Housing price surge drowns river of woe

Brisbane buyers looking to own a slice of the prized riverfront have all but forgotten the devastating floods of a decade ago.

Luxury property buyers in Brisbane looking to own a slice of the prized riverfront have all but forgotten the devastating floods that broke the banks 10 years ago, with prices climbing more than 40 per cent in sought-after suburbs.

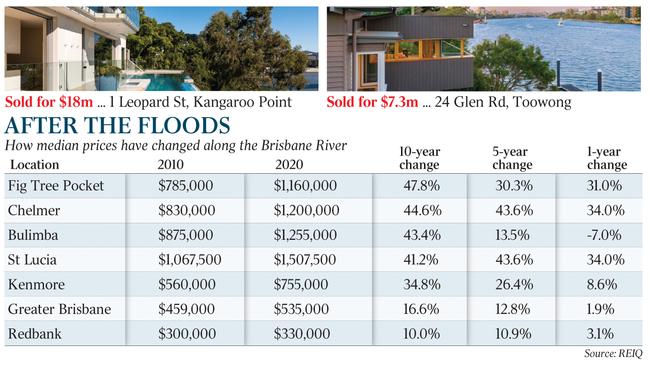

From prestigious Bulimba in the city’s east to Redbank to the west, property prices have risen along the Brisbane River since the unprecedented floods that swept through in January 2011 to outpace the greater market in a majority of locations.

Data compiled by the Real Estate Institute of Queensland for The Australian shows while the whole of greater Brisbane has grown 16.56 per cent over the past decade, suburban riverfront locations have taken off.

Fig Tree Pocket has undergone the most significant growth since 2010, up 47.77 per cent to hit $1.160m. Similar growth has been felt in Chelmer (up 44.58 per cent to $1.2m) and St Lucia (up 41.22 per cent to $1.51m).

REA Group chief economist Nerida Conisbee said waterfront locations have long proven popular with buyers around the country. “When there is any flooding people get nervous. It’s bushfires too, any natural disaster really,” Ms Conisbee said.

“Now we are 10 years on and houses have been rebuilt, fortified and made safer, people have tended to forget.”.

Brisbane offers just 850 absolute riverfront lots. Since the floods, a growing number of sites are being developed vertically, making the water views more accessible but also placing a premium on freestanding homes.

Prestige agent Jason Adcock uploaded a 30-second Instagram story about a three-storey property on the edge of the riverbend at Yeronga in October. Within five minutes, with no other advertising, he had received an inquiry. It sold a few days later for $2.715m

He says demand is red hot.

“It was dire in 2011, 2012 and 2013, there just weren’t a lot of buyers or sellers,” Mr Adcock said. “It wasn’t until mid-2018 that momentum started to build. People are now snapping riverfront properties up.”

While the prestige end of town was affected, it was further down river towards the flood plains of Ipswich that suffered most. Redbank, which was significantly hit by the deluge, has had a humble growth of 10 per cent over the past decade to $330,000.

Principal of Ray White Ipswich Warren Ramsey said that further west, the question of flooding was still on buyers’ minds.

“It comes up in seven seconds,” he said. “The first question is ‘did it flood?’ and the second is ‘how high?’. “That is disappearing but buyers keep getting reminded of it again by their valuer, insurer and lender”

REIQ chief executive Antonia Mercorella said buyers need to beware of how the Sunshine State’s extreme weather can affect their prospective property and their due diligence. The past year has enjoyed a string record-breaking sales occurred along the edge of the Brisbane River, including the resale of the city’s most expensive property. A deal was struck on 1 Leopard St, Kangaroo Point for $18m following its $18.48m sale two years ago.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout