Headaches for local manufacturers if aluminium tariffs hit China hard

China could start dumping cheaper aluminium on Australian markets, causing headaches for manufacturers even if Donald Trump exempts Australia from his tariffs, industry chiefs say.

China could soon start dumping cheaper aluminium on Australian markets, causing headaches for local manufacturers even if Donald Trump exempts Australia from his proposed tariffs, according to industry chiefs.

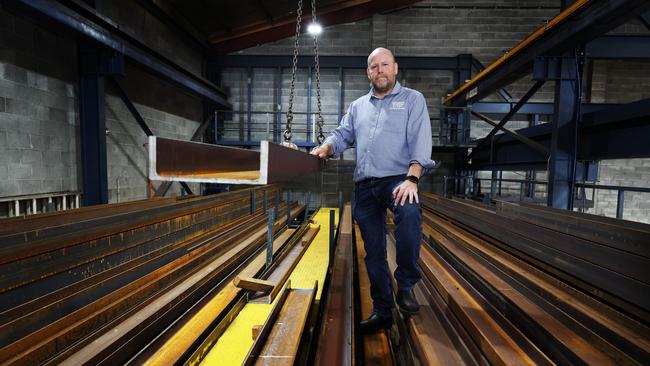

Edcon Steel managing director Hugh Edmunds said the tariffs could lead to an influx of new international product diverted from the US onto Australian shores, impacting the local market.

“If imported steel from other countries can’t go to America, it ends up in Australia at, rather often, a reduced price,” Mr Edmunds said.

“For the end users it might be a benefit because the sale prices might come down, but for the Australian industry it’ll impact them because the prices they’re receiving for locally made products will also come down, impacting their margins.

“There’s a good chance (of oversaturation), and in the past when there’s been changes in tariffs and rebates in China it’s affected local supply. History would say if it does go ahead as proposed it will change the supply situation in Australia.”

Mr Edmunds described the current demand for steel in Australia as “soft”, adding Edcon would “follow the market” if an influx of foreign materials were to flood into it.

“If imported steel prices were to drop as a result of increases in supply then we will just have to … source more steel from overseas,” he said.

Capral Aluminium chief executive Tony Dragicevich believes the tariffs will potentially open the gate for China to redirect cheaper aluminium exports to the Australian market, creating a dumping effect that existing local suppliers would struggle to compete with.

Capral, which has plants across the country, is one of the largest distributors of aluminium extrusions, whereby material is moulded to the desired shape by being pushed through a die.

Any move by China to sell raw materials well below cost price would threaten the local aluminium extrusion industry and smelters, from whom some 10 per cent of local aluminium is exported to the US.

While Capral does not export to the US, the company relies on its suppliers who may begin to feel the pressure if the Albanese government cannot secure an exception from the tariffs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout