Inflation drops to 6.8pc in February, from 7.4pc in January

Hopes the RBA could pause aggressive rate hikes are buoyed after new figures showed inflation dropped to 6.8 per cent in February.

A pause in the punishing series of back-to-back Reserve Bank rate rises could come as soon as next week, after inflation decelerated sharply to 6.8 per cent in February, from 7.4 per cent the month before.

Economists are confident the worst of the inflationary shock is behind us, although cost-of-living pressures remain intense and a decision to hold the cash rate steady at 3.6 per cent at Tuesday’s RBA board meeting after 10 straight increases was no foregone conclusion, they said.

With Australian Bureau of Statistics figures showing electricity prices increased by more than 17 per cent in the year to February, Jim Chalmers welcomed the ongoing “moderation” in consumer price pressures but said addressing the still “unacceptably high” rate of inflation remained at the centre of the government’s economic strategy ahead of the May 9 budget.

“We do understand Australians are under the pump from cost-of-living pressures,” the Treasurer said in question time.

There may be some good news for mortgage holders, who have suffered a steep increase in interest payments since May when the RBA began the most aggressive rate hike cycle since the 1980s.

Capital Economics head of Asia-Pacific Marcel Thieliant said “the further sharp fall in inflation coupled with the softness of consumption will probably prompt the Reserve Bank of Australia to pause its tightening cycle next week, though we still expect one final rate hike at its May meeting”.

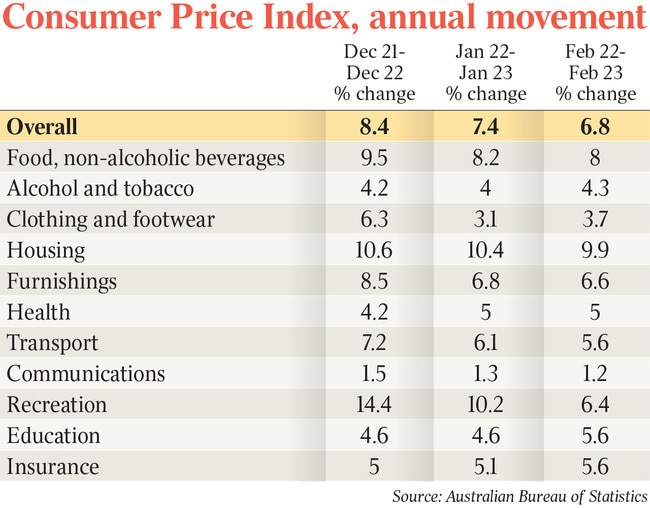

By category, the biggest price rise in the year to February was a 9.9 per cent jump in housing costs, ABS figures showed.

While asking rents are reportedly rising at double-digit rates, rent inflation in CPI figures was steady at 4.8 per cent, if remaining on an upwards trend.

Similarly, electricity prices accelerated to 17.2 per cent from 16.8 per cent, although building cost growth eased to 13 per cent from 14.7 per cent in the year to January, the ABS data revealed.

The data showed food prices were 8 per cent up on a year earlier, relatively unchanged from 8.2 per cent in January, but recreation and culture inflation fell sharply to 6.4 per cent in February, from 10.2 per cent, as the end of a bumper holiday season saw travel and accommodation price rises fall from 17.8 per cent to a still-high 14.9 per cent.

Fuel prices climbed by 5.6 per cent in the year to February, after rising at annual pace of 7.5 per cent the month before.

In the wake of the Russian invasion of Ukraine, petrol prices were climbing year on year by more than 40 per cent.

Minutes from the March meeting showed the board had considered holding rates steady, before ultimately deciding to hike.

RBA governor Philip Lowe has made it clear he will be guided by the data – including Wednesday’s inflation report.

Monthly annual inflation reached a high of 8.4 per cent in December before dropping to 7.4 per cent in January and 6.8 per cent in the most recent figures

While ABS figures underlined a disinflationary trend taking hold in early 2023, ANZ senior economist Catherine Birch said there was still too much momentum in consumer price growth, and the RBA would hike again on Tuesday.She pointed to three key pieces of data since the last central bank board meeting – including February’s strong employment report, ongoing cost pressures in NAB’s business survey, and ongoing strength in services spending – pointing towards ongoing economic resilience.

“Moreover, the banking sector issues over the past few weeks seem (at this stage) to have been ring-fenced by quick action from central banks,” Ms Birch said. “The US Fed, the ECB (European Central Bank), the BoE (Bank of England) and the SNB (Swiss National Bank) have all raised rates over the past few weeks, signalling that financial stability concerns, while under close watch, are not outweighing ongoing inflationary concerns.”

The relatively new monthly CPI data do not include the full basket of consumer goods in each month, with the quarterly report offering the most complete picture. Despite those drawbacks, the RBA has made it clear the more frequent inflation number provides a useful and more up-to-date guide on price pressures.

Inflation based on the quarterly figures reached 7.8 per cent in December, and the March quarter report is due on April 26.

Westpac senior economist Justin Smirk predicted quarterly inflation in the year to the March would drop to 7.2 per cent, but Wednesday’s soft CPI figures suggested the figure could come in meaningfully lower.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout