More mortgage pain as RBA delivers rate hike to 2.35pc

The RBA warns interest rates have further to rise, as Anthony Albanese flags ‘tough decisions’ in the October budget.

The Reserve Bank has warned that interest rates have further to rise after announcing its fifth straight increase in the official cash rate, as Anthony Albanese flagged “tough decisions’’ in an October budget constrained by surging inflation and high government debt.

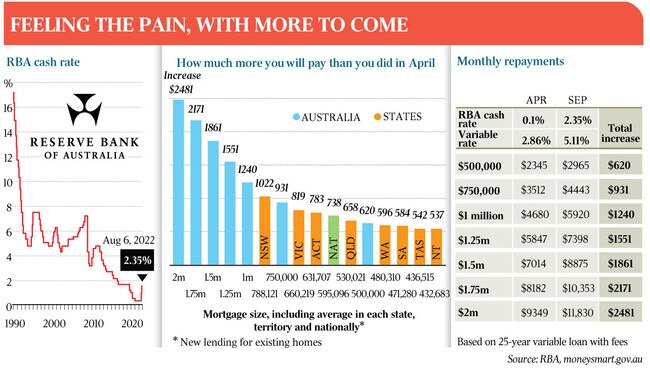

The RBA board’s widely anticipated decision to increase its cash rate target by half a percentage point to 2.35 per cent, would add another $220 to the monthly interest bill on a $750,000 mortgage, leaving repayments $930 higher than before the first move in May.

But with inflation expected to accelerate from 6.1 per cent to nearly 8 per cent by the end of the year, RBA governor Philip Lowe flagged further pain even as the pace of interest rate rises was expected to slow.

“The board expects to increase interest rates further over the months ahead,” Dr Lowe said.

While monetary policy was “not on a preset path”, the central bank was “committed to returning inflation to the 2–3 per cent range over time”.

After pledging to improve workers’ living standards during the election campaign, the Prime Minister on Tuesday told Labor MPs at a caucus meeting: “We need to address the cost of living issues Australians are facing while being mindful of a trillion dollars of debt we inherited. We must be straight with Australians about the challenges before us and the difficult decisions we must take.”

Alongside rising interest rate burdens, petrol prices are due to jump by 25c a litre following the end of the six-month petrol excise discount on September 28.

Jim Chalmers said the latest increase in borrowing costs would “tighten the screw on family budgets”, and households would have to make “more hard decisions about how to make ends meet”.

“It is our job to do what we responsibly can to help Australians deal with these pressures in the near term,” the Treasurer said.

Dr Chalmers warned that higher rates would mean “more difficult decisions for governments” by increasing the cost of “servicing the trillion dollars of debt that has been left to us”.

The government on Wednesday will seek to deliver on one of its key cost-of-living commitments by introducing a bill to reduce the cost of prescription medicines by $12.50 from the start of next year.

The proposed legislation will reduce the maximum cost of general scripts under the Pharmaceutical Benefits Scheme from $42.50 to $30. The measure is expected to cost $700m over the forward estimates period, and would save someone taking one medication a month as much as $150 a year.

Mr Albanese said he was “really pleased that we’re introducing this legislation to make many medicines cheaper for Australians”.

“My government is serious about delivering on our election commitments and easing the cost-of-living pressures left by the former government,” he said.

After four straight 0.5 percentage point rate hikes, economists said Dr Lowe’s latest rhetoric suggested the frenetic pace of increases would slow from here.

Dr Lowe said in his statement: “The further increase in interest rates today will help bring inflation back to target and create a more sustainable balance of demand and supply in the Australian economy”. He did not, however, refer to the rate hike as an ongoing “normalisation of monetary policy conditions” – a phrase that appeared in last month’s statement.

“The size and timing of future interest rate increases will be guided by the incoming data and the board’s assessment of the outlook for inflation and the labour market,” Dr Lowe said.

The RBA governor is due to deliver a major address on Thursday where he is expected to outline the bank’s thinking on the direction of monetary policy.

Dr Lowe has admitted that he held rates at virtually zero for too long, and the RBA has been scrambling to remove this extraordinary pandemic-era stimulus after inflation unexpectedly surged this year, from 3.5 per cent in December, to 6.1 per cent over the year to June.

JP Morgan chief economist Ben Jarman said that, with its latest decision, the RBA “appeared to reach an important threshold” that may signal an end to the race to “normalise” monetary policy.

“While there are further hikes to come, the board now seems to view conditions as being in the ballpark of normal (or) neutral, such that monetary policy is no longer providing any significant tailwind to inflation,” he said.

CBA head of Australian economics Gareth Aird agreed, saying the next move should be a “business as usual” 0.25 percentage-point increase.

The RBA governor has faced a storm of criticism over his failure to foresee this year’s burst of inflation, which has been supercharged by surging global energy prices following Russia’s invasion of Ukraine in February.

Dr Lowe defended his determination to bring inflation under control, saying “price stability is a prerequisite for a strong economy and a sustained period of full employment”.

“It (the RBA board) is seeking to do this while keeping the economy on an even keel,” he said. “The path to achieving this balance is a narrow one and clouded in uncertainty, not least because of global developments.”

While cost of living remains top of mind for many Australians and a political headache for a Labor government elected on a platform of driving wages higher, there is little evidence that higher consumer prices, plunging real pay and climbing interest rates are deterring economic activity.

Ahead of national accounts figures on Wednesday that economists said would show real GDP grew by more than 3 per cent over the year to June, Dr Lowe said: “The Australian economy is continuing to grow solidly and national income is being boosted by a record level of the terms of trade. Wages growth has picked up from the low rates of recent years and there are some pockets where labour costs are increasing briskly.

“An important source of uncertainty continues to be the behaviour of household spending. Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments.”

Australian Bureau of Statistics data on Tuesday showed household spending in July was 18 per cent higher than a year earlier, and the ABS’s retail trade data show record monthly shopping in stores and cafes. Economists believe the $270bn in additional cash saved through the pandemic has given a buffer to many households, while low and middle-income taxpayers receive $12bn back on their taxes thanks to the special tax offset.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout