RBA rate rises to run for months, Philip Lowe warns

Interest bills are set to soar as the RBA increases rates for the ninth time since May in a bid to contain stubborn inflation.

Reserve Bank governor Philip Lowe has warned homeowners to expect more rate rises “in the months ahead” as the central bank steps up efforts to bring inflation down, leaving the Albanese government dogged by a cost-of-living crisis.

After the RBA handed down its ninth straight rate hike, lifting the cash rate to 3.35 per cent, Dr Lowe said the board was resolute in its determination to return inflation to the bank’s 2-3 per cent target range and would “do what is necessary to achieve that”.

Dr Lowe’s comments led economists to conclude rates would peak at 3.85 per cent by April, rather than 3.6 per cent.

The RBA board believes the task of regaining control of inflation, which is running at a 33-year high of 7.8 per cent, has become more pressing since it last met in December and that the path to “achieving a soft landing remains a narrow one”.

Dr Lowe acknowledged the “painful squeeze” on household budgets as families struggled to deal with climbing interest bills, and said he recognised “the full effect of the cumulative increase in interest rates is yet to be felt in mortgage payments”.

A looming mortgage cliff is also set to force 800,000 households off cheap fixed-rate loans and on to more expensive variable rates over the course of 2023.

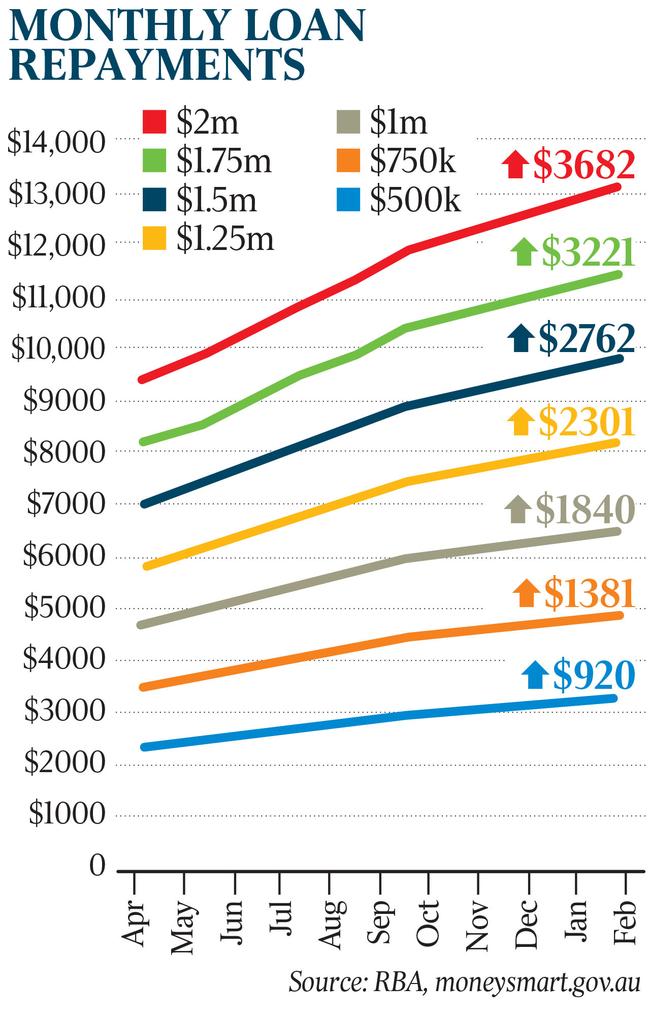

Once passed on to borrowers, the RBA’s decision will add a further $114 to the monthly repayment on a $750,000 mortgage. Since the board started hiking in May last year, a borrower with that sized loan has seen their interest bill soar by $1360 a month, or more than $16,300 a year, according to RateCity analysis.

Jim Chalmers was forced to defend himself in parliament on Tuesday against opposition attacks that sought to pin soaring cost of living and climbing rates on the government.

“Each of these interest rate rises, which began before the election, has put extra pressure on Australians and put extra pressure on the Australian economy as well,” the Treasurer said. “I think we understand in this place … that the Reserve Bank makes these decisions independently, and it’s not our job in this place to interfere or to second guess their decision making. It’s our job to focus on the broader pressures that are coming at us from around the world and being felt around the kitchen tables of this country.”

Dr Chalmers pointed to Labor’s cost-of-living relief measures including cheaper childcare, lower prices for prescription medicines and the government’s energy market interventions. The Treasurer has made $1.5bn in taxpayer-funded energy bill subsidies to vulnerable households the centrepiece of his May budget, but high inflation has limited the capacity of policymakers to spend for fear of making the central bank’s job harder.

There were signs of growing discomfort in ministerial ranks that voters would begin to hold the government responsible for soaring mortgage bills as rates begin to bite hard this year.

Speaking ahead of the rates announcement, NDIS Minister Bill Shorten questioned whether the central bank was going too far to tame inflation.

Mr Shorten told Sky News the rapid run of rate rises through 2022 was “already massive” and would be “incredibly painful for millions of Australians who are paying their mortgages off”.

“Economic history shows that inflation is a lagging indicator,” Mr Shorten said. “So, in other words, last quarter (consumer price index increase) was big, but some of the signs are that inflation is easing this quarter.

“So, if the Reserve Bank increases mortgage rates in the future to deal with something which is already coming down in the past – it could cause pain.”

In a statement accompanying the decision, Dr Lowe offered little relief ahead and highlighted the perils of letting inflation get out of control in a statement that analysts described as “hawkish”.

“The board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target, and that this period of high inflation is only temporary,” he said. “High inflation makes life difficult for people and damages the functioning of the economy. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later.”

Dr Lowe noted that the bank’s preferred measure of underlying inflation, at 6.9 per cent in December, “was higher than expected”.

“Global factors explain much of this high inflation, but strong domestic demand is adding to the inflationary pressures in a number of areas of the economy,” he said.

Instead of a rates pause, CBA head of Australian economics Gareth Aird said he now expected hikes in March and April, taking the cash rate to a “deeply restrictive” 3.85 per cent.

“Two further (0.25 percentage point) interest rate hikes means the probability of a soft landing for the economy is lowered significantly,” Mr Aird said.

“The budgets of many home borrowers will be under considerable strain over the coming year,” he said.

NAB head of market economics Tapas Strickland said Dr Lowe’s comments put in doubt his previous expectation for a single additional rate rise.

“Today’s hawkish statement highlights the real risk that the RBA feels the need to take rates higher than this, with a terminal rate perhaps as high as 3.85-4.10 per cent,” Mr Strickland said.

Spending and the economy more broadly have proved resilient to the most aggressive rate hike cycle in the modern inflation-targeting period, but economic growth is anticipated to halve to about 1.5 per cent through this year and the next, Dr Lowe said.

The RBA governor also acknowledged that there were “a range of potential scenarios for the Australian economy” amid heightened uncertainty here and abroad.

Economists have warned borrowers are yet to bear the full brunt of the past 10 months’ of policy tightening, especially the roughly 800,000 households who will shift off ultra-low fixed rates through 2023.

“There is uncertainty around the timing and extent of the expected slowdown in household spending,” Dr Lowe said.

“Some households have substantial savings buffers, but others are experiencing a painful squeeze on their budgets due to higher interest rates and the increase in the cost of living. Household balance sheets are also being affected by the decline in housing prices. Another source of uncertainty is how the global economy responds to the large and rapid increase in interest rates around the world.”

Dr Lowe said the bank’s decision on how much further rates would need to climb would be determined by economic data.

“In assessing how much further interest rates need to increase, the board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market,” he said.

“The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

Dr Lowe flagged a largely unchanged set of economic forecasts would be revealed in Friday’s Statement on Monetary Policy. Inflation would not return to the top of the 2-3 per cent target range until mid-2025, but would ease from 7.8 per cent in December to 4.75 per cent by the end of the year.

As unions push for pay rises of at least 5 per cent to offset falling living standards, Dr Lowe said wages growth was continuing to pick up from the low rates of recent years and a further lift was expected due to the tight labour market and higher inflation.

“Given the importance of avoiding a prices-wages spiral, the board will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms in the period ahead,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout