Groceries, housing expenses squeeze budgets as cost of living shrinks savings

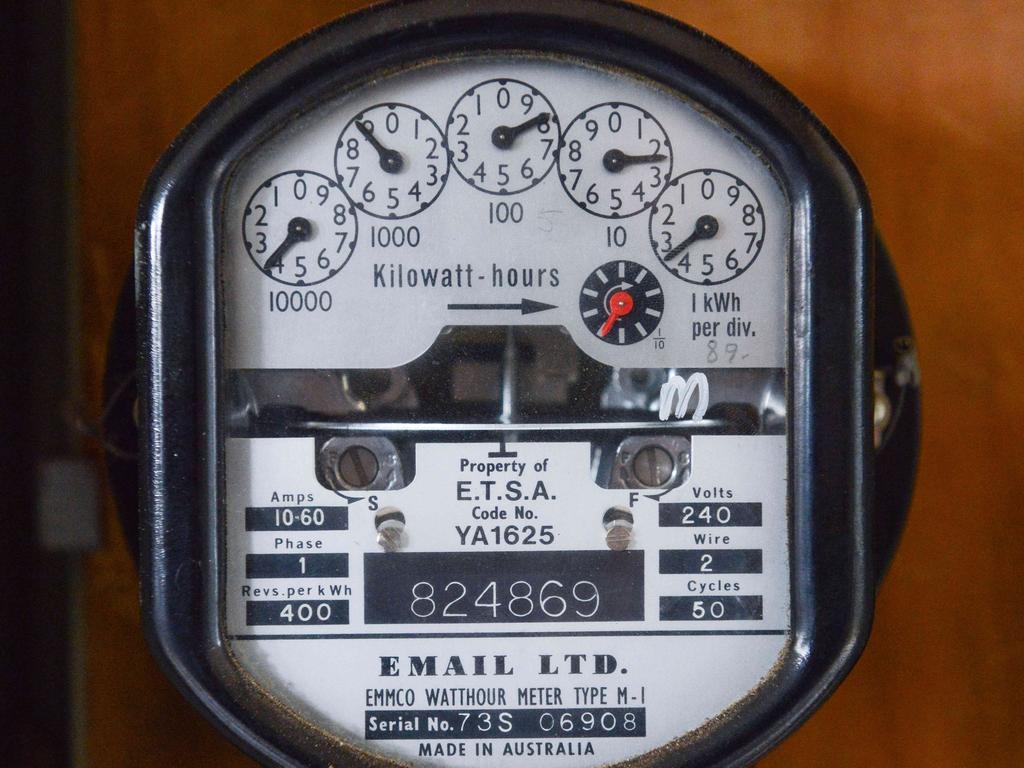

Groceries, rent and mortgage costs, petrol and energy bills were the biggest pain points revealed in a report that shows many Australians now struggle to afford basic needs.

Four in five Australians say they have pulled back on spending on non-essentials and holidays after household bill stress spiked under cost-of-living pressures.

A new report from financial comparison site Finder has found the biggest pain points in the household budget between December and February were groceries, rent and mortgage costs, petrol and energy bills, which have each increased steadily since March 2021.

Bill stress is causing some to eat into their savings. The average Australian has around $30,000 in savings and is saving roughly $600 per month, but Finder estimates that on a rolling three-month average, they have lost almost a month of their perceived savings buffer since the beginning of 2021, down from around 18 weeks to 14 to 15 weeks.

Finder Australia chief executive officer Chris Ellis said the combination of interest rate rises on mortgage repayments, surging rents and high inflation has caused the budget to be stretched for many families and singles.

“The cost of living has soared dramatically, making it increasingly difficult for many Australians to afford their basic needs,” Mr Ellis said.

“The economic conditions are some of the most challenging households have faced in decades.

“Young consumers, those who are renting, paying off a mortgage, or raising young children are feeling the effects most acutely.”

Australians are pulling back on their spending, with half of households already reducing their grocery bill. Holidays were next on the chopping block, with 37 per cent of people committing less to travel and just under a third no longer splurging as much on entertainment, food delivery and petrol.

Nine in 10 Gen Z and Gen Y have re-evaluated their spending in recent months compared to just 72 per cent of Gen X and 59 per cent of Baby Boomers, with younger people having considerably less savings than their elders.

Homeowners are refinancing their mortgages in droves to find extra savings after variable rates increased the average mortgage by more than $1000 per month and 800,000 fixed deals are set to expire this year. Over a third of Australians (37 per cent) said they have struggled to pay their loan in the past three months, up from a Finder survey low of 17 per cent in October 2021.

Mr Ellis said Australians need to be empowering themselves with information during this difficult economic period.

“Raising awareness of the issues Australians are facing, and considering ways to respond, supports increased financial literacy at a time like this,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout