringing a new level of pressure on Jim Chalmers to reconsider the tax.

The Treasurer has dismissed criticism and dug in around the tax policy, highlighting the Albanese government’s desperate need for more tax revenue to pay for big spending promises.

Among the alternatives not considered in a key piece of advice provided in 2023 to Anthony Albanese and Dr Chalmers was a recommendation from the Henry tax review that made the concessional tax rates on super contributions more equitable between richer and poorer superannuants.

Dr Henry, who was Treasury secretary during the Rudd government and proposed the resource super-profits tax, told The Australian on Wednesday he was puzzled why such an important alternative approach to make the system more equitable was not adopted nor considered, instead of taxing unrealised capital gains. “It’s understandable the government would want a more equitable tax treatment of superannuation but to do that you do not need to tax unrealised capital gains,” Dr Henry said. “There are other options and these are outlined in our review from 15 years ago.”

Many of the recommendations from the Henry tax review were ignored by then treasurer Wayne Swan who was advised at the time by Dr Chalmers.

Dr Henry’s recommendation 18 in the retirement-income section of his review explained that a better way to make the tax on superannuation contributions more equitable was to provide a 15 per cent rebate on a superannuant’s marginal tax rate for any contributions they made to their superannuation account.

If a superannuant’s income was $220,000 then for every $1 contributed, the superannuant would be taxed their marginal tax rate (47 per cent) less 15 per cent, giving them a super contributions tax of 32 per cent.

If a poorer superannuant earning $30,000 contributed then they would be taxed their marginal tax rate (18 per cent) less 15 per cent, giving them a super contributions tax of just 3 per cent.

This mechanism was not used as an option in Treasury’s 2023 analysis of how to make the system fairer, titled “Better Targeted Superannuation Concessions”.

The analysis provided four main options: status quo; reduce the tax concessions for individuals with a total superannuation balance over $3m; taxing an estimate of earnings based on change in value; and tax an estimate of earnings using a deeming rate.

“There are other possible pathways to achieve the broader policy objective of targeting the superannuation earnings tax concessions, however these were viewed as less appropriate than the direct avenue of adjusting the earnings tax rate for balances exceeding $3m,” the analysis said.

The Albanese government is seeking to ram through its unrealised gains tax when parliament resumes in July. Labor wants to use its majority election win and the Greens’ depleted status in parliament to pass the tax, which modelling shows would hit 1.8 million people over the course of a working life if applied to accounts of $2m or more. Modelling has also shown more than 500,000 people would end up being taxed at 30 per cent under Labor’s $3m threshold over the course of a working life.

The superannuation sector has warned that many retirees are already pulling money from accounts to avoid a tax Labor hopes will bring in almost $40bn in tax revenue over the next decade. The government has baked into its March budget proceeds of the tax, which it expects will reap as much as $2.3bn in its first full year and as much as $7bn a year after that.

Business leaders including CSL chairman Brian McNamee, Sydney Swans chairman Andrew Pridham, retailer Gerry Harvey, Wilson Asset Management boss Geoff Wilson, the first investor in AfterPay and Labor donor David Hancock, and former Labor vice-president and union leader Michael Easson have all criticised the proposed tax on unrealised gains.

Some industry super funds lobbied Dr Chalmers to change the tax in the lead-up to the election. A main concern of business leaders and finance _academics is that once introduced it would spread to other structures and income brackets.

The new tax essentially means superannuants, starting with those with accounts of more than $3m or about 87,000 people, would be forced to pay tax on the increase in value of their assets even if they do not sell.

Miles Hampton, former chairman of Forestry Tasmania and MyState bank, raised serious concerns with the tax because people who had lost value on an asset and were trying to recover the losses would be taxed on the recovery after the tax started July 1.

The Tax Institute’s Julie Abdalla said on Wednesday that while it was reasonable for the government to consider ways to reduce overly generous concessional tax treatment, the proposed unrealised gains tax, known as Division 296, was a step too far.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout