Insurers call on taxpayers to help cover wild weather

The $55bn insurance industry will enter the federal election campaign, urging major parties to increase spending on natural disaster resilience and contain the mounting damage bill.

Australia’s $55bn insurance industry will enter a federal election campaign for the first time, pitching to both major parties on the need to increase spending on natural disaster resilience and new ways to contain the mounting damage bill.

The Insurance Council of Australia’s policy platform – backed by national advertising – calls for the doubling to at least $200m a year of federal funding to help households and communities resist storms, floods and bushfires.

The ICA also proposed changes in 12 policy areas to combat the increased frequency of climate change-related extremes and axing state taxes on insurance products to make premiums cheaper in high-risk areas.

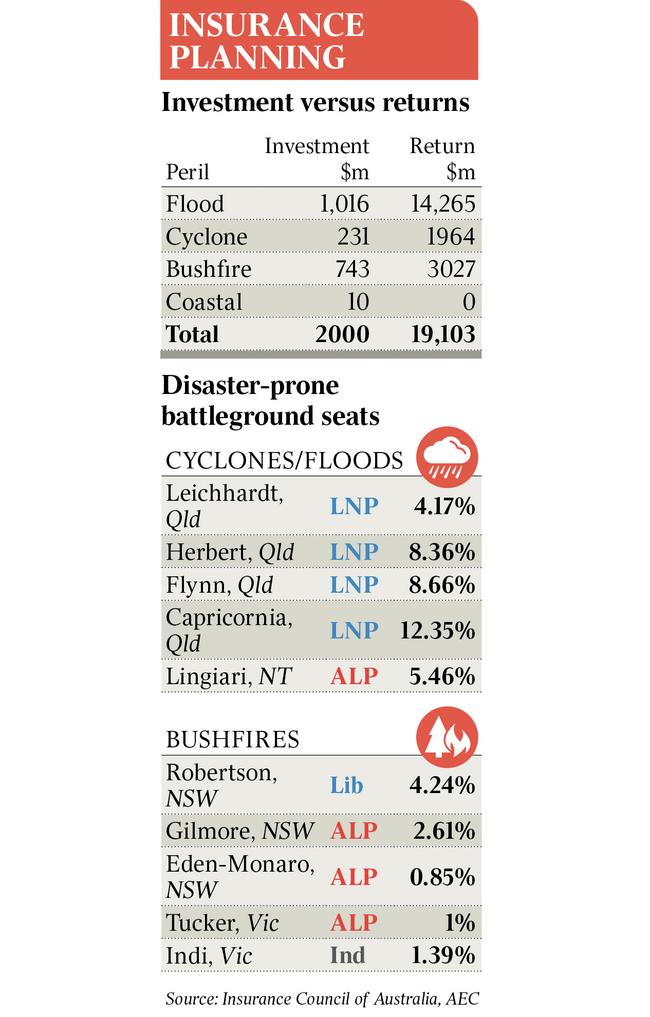

The cost and availability of home insurance as well as public liability cover for small businesses could be a sleeper issue in the election campaign, playing into marginal seat battles in the cyclone zones of north Queensland and the Northern Territory, as well as flood or bushfire-prone parts of regional NSW and Victoria.

ICA chief executive Andrew Hall said: “In the face of worsening extreme weather, the next Australian government must boost investment in stronger homes and local infrastructure that makes communities safer and more resilient.

“This means subsidies to improve the resilience of the nation’s homes and businesses to cyclone, flood and bushfire, as well as funding for projects that protect the community, like levees, floodways and (fire) fuel reduction.”

In addition to seeking commitments from both the Coalition and Labor to lift Canberra’s existing $100m contribution, the ICA will press the states and territories to match the increased funding. Over five years, this would pump $2bn into disaster prevention at both household and community levels, with a projected return of $19bn.

The campaign promises to bite hardest north of the so-called Capricorn line in central Queensland, where some insurers have stopped offering home cover due to the seasonal cyclone menace.

The Cairns-based federal seat of Leichhardt – held by Liberal Party stalwart Warren Entsch on a margin of 4.2 per cent, but a focal point of business and tourism operator anger over Covid-inspired border closures – is a must-win for both sides.

Anger at the soaring cost of home and business premiums is simmering along the Queensland seaboard in Townsville-based Herbert, Mackay-based Dawson and Gladstone-based Flynn, all held by the Liberal National Party.

Insurance issues will also have traction in electorates hit by the 2019-20 black summer bushfires, among them lineball Eden-Monaro reaching from the south coast of NSW to the snow country. The scenic region bore the brunt of some of the most destructive and lethal blazes to erupt three years ago. Labor holds the federal seat by barely 0.8 per cent.

Mr Hall said insurers had incurred $8.6bn in natural disaster claims since the Black Summer emergency, smashing their bottom lines. An inquiry by the Australian Competition & Consumer Commission into insurance in northern Australia found that insurers had combined losses of $856m in the 12 years to 2020.

While conditions had improved, in the calendar year 2020 insurers had made a combined profit of $35m, a poor return on capital.

Asked why taxpayers should chip in, Mr Hall said: “In addition to better protecting property and providing premium relief there are wider benefits that come from greater investment in resilience measures, with significant evidence demonstrating the economic and social benefits of more resilient communities.”

The ICA’s bid for $400m a year in matched funding from the commonwealth and states is in line with a recommendation from the Productivity Commission for increased natural disaster spending by governments.

A $522m local infrastructure fund, accounting for about a quarter of the proposed five-year outlay, would target flood control projects such as levees and floodways. Insurers had identified the “areas of greatest need”, the policy platform says.

More money would go to cyclone-proofing homes under the ICA plan – building on an oversubscribed household resilience program run by the Queensland government, for example. Domestic utilities would be raised above floodlines to floodproof homes; flood early-warning systems established; fuel management and reduction in fire-prone places improved; and a national coastal hazard information database set up, the insurers say.

The states and territories should have incentives to abolish taxes, levies and charges which add up to 40 per cent to the cost of insurance premiums. One option would be to replace those imposts with broadbased land taxes. This could add $5.52bn net to annual household spending capacity, the ICA says, citing a 2015 Deloitte Access Economics report. “While our advocacy on issues of importance to insurers and their customers is ongoing, there are a number of issues that must be dealt with by the next Australian government,” Mr Hall said.