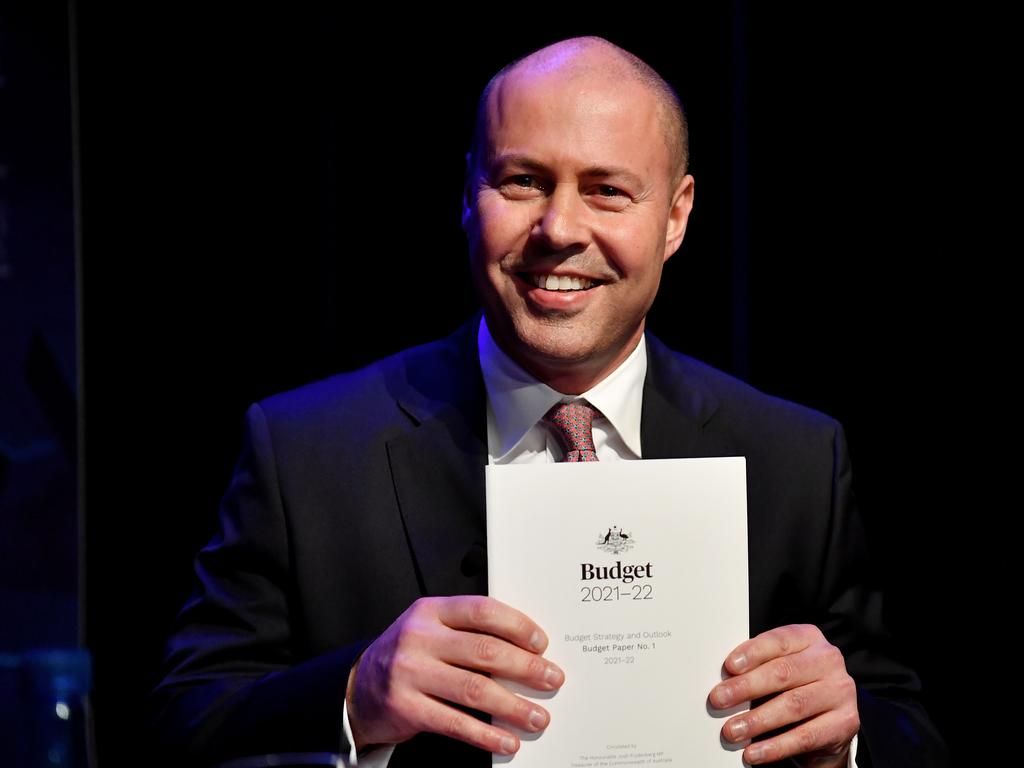

Budget 2021: Josh Frydenberg sets tax battlelines for election

The Treasurer has warned that a Labor failure to support the $130bn phase three tax cuts will hurt middle-income earners.

Josh Frydenberg has drawn election battlelines with Labor over his $130bn phase three tax cuts, warning that a failure to support them would leave middle-income earners hundreds of dollars a year worse off.

As the Treasurer pressured Labor to support the tax cuts due in mid-2024, Anthony Albanese said the budget failed to predict a boost to real wages despite record spending, and the nation would be left with “a trillion dollars of debt but nothing really to show for it’’.

In a National Press Club address at Parliament House, Mr Frydenberg declared his big-spending economic statement, headlined by a $31bn services package for the aged-care sector and National Disability Insurance Scheme, as a “Liberal budget” that stayed true to the Menzian tradition of getting more Australians into home ownership.

Mr Frydenberg said Australians would be worse off if the Opposition Leader abandoned the government’s tax cuts, which would abolish the 37 per cent tax bracket, leaving earnings between $45,000 and $200,000 taxed at 30 per cent. Insisting that they were “affordable and would create a stronger system,” Mr Frydenberg said the Labor Party had not said if it was committed to stage three, “even though at the time it passed through the parliament they said they supported our tax cuts’’.

“But if they were to abandon stage three or propose to abandon stage three, it would mean that somebody on $80,000 a year — a middle income earner — would be $900 a year worse off,” the Treasurer said.

The budget received mixed reviews from some business leaders and economists who argued that the government must do more to drive private sector investment and attract new businesses to Australia.

Business Council of Australia chief executive Jennifer Westacott said driving investment across the private sector, which supports eight out of 10 jobs, would boost productivity and wages growth.

“What we remain constantly concerned about is that unless we turn around the 28-year low in business investment as a share of the economy — and more importantly unless it encourages investment in new job creation and new industries — we run the risk of a false dawn,” Ms Westacott said.

“We run the risk that we are not going to drive productivity.”

Credit ratings agencies and the Commonwealth Bank raised concerns about the long-term budget position. S&P Global Ratings said that its existing “negative” outlook on Australia’s AAA rating reflected “a substantial deterioration of fiscal headroom” and stressed the need for projected deficits to “narrow toward their long-term trend over the next two to three years”.

The Opposition Leader’s budget reply speech on Thursday night will focus on boosting productivity and wages as it outlines Labor’s policy manifesto. Mr Albanese on Wednesday attacked the government over record COVID-19 debt and deficit levels and said the budget identified a “further decline in real wages”. He warned they would not keep up with the cost of living over the next four years.

“There’s no long-term vision,” Mr Albanese said. “We would have dealt with the issue of low wages. And what we’ll be left with at the end of this is a trillion dollars of debt, but nothing really to show for it. Labor budgets have plans to help people, to actually lift people up, to lift wages, to boost productivity. This isn’t a reforming budget.

“The election’s due next year. If they go early, it will be because things are going to get a lot worse. And people will notice the fact that their wages aren’t increasing and that a lot of this government’s plan … never matches up to its rhetoric.”

The Australian understands Labor MPs are split over whether to support the stage three tax cuts. Opposition Treasury spokesman Jim Chalmers said the party would “make our views clear on income tax between now and the election”.

A Labor Right faction MP suggested a compromise option could be to “not quite (go) all the way at the top end but giving ourselves a bit of differential”.

Another Labor MP said there was a large proportion of caucus members who supported repealing the tax cuts.

“People in that bracket vote for us and I would say 99.9 per cent of them want a tax cut,” the MP said. “The Left want to spend it, and so do a whole lot of people in the Right.”

One Labor Left-faction MPs said “we should agitate to knock over stage three” because “high-income earners don’t need the money”.

“We are a trillion dollars in debt,” a Labor MP said. “It is time to get serious about making savings. It is not money that people on high incomes need. Taxpayer money should go to low-income earners not high-income earners. We don’t need those tax cuts.

“Chalmers is clearly indicating he is not going to support it. They have given away all the revenue options, with negative gearing and other measures we took to the election. So we are going to have to find other revenue measures.”

Mr Frydenberg rejected suggestions the Low and Middle Income Tax Offset should be made a permanent feature in the tax system, after the government extended the measure for another year, delivering $7.8bn in tax cuts for about 10.2 million Australians.

“It is a fiscal stimulus in order to support aggregate demand and, therefore, support job creation,” the Treasurer said. “And if you are a tradie or a nurse or a teacher earning between $48,000 and $90,000, you get just over $1000 in your pocket at the end of your tax year. That’s a significant boost to household income. But it’s not a permanent feature of the tax system.”

Mr Frydenberg said a key feature of the stage three tax cuts, which are due to begin in 2024 at a cost of $17bn-a-year, was how they would “ensure the progressive nature of our tax system”.

“The top 5 per cent of income earners are paying a third of the overall tax burden,” he said. “That is before stage three and that is after stage three.”

Treasury estimates that by the middle of the decade, about 95 per cent of taxpayers will face a marginal tax rate of 30 per cent or less and that the top 1 per cent of earners will pay 17 per cent of the total income tax take under stage three by 2024-25, versus 15.6 per cent without it.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout