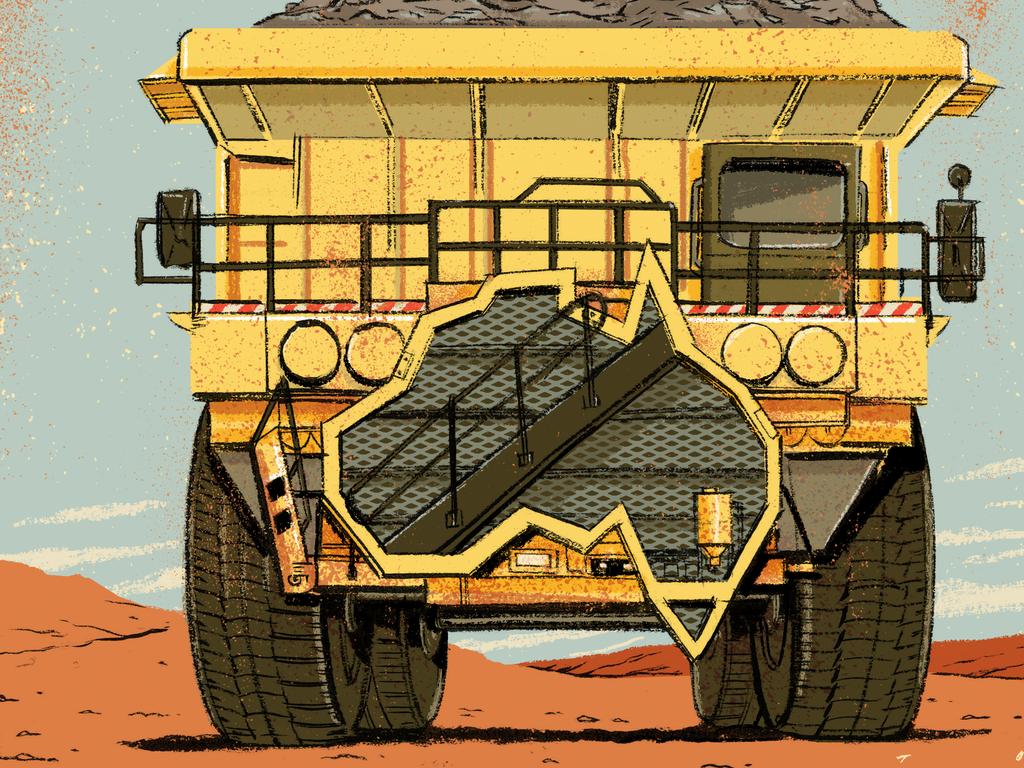

Mining makes case for tax help

Minerals Council chair calls for blueprint to address high company tax, accelerate project approvals.

Helen Coonan — chair of Crown Resorts and the Minerals Council of Australia — has called for a national COVID-19 recovery and reconstruction blueprint to address high company tax rates and accelerate mining project approvals to “supercharge” the economy.

Ahead of Josh Frydenberg and Mathias Cormann delivering economic statements to parliament on May 12, and releasing a broader fiscal outlook update in June, Ms Coonan warned “higher taxes will discourage investment, impede growth and threaten jobs”.

The former Howard government minister, who sits on the Snowy Hydro board and the JP Morgan advisory council, said the mining industry, which notched $290bn in export earnings last year, had paid $234bn in company tax and royalties since 2007.

“For the industry to continue as a global leader and be competitive Australia’s fiscal settings should encourage investment and growth,” Ms Coonan writes in The Australian.

“A balanced approach provides governments and the community with an appropriate share of the benefits from Australia’s rich resources bounty, and benefits industry and the economy through a competitive business tax system that attracts investment, encourages risk taking and creates jobs in our regions.”

Ms Coonan said, globally, company tax rates had been reducing since 2010, except in Australia, which has “not reduced large business taxes for two decades”.

“In 2020, Australia’s company tax rate is 3 per cent higher than the G20 average and the second-highest in the developed world,” she said. “With the Reserve Bank governor warning of the severity of the coming economic downturn and emphasising the importance of pro-growth, pro-productivity reforms, the post-COVID recovery provides a great opportunity using the national cabinet model to supercharge economic recovery through sensible policy reform.”

Ms Coonan said COAG’s strategic agenda for resources should “urgently be recast as a blueprint for national recovery and reconstruction”. The former communications minister said mining projects in Australia could take more than a decade to deliver and she was pushing for faster project approvals and the eradication of “wasteful duplication between federal and state systems”.

As business leaders urge the government to use the COVID-19 pandemic and economic crisis as a platform for tax and fiscal policy reforms, the Treasurer and Finance Minister are preparing statements outlining the impact of coronavirus on the economy.

In a joint statement, Mr Frydenberg and Senator Cormann said following the release of the March quarter national accounts, they would provide an update on the economic and fiscal outlook in June. The government, which has provided $320bn in COVID-19 economic and fiscal support, has pushed back the delivery of the 2020-21 budget to October 6.

“With the coronavirus pandemic having a major health and economic impact globally, Australia has made important gains in containing the spread of the virus,” the joint statement said. “The near-term outlook depends critically on this ongoing success and our ability to gradually ease restrictions so people can return to work. It is reasonable to expect that the pace and scope of any easing in containment measures will become more clear in the period ahead while economic data on the current state of the economy will become more readily available.”

Ms Coonan said “stronger business-led growth will lead Australia to recovery” when the nation emerged from the coronavirus pandemic. “Post-COVID-19, world demand for metals and minerals – especially industrial metals such as steel, copper and aluminium – will grow in line with the expanding needs of highly populated nations.”

Mr Frydenberg and Senator Cormann said the government was continuing to provide updates on the nation’s fiscal position.

“Australia entered the coronavirus crisis from a position of economic strength. The government returned the budget to balance for the first time in 11 years, while government debt to GDP was about a quarter of what it is in the US or UK, and about one-seventh of what it was in Japan.”

“The measures we have implemented are temporary, targeted and proportionate to the challenge we face and will ensure Australia bounces back stronger on the other side.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout