Labor blinks in battle over stage-three tax cuts

Labor is expected to defer a fight over dismantling the stage-three tax cuts until next May’s budget.

Labor is expected to defer a fight over dismantling the stage three tax cuts until next year’s May budget, when Australians will face the worsening effects of inflation, interest rate hikes and global recessionary impacts.

Facing a political backlash over any move to trim tax cuts for middle-to-high income earners five months after promising voters that Labor would stick with the legislated stage three package, Anthony Albanese on Sunday repeatedly said “Our position hasn’t changed”.

The Prime Minister, whose Sydney seat of Grayndler is ranked fourth in the nation for the highest percentage of workers earning more than $104,000 a year, talked down internal government discussions over changes to stage-three tax cuts.

“Our position hasn’t changed,” Mr Albanese said. “So, it’s very clear. These (tax cuts) are due to come in 2024. We’re producing a budget in October 2022.”

Treasurer Jim Chalmers has led a national debate, supported by the expenditure review committee of cabinet chaired by Mr Albanese, about a potential rethink of the final stage of tax cuts estimated to cost the budget $243bn over nine years.

A dramatic shake-up of stage three, due to begin from July 2024, is now unlikely to feature in the October 25 budget, with the government wanting to amplify its cost of living measures, productivity policies including cheaper childcare and fiscal repair strategy tackling record debt and spending levels. The budget is expected to provide an updated estimate on the cost of stage three.

The Albanese government, which has come under pressure from unions, think-tanks, the Greens and key crossbenchers to dump or cap stage three, will monitor the impacts of deteriorating global economic conditions ahead of the May budget.

Dr Chalmers on Friday said “When it comes to the tax cuts, I think we’ve made the obvious point that when it comes to cost of living relief it should be targeted to people on low and middle incomes”. Under stage three, the 37 per cent tax bracket would be abolished and replaced with a flat rate of 30 per cent for Australians earning between $45,000 and $200,000. The top 45 per cent bracket would start from $200,000.

Two weeks out from handing down his first budget, Dr Chalmers will attend a cabinet meeting on Tuesday before flying to Washington DC to attend the G20 Finance Ministers and Central Bank Governors Meeting, and World Bank and IMF annual meetings.

Dr Chalmers will meet with US Federal Reserve chairman Jerome Powell, chief executives of BNP Paribas and JP Morgan, UK Chancellor of the Exchequer Kwasi Kwarteng, and counterparts from Canada, India and South Korea. He will become the first Australian Treasurer to attend a Coalition of Finance Ministers for Climate Action meeting.

“These meetings are a valuable opportunity to take stock of the rapidly evolving global situation and ensure our budget is informed by the best, most accurate, most up-to-date assessment of the global outlook,” Dr Chalmers said.

“I will meet with my counterparts, global leaders and executives from some of the world’s largest financial institutions to get a better sense of the challenges ahead and the potential implications for Australia.”

The Treasurer said “rampant inflation, skyrocketing energy costs and the threat of recession in some major economies” were fuelling global “economic storm clouds”.

“We will not be spared from this worsening global outlook and Australians are already feeling the pinch – through high and rising inflation, compounding cost of living pressures and supply chain challenges,” he said.

Dr Chalmers and Mr Albanese last week stressed the importance of balancing fiscal and monetary policy after the Reserve Bank of Australia announced a sixth consecutive cash rate hike, heaping mortgage stress on millions of homeowners.

Opposition Leader Peter Dutton said Australians would be “astounded” if Mr Albanese broke an election pledge.

“What we’ve seen this week is a real split between the Prime Minister and Treasurer and the Treasurer has demonstrated his inexperience,” Mr Dutton said. “He is obviously close to Wayne Swan and studied Paul Keating very closely. He’s been out there pushing a particular argument and the Prime Minister sensibly has abandoned that.

“I fear they have contemplated whether they’ll lie to the Australian public and that’s clearly still in their mind. We will take a policy to the next election and when we’re successful at the next election and we’re in government, we will honour it, without any asterisks, no fine print.”

Mr Albanese said the public was not “that engaged” in the debate over changes to stage three and accused the media of being “engaged in this position”.

The Prime Minister said Dr Chalmers had been making an “obvious statement” that monetary and fiscal policy should “work in concert … rather than against”.

“That is what we have said. We’re framing a budget in which there is a trillion dollars of debt being left by the former government and frankly, not enough to show for it,” he said.

“So, what we’re doing is going through line by line, making sure that we get rid of the waste that is in the budget. And that will be announced, of course, in just a couple of weeks’ time.”

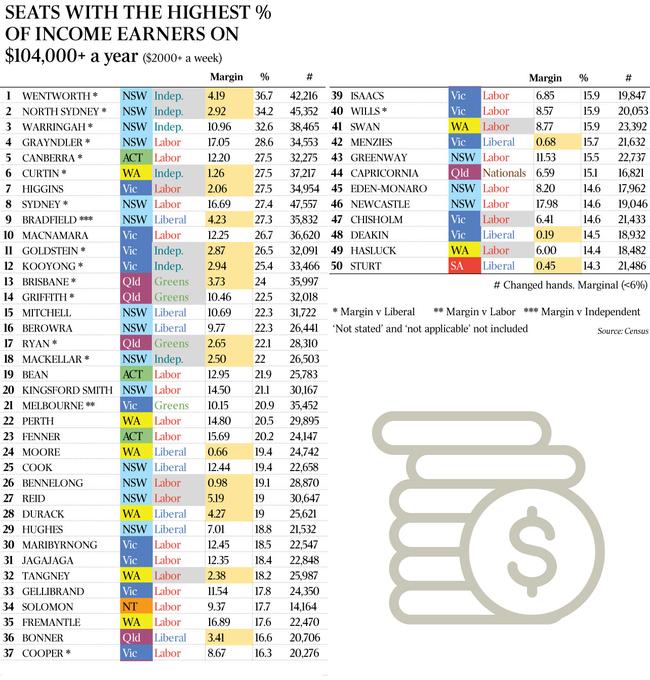

Analysis of federal seats by The Australian revealed that electorates with the largest proportions of voters earning more than $104,000 a year were dominated by Labor, teal independent and Greens MPs.

After losing a swathe of inner-city seats to Labor and the teals, the Liberal Party has only one seat in the top 10, and three electorates in the top 20.

Across the top 50 seats, Labor has 27 compared with the Coalition’s 12. Seven of the top 18 seats, traditionally held by the Liberals, are now home to teal independents.

The top five seats are Wentworth (Allegra Spender), North Sydney (Kylea Tink), Warringah (Zali Steggall), Grayndler (Albanese) and Canberra (Alicia Payne).

Labor seats in the top 10 include Higgins, won by the ALP for the first time on May 21, Sydney (Tanya Plibersek) and Macnamara (Josh Burns). The Greens seats of Brisbane, Griffith, Ryan and Melbourne are in the top 21.

Sydney Trains fleet operations controller Kane McParland, who voted for Labor on May 21 and is in the $120,000 to $180,000 tax bracket, told The Australian that middle-income earners were “constantly getting hammered”.

The Harrington Park resident, who lives in the Labor-held western Sydney federal electorate of Macarthur, said “You feel like you’re working harder for less, and you just sort of get smashed”.

“To have these tax cuts passed would be massive. I feel like the rising inflation, the cost of living pressures and interest rates on homeowners are going up,” Mr McParland said.

“There’s no reward for going out and chasing a decent wage to be able to support your family, and you’re in the highest tax threshold and you’re not making any progress. You’re never going to be a multi-millionaire earning that sort of money, you’re just going to be comfortable in society.”

ADDITIONAL REPORTING: LIAM MENDES

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout