Jim Chalmers seeks to cool expectations and Labor MPs ahead of possible RBA rate cut

Jim Chalmers has been privately telling Labor colleagues not to speculate on an interest-rate cut ahead of the RBA board meeting, in an effort to manage expectations of relief.

Jim Chalmers has sought to cool expectations of a rate cut in the face of market predictions that the Reserve Bank board will deliver the first downward move in more than four years, with Labor MPs facing a gag order ahead of Tuesday’s decision to shield the government from claims it is trying to pressure the bank.

Despite economists being split over which way the RBA might go on Tuesday, the money markets are factoring in an 85 per cent chance of a cut amid deterioration in the economy and a faster-than-expected fall in inflation at the end of 2024.

While it would mark the first easing since the aggressive tightening cycle began in 2022, some economists warn that while cuts are likely, they will be gradual, offering only limited relief.

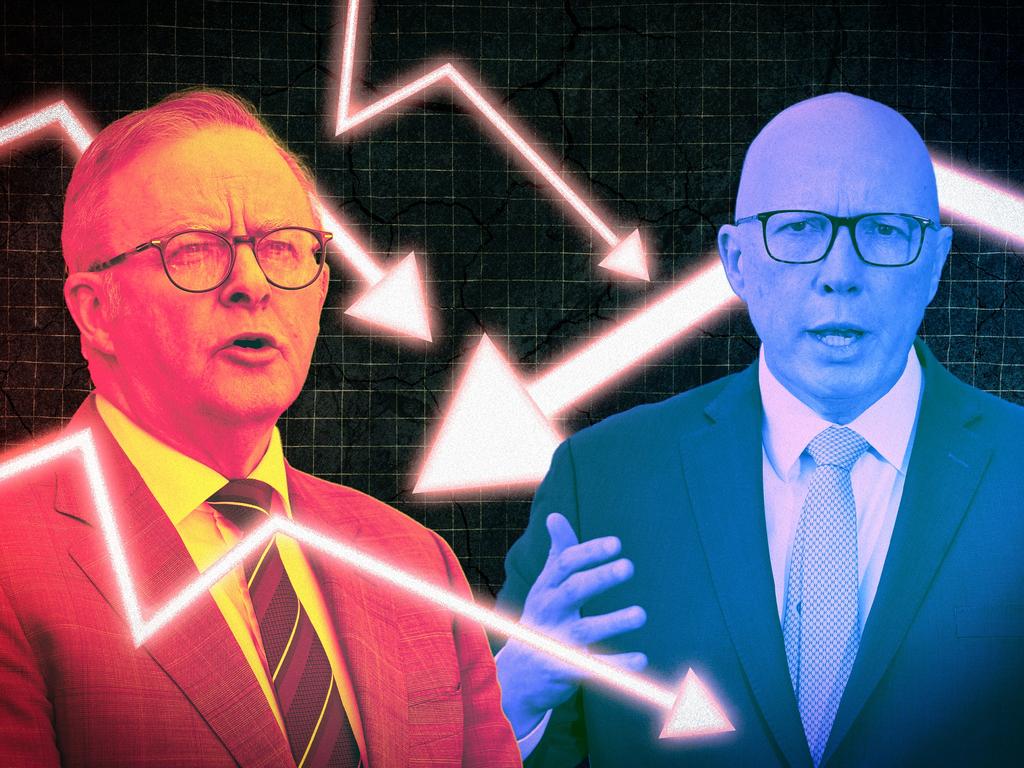

With Anthony Albanese due to call an election within weeks, the Treasurer told The Australian on Sunday that no matter the RBA’s decision, the government would not stop pursuing policies to fight inflation and the cost-of-living crisis.

“We take nothing for granted,” Dr Chalmers said. “Regardless of what happens on Tuesday, our primary focus on fighting inflation and easing the cost of living doesn’t change. We’ve taken the right economic decisions for the right economic reasons. We don’t make predictions about the decision the independent Reserve Bank will make this week, nor do we apply a political lens to it.

“I respect the independence of the Reserve Bank, its governor and its board, and that’s why I don’t predict or pre-empt the outcomes of their deliberations.”

The Australian understands that Dr Chalmers has been privately telling colleagues not to speculate ahead of the decision, in an effort to manage expectations of rate relief. He is believed to have also been asking MPs to avoid political commentary around the bank’s decision.

Dr Chalmers on Sunday accused Peter Dutton of barracking against households by appearing to make the case for why the RBA should keep rates on hold.

“Peter Dutton can explain why he made the case for higher interest rates in the lead up to this decision,” Dr Chalmers said. “Peter Dutton is the biggest risk to household budgets, the national budget and the broader economy.

“Australians would be thousands of dollars worse off if he had his way, and they’d be worse off still if he wins the election.”

Economists on Sunday were expecting the central bank to move cautiously, keeping its guidance deliberately vague and avoiding firm commitments on future cuts. AMP chief economist Shane Oliver said easing would be driven by growing confidence at the central bank that inflation is sustainably returning to target, supported by downward revisions to inflation, wages and GDP forecasts. However, he cautioned that the RBA would likely proceed cautiously.

“With low unemployment and the weak Aussie dollar, we see it providing cautious and noncommittal guidance around future moves,” he said. “We expect three rate cuts this year, but it’s likely to be a gradual process, with the next move unlikely until May, which will be well clear of the upcoming federal election.”

Analysis from Canstar shows a 25-basis-point rate cut would reduce repayments on a $600,000 loan by $92 a month, $115 on a $750,000 mortgage, and $154 on a $1m mortgage. However, the broader economic effects will take time to materialise, with economists expecting only a modest uptick in growth and property prices in the near term.

Dr Oliver said the rate cuts would provide some relief but would take time to filter through the economy, reversing only a fraction of the 13 hikes delivered since May 2022. “The impact is likely to be minor, at least initially, as it takes a while for rate moves to start impacting spending,” he said.

HSBC chief economist Paul Bloxham said the case for the RBA to cut rates was not unambiguously strong, but noted that inflation had fallen below the RBA’s own forecasts from November, making a cut defensible.

However, he ruled out a rapid sequence of cuts.

“An option is for the RBA to hold steady in February, noting good progress towards its inflation target but that it still is not yet confident enough that progress will be sustained to cut,” Mr Bloxham said.

“Another option is to cut, pointing out that further easing may be quite gradual and will depend on further progress on seeing core inflation fall.”

The headline Consumer Price Index indicator increased 2.4 per cent in December compared to 2.8 per cent in September – the lowest reading since 1.1 per cent in March 2021.

The result was lower than the 2.5 per cent markets had expected, and down from the peak of 8.4 per cent in December 2022.

The RBA has avoided a rate cut as it looked for inflation to return to target, which RBA governor Michele Bullock said in September must be sustained before cutting rates.

UBS chief economist George Tharenou said the RBA’s dovish pivot in late 2024 had locked it into a corner. With inflation surprising to the downside in the December quarter, a failure to follow through on the policy shift could rattle markets.

“It seems difficult for the RBA to walk back now after it opened the door in December,” he said. “Initially, due to the RBA’s own dovish shift, markets moved to almost fully price a 25bps rate cut in February, and more than 50bps by May. So if the RBA doesn’t deliver (on Tuesday), it will be difficult to communicate the reason to markets.”

Mr Tharenou said UBS expected the RBA to cut rates by a cumulative 75 basis points in 2025, with three rate reductions – beginning in February, followed by May and August.

Households have been squeezed by stubborn inflation and the sharpest rate hikes in history, leaving little room for discretionary spending. This has flowed through to record insolvency rates, with cafes and hospitality venues among the hardest hit.

Commonwealth Bank boss Matt Comyn said a legion of homeowners would be disappointed if the RBA did not move this week but warned that rate relief was not yet certain amid competing economic pressures.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout