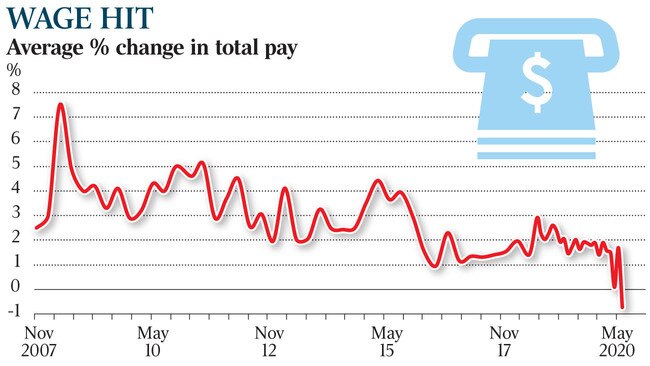

Negative pay growth for first time in two decades

Annual pay growth has turned negative for the first time in two decades as employers slash workers’ hours

Australians’ annual pay growth turned negative for the first time in two decades this month as employers slash workers’ hours through the COVID-19 crisis, new figures from the Melbourne Institute show.

The monthly survey of 1200 workers from the University of Melbourne’s applied economics unit found that pay dropped by 0.7 per cent over the year to June — a record low for a series which stretches back to the mid-1990s.

The last time pay shrank on a year-on-year basis was in the early 2000s downturn.

“A negative (pay growth) number on its own is very unusual, and a large negative number is unique,” MI senior research fellow Sam Tsiaplias told The Australian.

The survey only includes those with jobs, but would reflect a drop in hours as employers struggled through the pandemic.

Dr Tsiaplias said workers have experienced very little growth in wages for years, and that there were not any obvious catalysts on the horizon that could break this trend.

“If anything, the negative economic shocks will cause further downward pressure on wage growth even if the economy does recover.”

The Australian Bureau of Statistics’ quarterly wage price index — which is tracked by the Reserve Bank — climbed by 2.1 per cent over the year to the March quarter. The full impact of the pandemic on the ABS wages measure will not be revealed until the June quarter figures, to be released on August 12.

ATO payroll figures show a 5.4 per cent drop in total wages paid between March 14 and May 2, but this would also reflect job losses and stimulus payments.

Economists and policymakers have been encouraged by evidence the economy is recovering faster than expected in the early stages of the pandemic.

Consumer confidence has returned to near pre-COVID levels, and retail spending has surged as restrictions have been progressively eased in recent weeks.

But the challenge facing workers in coming months is likely to intensify.

Unemployment is expected to climb towards 8 per cent by June and to stay elevated well into next year. The prospect of the removal of billions of dollars in emergency government support come the end of September will drive an 8 per cent plunge in household cash flow in the December quarter, UBS estimates.

ANZ head of Australian economics David Plank warned that talk of a “snap back” in the economy could lull the government into a false sense of security.

“The government is very conscious of the fiscal cliff and managing that transition, but there is not insignificant risk they are overly encouraged by the rebound,”, Mr Plank said.

“We need a sizeable stimulus package before the (October) budget to give households and businesses confidence on the economic outlook past September.”

The recent Westpac consumer confidence survey showed a wide divergence between households’ relatively optimistic near term view on their finances, and their still deep pessimism about the economic outlook in the coming 12 months.

“It makes you wonder is that confidence around finances propped up by stimulus, and what’s going to happen when it gets taken away,” UBS economist Carlos Cacho said.