Nation ‘needs to expect bad news’: Jim Chalmers

Jim Chalmers has flagged the October budget will reveal the nation’s finances are in a worse position than Treasury’s pre-election update.

Jim Chalmers has flagged the October budget will reveal the nation’s finances are in a worse position than Treasury’s pre-election update, saying “pressures on the budget which were not disclosed or booked by the previous government” would overwhelm the expected windfall from soaring commodity prices.

The Treasurer prepared the country on Wednesday for more bad news on debt and deficits, saying he would give a “detailed statement to the parliament when it returns, whether it is June or July, which is blunt and frank and upfront with the Australian people about the challenges we have inherited from our predecessors”.

After campaigning on lowering power bills longer term through boosted investment in renewable energy, Dr Chalmers said over coming months households should brace themselves for “a spike in power prices that will make it harder for Australian families to make ends meet”.

“The defining challenges in our economy are skyrocketing inflation, rising interest rates, falling real wages. We’ve got a full-blown cost-of-living crisis in this country and interest rate rises will add to the pain of that,” he said.

Speaking after a series of morning meetings with Reserve Bank governor Philip Lowe and the heads of ASIC, APRA, the taxation office and the ACCC, Dr Chalmers said “you shouldn’t assume automatically that the budget, absent of any policy decisions, will necessarily be stronger in October than it was in the pre-election fiscal outlook”.

“There are issues – inflation is worse than what Treasury and the Reserve Bank thought not that long ago, and there are other factors as well,” he said.

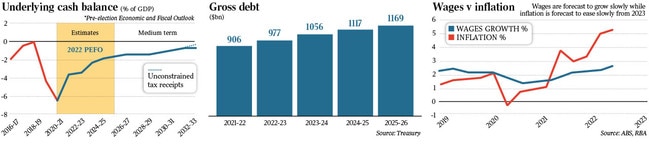

The pre-election economic and fiscal outlook estimated deficits of $80bn in this financial year, and $78bn in 2022-23, before falling to $43bn by 2025-26.

Gross federal debt will push above $1 trillion in 2023-24.

Deloitte Access Economics partner Chris Richardson said the budget faced significant structural challenges, including a blowout in the cost of social spending and defence.

“Everybody knows the pressures are out there,” Mr Richardson said.

“The last government over the last year and a bit added to ongoing social spending by $25bn a year, notably in the NDIS and aged care. And even that doesn’t fully cover the range of problems covered by the royal commission and various inquiries,” he said.

While Treasury estimates the deficit will remain at 1.8 per cent of GDP in a decade’s time, Mr Richardson said the long-term gap between spending and revenue was more like 3 per cent, suggesting a fiscal repair task even larger than the one presented in the budget.

Mr Richardson said the lack of a strong mandate for change from the election meant budget repair would likely be piecemeal, although he noted that a “fundamental problem” was the spiralling cost of the NDIS program.

“Australia has to have that conversation. We have to do the best we possibly can by our disabled, but we also need to do that in a way that doesn’t break the budget – that is one of many trade-offs.”

Finance Minister Katy Gallagher slammed the Morrison government for abandoning any fiscal rules, and said Labor would be running through the budget “line by line” to identify savings or the opportunity to reallocate money into more productive areas.

“Absolutely we need strong fiscal discipline. The budget is not in good shape and this is not an environment where you just spend and spend,” Senator Gallagher told Sky News.

The prices of Australia’s major commodity exports have remained high this year, filling miners’ coffers and flowing into a much larger tax take than assumed in the March budget.

Rather than slowly trending back to $US55 a tonne – as is Treasury’s ongoing, conservative assumption – iron ore prices remain elevated at about $US135 a tonne, while coal prices have also stayed high as a result of the global energy price shock from the war in Ukraine.

The Morrison government leaned heavily on mining profits to drive improvements in the federal bottom line through the pandemic, alongside the substantial drop in unemployment, which hit a 48-year low of 3.9 per cent in April.

But Dr Chalmers signalled an end to these rolling budget improvements, and that the hard work of spending constraint had begun.

“Be careful not to assume necessarily that the budget is automatically improving over time,” he said. “Commodity prices is one part of the story but not the whole story and we are inheriting a set of challenges which commodity prices cannot, on their own, fix.

“We can’t flick a switch and make $1 trillion of debt disappear. We have to prioritise, we have to sequence, we have to weigh up our priorities and work out what we can responsibly do, and when we can do it, and that inevitably means that some things that we would like to do will take a bit longer for us to find room for in the budget.”

Dr Chalmers confirmed the October budget would not include the extension of one-off cost-of-living relief measures introduced by the Coalition government to help shield Australians from rising prices.

Speaking on a podcast interview with The Conversationnetwork, Dr Chalmers said it would not be possible “in a budget heaving with that much debt, to extend some of those measures forever”.

“I said that before the election, and I say that again after the election,” he said. Dr Chalmers clarified this would mean no extension of the halving of the fuel excise. “We said that before the election. We were upfront about it,” he said.

On the Reserve Bank review, Dr Chalmers said it was a “really important opportunity” to examine the central bank’s framework “to make sure that we are making monetary policy in this country in the best possible way”.

He said the timeframe for the review and its terms of reference would be made clear shortly but in the interim, he would write to the RBA to indicate that “all of the existing arrangements that the bank operates under … will remain in place until the conclusion of that review”.

“It makes sense to us not to pre-empt the outcomes of the review and not to substantially change our statement of expectations when it comes to the Reserve Bank until we’ve seen the outcome of that review.”

More Coverage