NSW budget: winners and losers

Low income earners, DV victims and key workers stand to benefit, while wealthy property owners might be somewhat miffed.

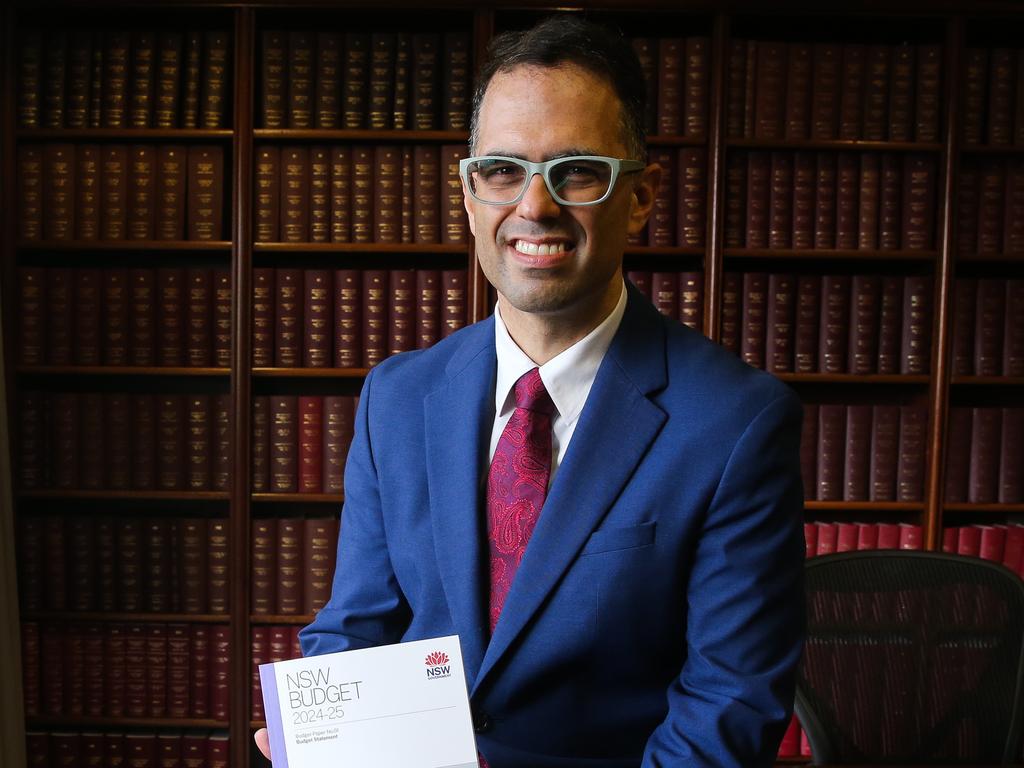

NSW Treasurer Daniel Mookhey has handed down his second state budget, which forecasts a $3.6bn deficit but includes spending measures for “must-haves”. Here are the winners and losers:

WINNERS

- Low income earners

The NSW government has unveiled a $5.1bn investment which it promises will deliver 8400 new social housing. It says it will release surplus government land – identified by an ongoing audit – that will make way for 21,000 new homes.

Housing was the centrepiece of Tuesday’s budget – the Minns Labor government also pledged $520m in new infrastructure around eight public transport priority precincts, and rezoning around those precincts as well as 37 other train and metro stations.

The government also pledged $555.5m to “speed up” the planning system and $200m to incentivise councils to expedite assessments.

- Domestic violence victims

Of those 8400 new social homes backed by $5.1bn in funding, at least half will be reserved for victims of domestic violence, Treasurer Daniel Mookhey announced.

“There are currently 5013 women and children in urgent need of a safe place to live,” he said in his budget speech.

“But those 5013 women and children are yet to find a permanent home because for too long, NSW did not invest enough in public housing.”

In addition, the government has pledged $245.6m for various support measures including increased support for specialist workers, the government’s Staying Home Leaving Violence program, and planned changes to bail laws and justice system responses to domestic violence.

- Key workers

The government also pledged $655.1m in housing for key workers, including nurses, teachers, police officers, and paramedics.

A lion’s share of the funding – $450m – would go into a Key Worker Build-to-Rent program, and $200.1m for key health workers accommodation in rural and regional areas.

- Patients and GPs

Another key plank of this year’s budget was the $188.8m bulk-billing support scheme.

The government says it is the state’s first ever such scheme to address a fall in rates of bulk-billing among GPs.

The scheme incentivises GP practices to bulk-bill patients by offering a tax rebate if it meets a bulk-billing threshold – 80 per cent in metropolitan Sydney and 70 per cent in the rest of the state.

The government will also otherwise exempt past unpaid payroll tax liabilities on GP clinics from payments to GP contractors.

- The fish and the bees

The NSW government is putting $36.2m into the resilience of beekeepers and horticulture to aid in “managing” the Varroa mite infestations in bees, as well as $25m to help avoid mass fish deaths like the one seen in Menindee last year.

LOSERS

- Investment property owners

The land tax threshold will no longer be indexed and instead be fixed at 2024 values, the budget said. Treasurer Daniel Mookhey said 30,000 people are likely to be affected by this change and the budget papers show that the state government forecasts $1.5bn in additional revenue over four years.

“There are 8.16 million people in New South Wales,” he said. “Of them, 180,000 pay land tax. Of them, only 30,000 are likely to be affected by this change. And of those 30,000 people who are affected by that change, they are capable of claiming some of that back from the federal government through the negative gearing arrangements.”

The move would align the NSW regime with “most other jurisdictions” and “no other state, except South Australia, has a form of indexation”, the budget papers read.

- Foreign property investors

Foreign property investors will see their land tax surcharge increase from the current four per cent rate to five per cent. They will also see their foreign purchaser duty surcharge from the eight per cent rate to nine per cent. The Treasury forecasts this will generate $187.5m in additional revenue over the next four years.

- Feral pigs and fire ants

Feral pigs and imported fire ants face the chopping block as the government pledges tens of millions to eradicate both. Feral pigs and “other pests” will face $13.1m budgeted to improve environmental outcomes through their eradication, and $55.3m as been set aside to eradicate imported fire ants to protect agricultural production and native species.

- Private health insurers

The state government will “work with” private health insurers to make sure they’re paying the full fee for patients who use a single room in a public hospital. Currently, some insurers are paying less than half the rate, the budget papers read.

The government estimated this would add $187.5m to their bottom line over four years.

- Wagering and gaming operators

Gaming operators will face more stringent point-of-consumption tax and gaming machine tax compliance activity, backed by a $3.2m push from the government. The government estimated that this would increase tax revenue by $14.8m in the coming financial year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout