JobKeeper budget hit down $11bn as 640,000 drop subsidy

Josh Frydenberg will reveal on Thursday Treasury has revised the cost of JobKeeper payment from $101.3bn to about $90bn.

Australia’s economic resurgence has shaved $11.2bn off the projected cost of JobKeeper payments, with 640,000 fewer people expected to need wage subsidy support in the final three months of the year ahead of the COVID-19 welfare package ending in March.

In the mid-year budget update to be released today, Josh Frydenberg will reveal Treasury has revised the total cost of the JobKeeper payment from $101.3bn to about $90bn, reflecting improved forecasts on Australians returning to work.

The number of Australians ¬expected to rely on JobKeeper during the December quarter has been reduced from 2.24 million in the October budget to 1.6 million in the mid-year economic and fiscal outlook.

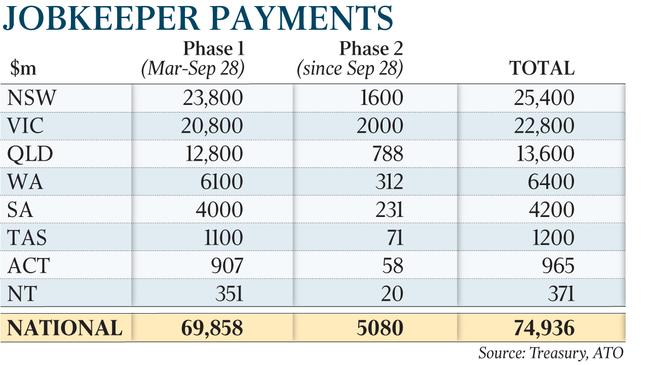

In the first phase from March to September, JobKeeper supported more than 3.6 million workers and about 1 million businesses, with payments totalling almost $70bn.

During the phase two rollout of Australia’s largest economic support program from September 28, JobKeeper payments in Victoria have hit $2bn, followed by NSW ($1.6bn), Queensland ($787.6m) and Western Australia ($311.9m).

As iron ore prices soared to $US155.75 a tonne this week, Treasury also revised its assumptions on the key commodity, with the mid-year budget update forecasting prices to decline steadily to $US55 a tonne by the end of the September quarter next year. The conservative approach to iron ore prices, which have boomed on the back of Chinese demand, is linked to uncertainty around how long President Xi Jinping’s stimulus rollout will continue and the resumption of normal production volumes in Brazil.

In the October budget, Treasury estimated an increase of $US10 a tonne in the iron ore price would result in an increase in nominal GDP of about $4.4bn in 2020-21 and about $3.4bn in 2021-22, resulting in a $300m increase in tax receipts in both years.

The Treasurer said that while the reduction in JobKeeper recipients reflected a labour market recovering faster than expected, there was “still a long way to go”.

“Australia’s economic recovery is well under way, with improvements in business and consumer confidence, a significant fall in the effective unemployment rate and businesses graduating off JobKeeper,” Mr Frydenberg said.

He said 650,000 jobs had been created in the past five months, with 80 per cent of Australians who lost their job or had hours reduced to zero at the start of the pandemic returning to work.

“As restrictions are eased and the economy begins to recover the need for temporary emergency support reduces,” he said.

“That said, the temporary JobKeeper payment remains in place until March next year to assist those businesses who need it most through the recovery and this period of transition.”

Treasury has estimated that, without the government’s economic support, the unemployment rate would have peaked five percentage points higher and remained above 12 per cent throughout 2020-21 and 2021-22.

JobKeeper was launched in March to deliver an economic lifeline for businesses and keep workers attached to employers during the pandemic. The wage subsidy payment was extended with updated eligibility tests and tapered payments in two phases from September 28 to January 3, and January 4 to March 28.

Phase one JobKeeper payments worth $1500-a-fortnight were reduced to $1200 between September and January, and will fall to $1000 between January and March.

The mid-year budget update, which coincides with the Australian Bureau of Statistics releasing labour force data, is expected to show a reduced deficit. Economists predict a $10bn turnaround, putting it at just over $200bn.

While iron ore exports have powered through the pandemic, Treasury assumptions on thermal and metallurgical coal prices are expected to be revised as China ramps up threats to blacklist Australian coal exports. In last year’s mid-year budget update, before the pandemic, Treasury predicted the iron ore price would fall to $US55 a tonne by the end of the June quarter this year. The $US55-a-tonne iron ore price forecast was updated in the July fiscal update to the end of the December quarter, and pushed out again to the end of the June quarter next year in the October budget.

Mr Frydenberg said the government would continue taking a “prudent approach to its commodity price assumptions in the budget as the global economic outlook remains uncertain”.

“It is unclear how long Chinese stimulus will persist and when normal production levels will resume in Brazil which has contributed to iron ore price increases over recent months,” he said.

“In the face of a one-in-a-century health and economic shock, Australia remains among one of the best-performing developed nations in the world supported by resilient economy and world leading resources sector.”

Australia’s current iron ore prices have hit 2013 levels in recent weeks, with China pushing monthly steel production to record levels of more than 90 million tonnes. The resumption of production by Brazilian miner Vale, which has been hit by supply disruptions during the COVID-19 pandemic, is considered a key factor in iron ore projections over the next 12 months.

With states and territories removing social and border restrictions, consumer confidence has surged, interstate travel has resumed and businesses have come back online. To support around 1.49 million Australians still on JobSeeker, the government in November extended coronavirus payments at a reduced rate to the end of March.

The housing and property market has also boomed, with the Housing Industry Association on Wednesday releasing new figures showing new home sales had increased by a further 15.2 per cent in November to “reach a decade high”.

In its latest business impacts of COVID-19 survey released on Wednesday, the ABS said one in five businesses were struggling to find skilled workers, with one in six reporting they did not have enough staff.

The survey, undertaken over the week to December 9, highlighted the challenges that some employers faced in ramping up their workforce as the economy recovers, despite an additional 245,000 Australians being recorded as unemployed in October compared to the start of the crisis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout