‘Arrogant’ fee hikes spark IOOF super fund rebellion

One of the nation’s biggest superannuation funds has backed away from a raft of steep fee hikes after advisers rebelled.

One of the nation’s biggest superannuation funds has backed away from a raft of steep fee hikes — to have been imposed on 326,000 members holding $26 billion — after advisers in its own financial planning arm rebelled, attacking the move as “unfathomable”.

Financial services company IOOF, which is in the process of buying a large chunk of ANZ’s “wealth” arm and is now creating all super products for the major bank, had attempted to bring in hefty “exit fees” on existing accounts and sought to lift by one third the fees it charges to manage simple “cash” investments.

But in explosive internal correspondence obtained by The Australian, almost 100 of the 150 financial planners employed by Bridges Financial Planners — which is fully owned by IOOF and is the biggest driver of super into the group — attacked the hikes as “inconceivable” and ripping off investors.

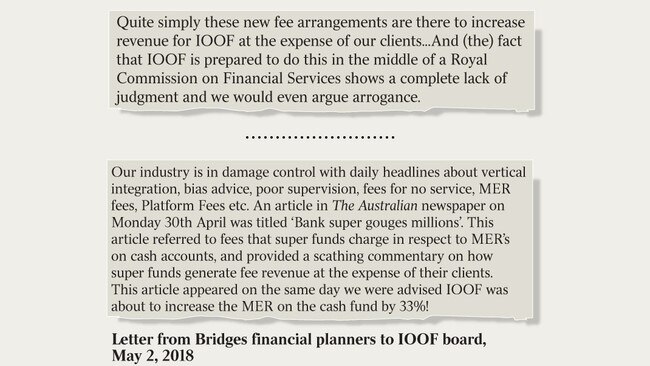

“Quite simply these news fee arrangements are there to increase revenue for IOOF at the expense of our clients,” the letter to IOOF executives, dated May 2, says. “Given the criticism of AMP … we find it unfathomable that IOOF would be implementing these fee changes.

“And the fact that IOOF is prepared to do this in the middle of a Royal Commission on Financial Services shows a complete lack of judgment, and we would even argue arrogance.”

While many of the fee increases for Bridges clients were waived, they were imposed on new investors. The rebellion comes as The Australian can reveal IOOF’s super members under the IOOF Portfolio Service Superannuation umbrella, which has 340,000 member accounts holding $25.8bn, have earned an average annual rate of return of just 2.1 per cent a year on their retirement savings in the 10 years to June 30, 2017. That is well below the annual average return on average risk-free “cash” investments — which returned 66 per cent more over the period — and significantly below the annual rate of inflation over the decade. That means those hundreds of thousands of investors have lost money, despite sending between 9 per cent and 9.5 per cent of every pay packet to super under the law.

They have collectively lost billions compared with what they would have made had they earned simple market rates. And those losses will be a potential burden on the national budget if people are forced onto the aged pension. On the back of those super guarantee contributions, however, IOOF has made billions in fees, charging $437.7 million in “management fees and service fees” in the year to June 30, 2017.

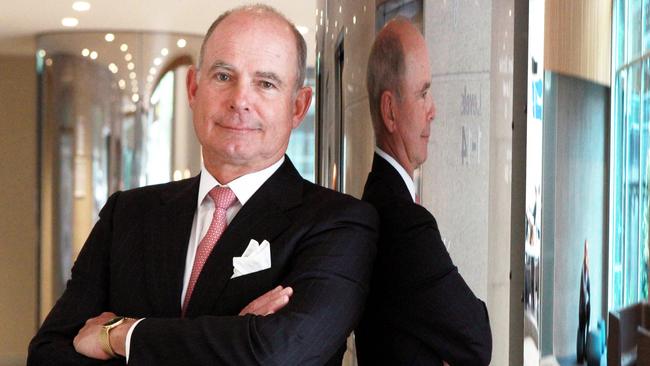

IOOF managing director Christopher Kelaher, who has held that position since 2009, and IOOF chairman George Venardos, also with the group sine 2009, declined to be interviewed. In a statement, head of corporate affairs Rachel Scully said the group reviews “our fees from time to time to ensure we are offering value to clients while maintaining a sustainable business model”.

Presented with evidence of the group’s huge charges, operating what is known as a “retail”, or for-profit, super fund, the Australian Securities & Investments Commission and the Australian Prudential Regulation Authority said they were powerless to act. “ASIC is unable to order any level of fees charged by superannuation funds,” an ASIC spokesman said.

An Australian Competition & Consumer Commission spokesman confirmed the matter was one for ASIC, which was “responsible for investor and consumer protection in financial services”. The spokesman directed The Australian to ASIC’s Money Smart website, which sets out in detail fees and charges that super funds can charge members.

In April, The Australian revealed the nation’s big four banks were gouging super funds by paying returns on simple cash investments as low as one-quarter of market rates.

In the May 2 letter to IOOF’s Mr Kelaher and Mr Venardos, the Bridges planners said the industry was in “damage control” over biased advice, “fees for no service” and gouging in fees which was reflected in “management expense ratios”.

“An article in The Australian newspaper on Monday 30th April was titled ‘Bank super gouged millions’,” the letter says. “This article referred to fees that super funds charge in respect to (management expense ratios) on cash accounts and provided a scathing commentary on how super funds generate fee revenue at the expense of their clients.

“This article appeared on the same day we were advised IOOF was about to increase the MER on the cash fund by 33 per cent!”

The advisers said the management fees on cash investments in super had increased from 0.32 per cent “just a few years ago” to 0.8 per cent, a 150 per cent rise “without any justification whatsoever”.

IOOF replied, saying it would waive for “existing Pursuit clients” the proposed exit fee and the rise in fees charged on cash investments. It would, however, push ahead with new “cost-recovery fees” for all members.

IOOF will be able to charge all the new fees for financial products it is now building and selling to ANZ’s customers. In the purchase from ANZ, IOOF will take control of billions of dollars in ANZ “legacy” superannuation funds into which members entered before 2013, when there were moves to crack down on fee gouging. Those legacy funds, which regularly deliver paltry returns, are hugely profitable for the banks and financial groups.

An introduction of exit fees would make it less likely people would leave those funds for lower-fee funds. Financial advisers have a legal duty to act in the “best interests” of clients, but also regularly obtain large “trailing commissions” by keeping clients in those funds.

The planners said they believed IOOF management had “badly misread consumer sentiment” and it was “difficult not to reach the conclusion that IOOF management are completely out of touch with consumer sentiment, the current market conditions, regulatory concerns with vertical integration and its own financial planners”.

Under vertical integration, financial institutions employ vast teams of financial planners, often via companies with different names but which they fully own, to provide advice to clients.

Do you know more? klana@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout