RBA to hold again on rates as inflation eases to 4.9pc

Reserve Bank governor Philip Lowe is all but certain to hold rates at his final board meeting on Tuesday, after inflation dropped by more than expected in the year to July.

Reserve Bank governor Philip Lowe is all but certain to hold rates at his final board meeting on Tuesday, after inflation dropped to 4.9 per cent in the year to July, from 5.4 per cent in June.

While consumer price growth remains too high, it has declined steadily since hitting a peak of 8.4 per cent in the year to December, based on the monthly numbers, and an increasing number of economists believes the RBA may have done enough to bring inflation under control without the need for further hikes.

Petrol prices remain high and climbed further in August, but in July they were down by 7.6 per cent against the peaks of last year, and this dragged on the overall inflation result, as did a 5.4 per cent annual drop in fruit and vegetables prices thanks to a bumper growing season, the Australian Bureau of Statistics said.

The puff also came out of holiday travel and accommodation inflation, which more than halved to 5.3 per cent in the year to July, from 13 per cent the month before.

KPMG chief economist Brendan Rynne said there was “nothing in today’s figures to lead the RBA to increase rates next week” from their level of 4.1 per cent.

After a dozen rate rises since May 2022 sent mortgage interest burdens to record highs, EY senior economist Paula Gadsby said further hikes looked “increasingly unnecessary”.

“This cooling is further evidence that rate hikes are working, and the Reserve Bank will be pleased with its piloting of the economy towards a soft landing. Whether … that soft landing is accomplished remains to be seen,” Ms Gadsby said.

The cost of living pressures crushing household budgets around the country persisted.

Rental inflation accelerated from 7.3 per cent in June to 7.6 per cent in July, the data showed.

Electricity bills on an annual basis were up nearly 16 per cent, up from 10 per cent in the year to June, even as government energy bill rebates worth up to $250 began to flow to eligible households.

ABS head of prices statistics Michelle Marquardt said the power bill shock would have been much worse had it not been for the taxpayer support. “If we exclude the impact of rebates from the July 2023 figures, electricity prices would have recorded a monthly increase of 19.2 per cent,” rather than the month-on-month rise of 6 per cent, Ms Marquardt said.

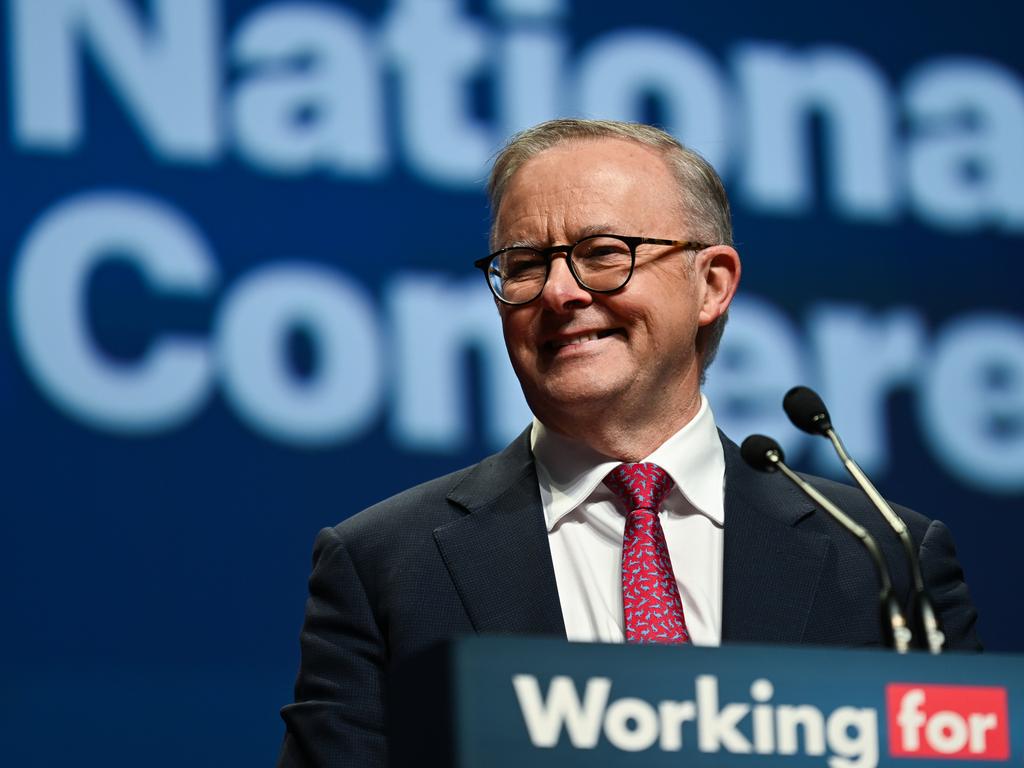

Jim Chalmers in a statement said the inflation numbers were “an encouraging result, but we know Australians are still under the pump”.

“It’s pleasing to see inflation is moderating but we know it will remain higher than we’d like for longer than we’d like,” the Treasurer said.

“This data makes it very clear our energy price relief plan is working as intended by helping to take some of the sting out of power price rises when people need it most.”

Despite the decline in fruit and vegetables prices, grocery bills remained much higher than a year earlier. Dairy prices were up almost 13 per cent (cheese was 19 per cent higher), while bread and cereals prices were 10 per cent higher.

Other food products climbed 8.3 per cent annually, although prices declined slightly in the month, and meat and seafoods inflation over the year was more subdued, at 2.4 per cent, as lamb and beef prices declined versus a year earlier.

Excluding the more volatile items of petrol, fruit and vegetables and travel, the price data showed a more modest fall in “underlying” inflation, from 6.1 per cent to 5.8 per cent, the ABS said.

Deputy governor Michele Bullock on Tuesday evening said she was “reluctant” to say how long interest rates would need to stay high.

“All I can say is that we may have to raise interest rates again, but we’re watching the data very carefully,” Ms Bullock said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout