Jobs at small business go backwards despite tax cuts

Small businesses have failed to generate jobs or increase investment since 2015, clouding the effectiveness of tax cuts.

Small businesses have failed to generate jobs or increase investment since 2015, casting doubt on the effectiveness of corporate tax cuts.

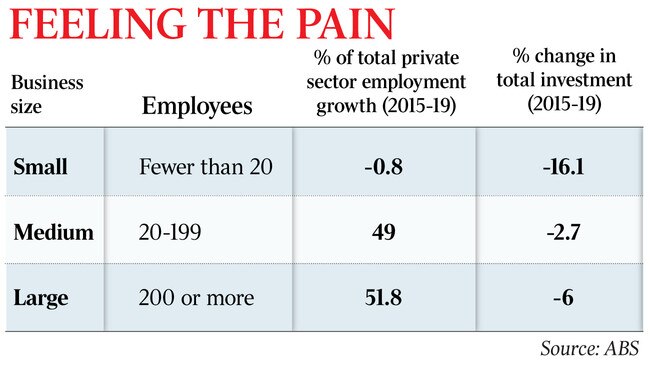

Larger businesses, defined as those with 20 employees or more, created all the new jobs between the middle of 2015 and last year, according to analysis by economist Saul Eslake.

“Small business has in fact been a net destroyer of jobs since the government introduced tax breaks for them in 2015,” Mr Eslake said.

Total employment by small businesses, those with fewer than 20 employees, shrank 0.8 per cent to 4.72 million over the four years to June 2019.

“All net employment growth has come from firms that pay payroll tax,” Mr Eslake said.

Medium businesses, defined by the ABS as having between 20 and 199 staff, and large businesses, having more than 200, combined employed just less than 60 per cent of the workforce in June last year, the most recent month available.

Arresting declining rates of business investment has been a challenge for the government and the Reserve Bank since the end of the mining boom.

Small-business investment dropped 16 per cent over the four-year period, almost three times as much as that of big business. “And big business includes the mining sector,” Mr Eslake said.

A former chief economist at ANZ and Bank of America, Mr Eslake said small businesses often “didn’t want to expand”, or would only do so up to when they needed to pay higher company or payroll tax. “A lot of them are perfectly happy as they are, they don’t want management challenges of more staff; it doesn’t matter what the tax rate is,” he said. In 2015, Joe Hockey as treasurer increased the level of assets that could be written off from $1000 to $20,000 for businesses with turnover up to $10m a year.

He also lowered the corporate tax rate to 28.5 per cent for businesses with turnover up to $2m a year, then increased the threshold to $10m in 2016 and lowered the rate to 27.5 per cent a year later.

From July next year the small-business rate will fall to 25 per cent for companies with turnover up to $50m. All other companies are taxed at 30 per cent.

Mr Eslake said offering tax breaks to new, rather than small, businesses was better policy.

“New business are more likely to take on staff and innovate; and it’s cheaper from the government’s point of view because new businesses become old,” he said, adding that he was in favour of taxing all companies at the same level. “Right now I wouldn’t advocate either lifting one or cutting the other, but in the long term a uniform company tax rate of around 25 or 27 per cent is where we should be heading,” he said.

“A problem with cutting company tax rate is it amounts to an increase in personal tax rate on dividends.”

Individual taxpayers pay income tax on dividends minus a credit for any corporate tax already paid.

“It’s possible the company tax rate will be raised as a politically easy way of reducing deficits in coming years,” Mr Eslake said.

“If Joe Biden wins the US election, the corporate rate there will jump back up to 28 per cent.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout