$15bn tax cuts to deliver kickstart for economy

Australians will be handed an immediate $15bn in tax cuts in a bid to boost the economy after parliament passed the $158bn tax relief package.

Australians will be handed an immediate $15 billion in tax cuts in a bid to boost the economy, drive retail sales and create new jobs, after parliament last night rubber-stamped Scott Morrison’s signature $158 billion tax relief package.

The combined effect of instant tax cuts and consecutive interest rate reductions to a record 1 per cent was hailed by business leaders and economists as a major economic stimulus that would increase consumption rates and help Australians pay off mortgages faster.

The passage of the Prime Minister’s headline election policy through parliament came after the government secured four of the six crossbench votes it needed to push its legislation through the Senate.

ANZ chief economist David Plank said economic growth was now forecast to be one percentage point higher in the second half of the year than in the first half, “largely as a result of the tax and interest rate cuts”.

“The interest rate cuts will affect the economy more slowly than the tax cuts, probably having maximum impact in around 18 months,” Mr Plank said.

Harvey Norman executive chairman Gerry Harvey said short-term stimulus packages had helped retailers get through the global financial crisis and predicted that the tax cuts would deliver a direct pick-up in consumption, which had been under pressure.

“It has been flat for the past 12 months. Profits are good, sales are good, but this money will help drive growth,” Mr Harvey said.

“On the basis of the tax relief, there will be a very big impact on retail sales. It will have a significant effect. Consumption rates will go up dramatically, and with housing loans so low, this will deliver a combined effect.”

The delivery of the tax cuts, which will deliver financial relief for more than 10 million workers, came as new data showed the retail sector remained sluggish. Sales rose just 0.1 per cent in May compared with April.

Job vacancies across the economy fell by more than 1 per cent over the three months to May.

Speaking after the bill passed through the Senate, Mr Morrison said last night the parliament had voted to reward aspiration.

“The hard-working aspiration of Australians all around the country quietly going about their (lives), seeking out their future, putting the effort in, having a go and as a result of what was passed (in) the parliament tonight, getting a go,” he said. “This is a win tonight not for the government, not for the Liberal and National parties; this is a win for those hard-working Australians going about their lives.

“These are the people we will keep our faith with every single day. I said we would burn for them and that is exactly what we have been doing this week.”

Labor failed in its bid to amend the government’s bill to fast-track stage two of the tax cuts, and carve off stage three, forcing Anthony Albanese into retreat. Opposition MPs voted for the entire package.

Josh Frydenberg took aim at Labor’s refusal to rule out going to the next election promising to repeal stage three of the government’s tax cuts, saying it would punish average income earners.

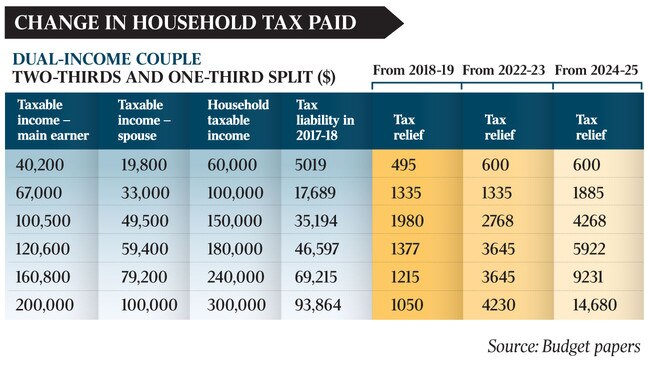

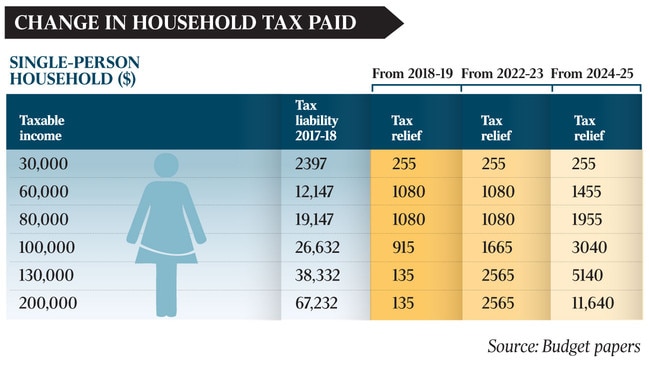

“If he (Mr Albanese) does do that, then someone who is on the average full-time earnings in 2024-25 — that will be around $100,000 — will be $1375 worse off as a result of the repeal of such legislation” the Treasurer said.

AMP Capital chief economist Shane Oliver said the imminent tax rebate for low- and middle-income workers, paired with the RBA rate cuts, would “provide some support to retail sales” in the future.

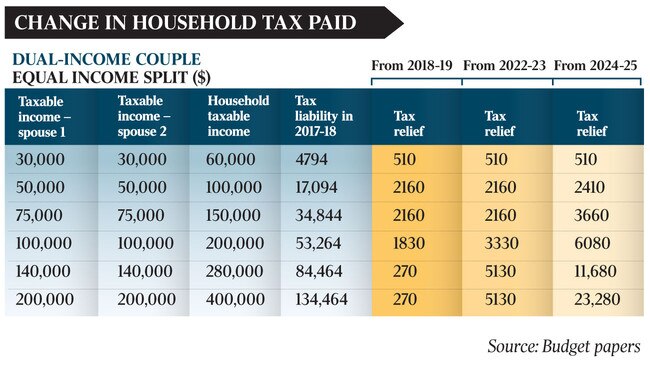

Starting from next week, single income earners will receive up to $1080 in tax relief or up to $2160 for dual-income families after lodging their 2018-19 tax returns. Those earning between $48,000 and $90,000 receive the full $1080 offset, with the tax cut tapering off for taxable incomes of $90,000 to $126,000.

After the interest rate cuts, first-home buyers will save a further $1500 a year in repayments, based on the typical size of $350,000, which was the average in April for first-home buyers.

The Australian Taxation Office said it would immediately update its processing system and “automatically include any new offset amounts taxpayers are entitled to when we process their tax returns”. The ATO, which has encouraged taxpayers to wait a few weeks before lodging, said workers would not need to “do anything different to receive the offset”.

Business Council of Australia chief executive Jennifer Westacott said the tax cuts were the “critical first step to ensure the Australian economy can grow faster”.

“We have to keep the focus on growing the economy. Personal income tax reforms are a good start, but we must act to implement a long-term growth agenda,” Ms Westacott said.

Deloitte Access Economics partner Chris Richardson said “the upfront dollars will likely have a bigger impact than the rate cuts”, in relation to its immediate impact.

“A dollar of tax cuts is worth more than a dollar of interest rate cuts,” Mr Richardson said. “While the interest rate cut helps people pay off the mortgage faster, the tax relief arrives as a lump sum.

“It will be unexpected for many people, who don’t follow politics or know this is coming. It’s a lot of money going out. The cash put out during the global financial crisis was largely spent, and people will make their own decisions in what they do with it.”

Mr Richardson said whether it was tax cuts or interest rate cuts, Australians should not get “carried away with the weakness of the economy”. He said the combined factor was about generating an extra 200,000 jobs and to get “wages moving faster”.

Ahead of the vote in the Senate, Jacqui Lambie, Cory Bernardi and Centre Alliance senators Rex Patrick and Stirling Griff pledged they would back the government and wave through the tax package in full. One Nation senators Pauline Hanson and Malcolm Roberts abstained.

The Opposition Leader left the door open to repealing tax cuts for higher-income earners, pledging to review the legislated stage three of the tax cuts ahead of the next election.

“We are saying very clearly and unequivocally, we are opposed at this point in time to making a decision about stage three,” Mr Albanese said. “We think it’s economically irresponsible.”

The government secured the support of Centre Alliance after pledging to work with the party on “short- and long-term reforms to deal with gas market concerns”.

“The full package of reforms will be announced by government in the coming weeks but will include changes to the Australian Domestic Gas Security Mechanism to deal with current pricing,” a Centre Alliance statement said.

The reforms, criticised by the Australian Petroleum Production and Exploration Association, will also consider market transparency measures, measures to deal with the monopoly nature of east coast gas pipelines and ensuring gas projects deliver surplus supply to the Australian market.

Additional reporting: Adam Creighton, Greg Brown, Michael Roddan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout