Surge in using superannuation to pay doctors’ bills

The amount of superannuation released early to pay for medical bills has increased by almost a third, to $278 million last year.

The amount of superannuation released early to pay for medical bills has increased by almost a third, to $278 million last year, as Australians find new ways to cover rising health costs.

The surge came as the federal government grappled with whether to rewrite the compassionate-access rules for super to prevent small drawdowns becoming a larger long-term reduction in retirement savings.

The Australian has previously revealed a fivefold increase in the number of applications for early access to super, partly driven by an increase in obesity rates and health industry marketing.

At one point, more than half of the applications were specifically for bariatric surgery, on the grounds it would treat a life-threatening illness or alleviate acute or chronic pain, as determined by a doctor.

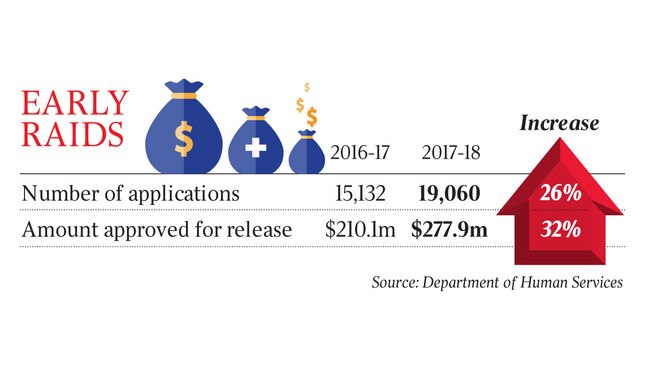

New figures show the number of early-access applications approved on medical grounds, the predominant reason, jumped from 15,132 in 2016-17 to 19,060 last year. The total amount approved for release surged from $210,119,410 to $277,938,340 — a 32.28 per cent increase — while the average increased to $14,482.

A Treasury review of the early-access laws was launched almost a year ago and was due to report in March.

The then assistant treasurer, Kelly O’Dwyer, said it was important to “strike an appropriate balance between protecting people’s retirement savings and giving a lifeline to those facing genuine hardship, whilst ensuring the rules can be administered fairly and effectively”.

However, the government has yet to act on the review and the responsible minister has also changed. A spokesman for new Assistant Treasurer Stuart Robert would say only that “the government is considering the feedback received during the consultation process”.

Meanwhile, Health Minister Greg Hunt has been working on reforms to reduce cost pressures in private health, with a taskforce to recommend measures to deal with consumer concerns over unexpected out-of-pocket expenses.

One solution may be allowing GPs to give referrals to a shortlist of specialists, allowing the patient to seek out quotes before making a final decision.

While health costs are rising above the rate of inflation, gap fees are increasing and insurance coverage is declining, the Australian Bureau of Statistics has found no evidence these trends are forcing more people to go without healthcare.

The annual ABS patient experiences survey, released yesterday, showed the proportion of people who delayed or avoided a specialist appointment due to cost in 2017-18 was 7.9 per cent. That was up from 7.3 per cent the year before but within the margin of error, and lower than the survey results from the previous two years.

The proportion of people who delayed or avoided a GP appointment due to cost was 4.1 per cent last year. Taking into account the margin of error, that was marginally down on the 5 per cent response the year before.

Mr Hunt has faced pressure from GP groups to increase Medicare rebates after a lengthy indexation freeze and doubts over official bulk-billing figures. He has vowed to work on chronic care funding changes, separate to whatever the government decides to do about out-of-pocket expenses.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout