Live export ban blamed for WA sheep price plunge

Sheep prices in Western Australia have dropped so low that some farmers say they can’t afford to sell or keep their flocks.

Sheep prices in Western Australia have dropped so low that some farmers say they can’t afford to sell or keep their flocks.

The poor prices have been partly attributed to a massive decline in industry confidence brought on by the Albanese government’s moves to scrap the live sheep export trade, which mostly operates out of Western Australia.

Reduced confidence has coincided with dry conditions and fewer export options, causing a glut in the market that has seen prices plummet.

Sheep producer Charles Wass averaged $20 a head for a flock of ewes he sold recently.

Factoring in transport, levies and sale commission, he will receive about $10 a head, a massive decrease on the usual $80 to $120 a head that sustains the business.

As an ex-accountant, Mr Wass knows the numbers aren’t viable.

“You’re going backwards at a fairly rapid rate,” he said.

Mr Wass runs about 2000 ewes on his property near Coorow in WA’s midwest, about 260km north of Perth.

Before winter, his Dohne Merino ewes are scanned to determine if they are pregnant. Those that aren’t are usually sold.

“It’s about being efficient,” Mr Wass said.

“Rather than carrying a ewe for the whole year without a lamb, we will sell them on, because it’s not enough just to shear them and get the value of the wool.

“The ones that weren’t quite fat enough we held on to and fed them up.”

But the price for the 70 sheep he sold at auction a fortnight ago is something Mr Wass has not seen in his time on the land and has him concerned about what’s to come.

“If you’re getting $20 for sheep it doesn’t take long to get to a point of not being able to sell them but not being able to keep them,” he said.

He puts the blame at the feet of the federal government’s plan to end the live sheep export industry.

“It’s the destruction of confidence in the sheep industry,” he said.

“A lot of farmers are looking at it and thinking that without live exports there’s going to be a whole lot of sheep without a market.

“When you destroy confidence and there’s an alternative like cropping, people will think, ‘stuff this’.”

Sentiment surveys have shown nearly half of all WA sheep producers intend to reduce their ewe flock within the next year.

Rabobank’s latest quarterly rural confidence survey found that changes to the live export sector were listed as a factor by 32 per cent of WA farmers who anticipated worsening economic conditions.

The June report recorded the third-lowest confidence reading since records began in 2004.

Meat and Livestock Australia’s sheep producer intention report, published in May, had contributed to a negative outlook in WA that was dampening national results.

Mr Wass said his only hope for the remainder of the year was for a new buyer such as Saudi Arabia to enter the market to take up some of the excess supply.

MLA has forecast Australia’s sheep flock to hit a 15-year high of 78.85 million head this year.

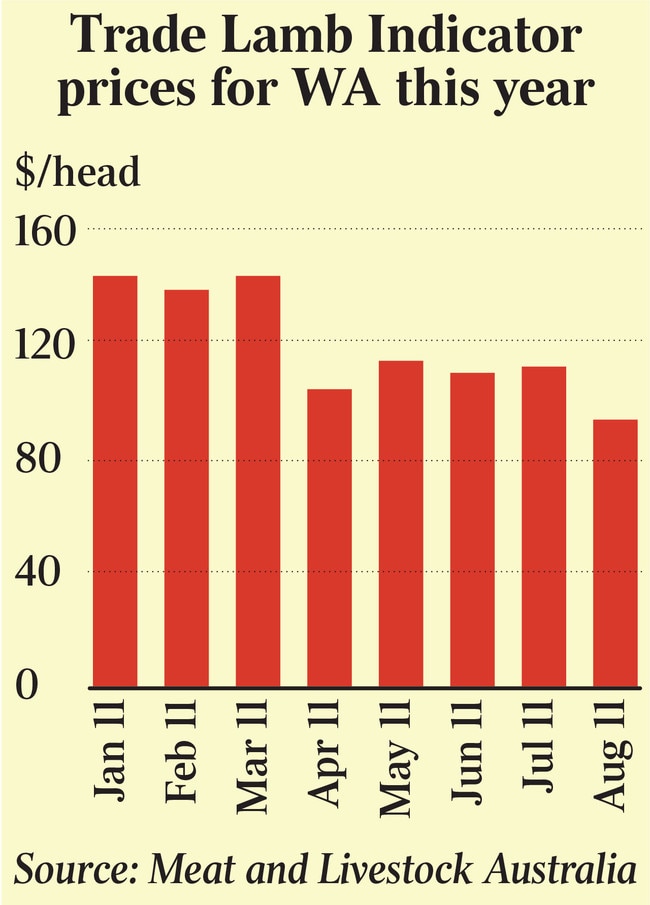

The bigger flock, combined with WA farmers looking to offload their ewes, has increased the supply of sheep and lambs available for slaughter, driving prices downwards.

“A lot of it’s probably the negative sentiment in the WA sheep industry at the moment off the back of all the discussions that are currently going on around light export,” Rabobank associate analyst Edward McGeoch said.

“(WA) has had a contracting flock for the last few years but I think what we’ve seen is a lot of sheep flooding back into the slaughter market.”

While sheep prices in the rest of the country are also down, the WA market is typically more restricted by fewer abattoirs and the cost of transporting sheep to the east coast.

Mr McGeoch said lower demand from the US, a key sheep meat export market, was also limiting prices.

Concerns around seasonal conditions are also affecting producers in both the east, where an El Nino is forecast, and the west, where a positive Indian Ocean Dipole is likely.

Despite the drop in sheep values, consumers are unlikely to see much reduction in lamb prices because of high input costs in processing and transport.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout