Households pile their cash into mortgages

Australian households are on average almost four years ahead on mortgage payments with a record $50bn sent into offset accounts.

Australian households are on average almost four years ahead on their mortgage payments, with a record $50bn funnelled into offset accounts over the past two years as homeowners used the pandemic to pay down their loans.

This is on top of more than $170bn in additional savings across other accounts since the outbreak of Covid-19 primed to drive the highest forecast consumption rates in two decades, according to new data from the Australian Prudential Regulation Authority.

The savings boom fuelled over two years of the pandemic comes as Josh Frydenberg warned that the economic recovery was not yet locked in, with the Omicron wave posing a “serious” health and economic challenge for the nation.

New data from the banking regulator provided to The Australian shows that average households were 45 months ahead of principal and interest mortgage payments, with offset account balances surging by almost $50bn since the start of the pandemic.

This was at the highest rate since 2008 when APRA began collecting data.

There was now almost $370bn sitting on household and business balance sheets combined, with part of those savings expected to drive a household spending surge this year.

The Treasurer, still recovering from a Covid-19 infection after testing positive last Friday, is in isolation at his Melbourne home with his wife Aimee – who has also contracted the virus – and their two children, one of whom tested positive on Sunday.

He said he had experienced the common symptoms, including fever, cough and lethargy, but was on the mend.

“The rapid spread of the Omicron variant is a reminder of the serious health and economic challenges we face,” the Treasurer told The Australian.

“We are not out of this pandemic, the recovery is not yet locked in and we cannot be complacent.

“But despite the challenges of Covid-19, households are well positioned to get ahead on their home loans thanks to a combination of record low interest rates, unprecedented support from the Morrison government and a significant increase in savings.

“This is confirmed by new APRA data showing the average borrower with a principal and interest mortgage is now 45 months ahead on their scheduled repayments compared to 32 months at the start of the pandemic, while the average offset account balance has ballooned by almost $20,000 over that same period.

“This means Australians can pay down their mortgages faster, while critically they are reducing their interest payments and strengthening their personal balance sheets with some $220bn in savings that was not there before the pandemic.”

This was based on 5.16 million principal and interest mortgage accounts. The APRA data also showed borrowers with an interest-only mortgage were on average 52 months ahead on monthly mortgage repayments in October 2021, eight months more than 44 months ahead in March 2020.

Mortgage offset account balances have risen by $48bn since the start of the pandemic, with households benefiting from record low interest rates, leading to larger savings.

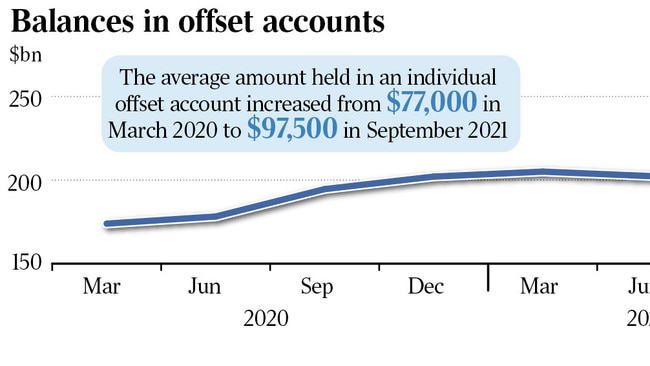

The APRA data revealed $222bn in mortgage offset accounts at the end of September 2021, up from $174bn in March 2020. In the September quarter alone, balances rose by 10 per cent or almost $20bn.

The average balance now residing in offset accounts was almost $100,000.

In terms of the share of mortgage prepayments, 57 per cent came from offset accounts, 40 per cent in available redraw balances and three per cent made up of other excess repayments.

Mr Frydenberg said the numbers reflected the pent-up savings from lower household spending during the pandemic lockdowns.

And while they were paying back their mortgages faster than before the pandemic, billions of dollars had also been put away into savings.

While acknowledging the benefit of households being so far ahead on their mortgage payments, providing a buffer for future interest rate rises, some of these savings would also be expected to flow through to increased household spending once the critical phase of the Omicron wave eased and conditions normalised, meaning the record high mortgage prepayments was more than likely at its peak.

Household consumption is forecast to rise 5.5 per cent in the next financial year, which would mark the strongest growth in almost 20 years, with household disposable income lifting 11.7 per cent since the start of the pandemic.

While consumption for the month of December was expected to show a rebound following the NSW, Victoria and ACT Delta lockdowns, January could show subdued activity due to the Omicron outbreak.

“Throughout the pandemic, the Morrison government has had the backs of Australian households, with significant economic support and $10bn in tax cuts which flowed to 11 million people in the September quarter alone,” Mr Frydenberg said.

“Our government is ensuring Australians keep more of their hard-earned money, which they can reinvest into their most treasured asset.

“In the face of a one in 100-year pandemic, Australia’s economy continues to prove its remarkable resilience.”

Housing Minister Michael Sukkar said the APRA data was encouraging as it showed households were well placed to get ahead on their home loans despite the broader economic impacts of the pandemic lockdowns.

“On top of strong jobs growth and unemployment at 4.6 per cent, household savings throughout the pandemic are ensuring people can get ahead and stay ahead of their mortgage,” Mr Sukkar said.

“The Morrison government’s housing programs, from HomeBuilder to the Home Guarantee Schemes, have seen more Australians achieve the goal of owning their own home.

“The economic support provided to households during the pandemic has backed in Australian homeowners.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout