MYEFO: Josh Frydenberg bets against lockdowns as deficit cut by $7.4bn

Josh Frydenberg has staked the Coalition’s re-election on keeping the country open.

Josh Frydenberg has staked the Coalition’s re-election on keeping the country open, with Australia’s record jobs boom and upbeat economic growth forecasts underpinned by the states and territories resisting lockdowns and restrictions in response to new Covid-19 variants.

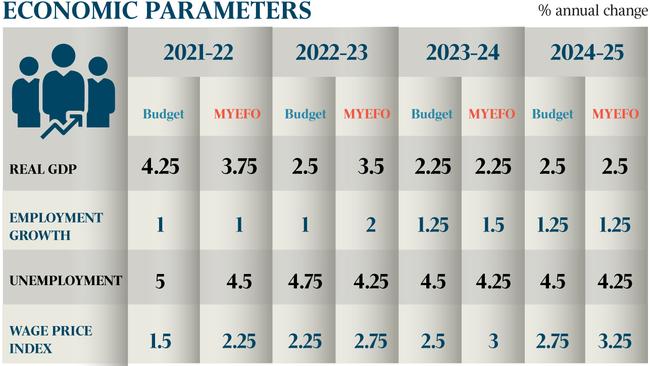

The Treasurer on Thursday released the government’s mid-year budget update – headlined by economic growth surging 4.25 per cent next year – after new jobs data revealed an employment bounce back with more people now in work compared to pre-pandemic levels.

Writing in The Australian, Mr Frydenberg said more than 366,000 jobs were created in November, with almost 60 per cent filled by women and one-third going to younger people.

“The unemployment rate fell to 4.6 per cent, compared to 5.7 per cent when we came to government,” the Treasurer writes.

“Employment is now at a record high, with 180,000 more Australians in work than before the pandemic. Unemployment is expected to fall further to 4.25 per cent, and to remain in the low 4s for only the second time since the 1970s. The strong outlook for the labour market will see one million more people in work over the next four years.”

The mid-year economic and fiscal outlook presented an optimistic picture ahead of a likely May election on the back of the labour market rebound and the reopening of domestic and international borders. It revealed the government had set aside an election war chest of up to $16bn in government policies not yet announced and confidential health and national security spending, some of which will be revealed in the March 29 budget.

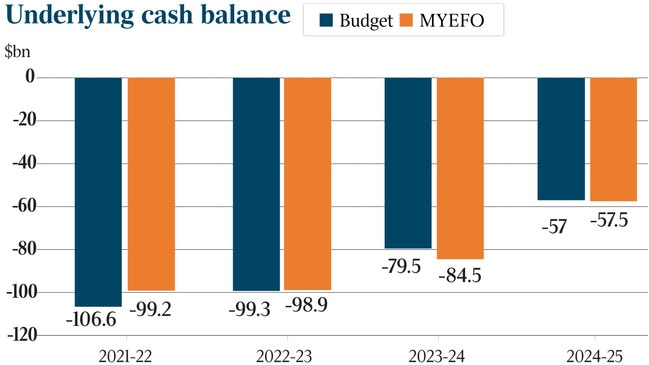

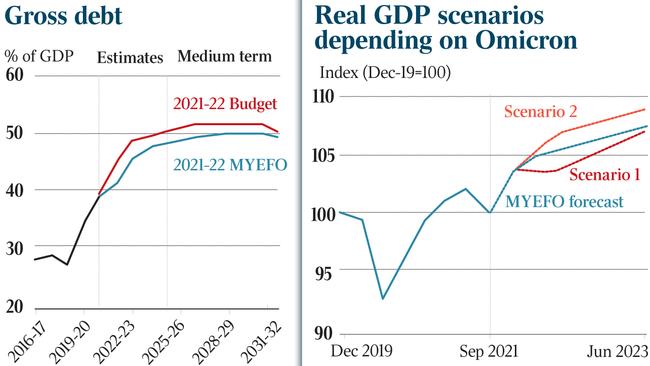

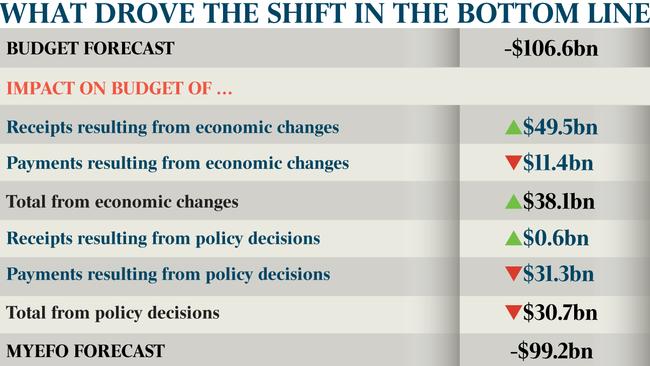

Surging tax revenue, booming resources exports and more people moving off welfare shaved the nation’s deficit bill to $99.2bn, down from the May budget forecast of $106.6bn. Australia’s gross debt, which is expected to hit about 50 per cent of GDP in the medium term, will peak at almost $1.2 trillion in 2024-25.

Treasury’s key assumptions rely on states and territories avoiding lockdowns, removing the majority of Covid-19 restrictions and reopening domestic borders early next year.

Mr Frydenberg said the country must stick with the national reopening plan and apply responses to the Omicron variant “proportionate to the risk”.

“They must show compassion. They must show common sense. That initial response where everyone on a plane heading into Queensland was subject to quarantine for two weeks, including Christmas Day – that was clearly an over-reaction,” Mr Frydenberg said. “We need the premiers to stick to the national plan.

“The momentum in the economic recovery depends on it. Premiers should not be spooked by the Omicron variant.”

Moody’s and S&P maintained Australia’s AAA credit rating with a stable outlook but warned of ongoing risks, while industry groups said the easing of domestic and international border restrictions would help drive investment and increase wages.

The upbeat federal MYEFO came as three states posted mid-year updates, with Covid blowing a $20bn hole in the NSW budget, debt forecasts in Queensland ballooning to $80bn in three years, and WA forecasting a $2.4bn operating surplus.

Western Australia Premier Mark McGowan used his state’s result to renew his feud with the NSW government, saying the state had “comprehensively failed” its people and was responsible for a wave of Covid infections around the country.

Scott Morrison said states and territories that have reimposed Covid-19 restrictions this week must maintain a “cool head and ensure we are approaching each challenge in a calm and certain way”.

“What is not helpful is stop-go, flip and flop … We must understand that case numbers now, in the phase we are in … are not the issue,” the Prime Minister said. “The issue is how many people are in ICU.

“My simple message to Australians is to go about your lives, enjoy the summer, exercise the commonsense precautions that you would.”

Opposition Treasury spokesman Jim Chalmers seized on Treasury’s conservative wage growth forecasts, which predict real wages will fall this financial year and remain flat over three years. “On the eve of an election, after a decade in office characterised by stagnant wages and insecure work, they want to take credit for the recovery and for wages growth that hasn’t even happened yet,” Dr Chalmers said. He attacked the government’s move to raise contingency reserves by $8.1bn over the next four years, accusing Mr Frydenberg of pouring “billions of extra dollars into secret slush funds for the election”.

Mr Frydenberg said the contingency reserve, which features in all federal budgets, was required to meet unforeseen and emergency needs.

“They are measures that we expect to eventuate but at this point we can’t allocate and confirm to specific programs … since we handed down the budget in May, we had the Delta variant,” he said.

“That required an additional $25bn in spending in both economic and health terms.”

Unemployment is anticipated to drop to 4.5 per cent by the middle of next year, instead of 5 per cent, and to 4.25 per cent by June 2023, also 0.5 percentage points below what was projected at the time of the last budget.

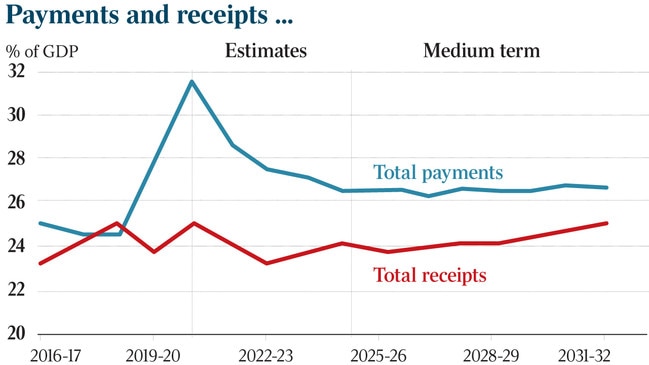

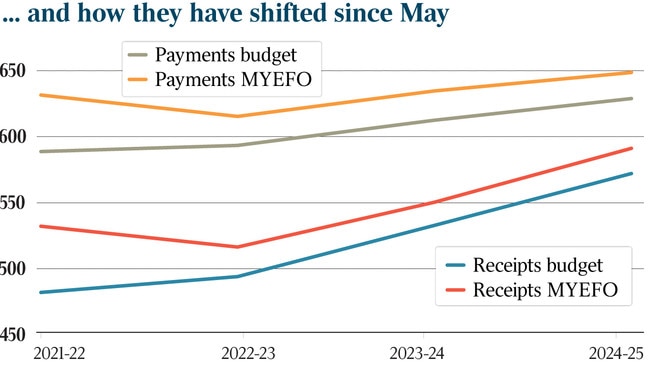

More jobs and faster growth would trigger a $95bn improvement in tax receipts by 2024-25, but a $26.6bn blowout in federal NDIS costs over the forward estimates, alongside an additional $25bn in Delta support payments, will drive a bare $2.3bn improvement in the budget by 2024-25.

Leading five new funding announcements was a $2.3bn infrastructure package, including $500m for regional Australia understood to be tied to negotiations with Barnaby Joyce on the net-zero emissions by 2050 plan.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout