Government spending balloons to highest share of economy ever as Labor prepares first budget

Government spending has ballooned to its highest share of the economy in history, with experts warning more public expenditure is on the way as Labor prepares its first budget.

Government spending has ballooned to its highest share of the economy in history, with experts warning more public expenditure is on the way as Labor prepares its first budget, including promises on child care and wages.

Taxpayers are bearing an increasingly heavy burden to fund higher expenditure at all levels of government, a load that has been made heavier by major new commitments over the past 2½ years to fund services such as the NDIS, aged care, health care, child care and defence.

Evidence of the expanding scope of government in the economy comes as the Albanese government on Monday announced an extra $1.4bn to extend Covid response measures.

The largest component of the spending will include $840m in additional funding for the Aged Care Support Program – which reimburses providers for the costs incurred in managing Covid-19 – with $35m for ongoing onsite PCR testing in aged care.

There will be a further $115m to supply rapid antigen tests to aged-care providers and other service providers and care recipients in high-risk settings.

Health and Aged Care Minister Mark Butler said “These investments also provide ongoing support and protection for our frontline health and aged-care workers, and people living in residential aged-care homes, as well as those people supporting the most vulnerable to severe illness from Covid-19”.

New Commonwealth Bank analysis of national account figures reveal a 16 per cent lift in ongoing spending since the health crisis has outpaced economic growth, with real GDP only 5.5 per cent above its pre-Covid level.

CBA head of Australian economics Gareth Aird said “The upshot is government spending as a share of the economy has risen significantly”.

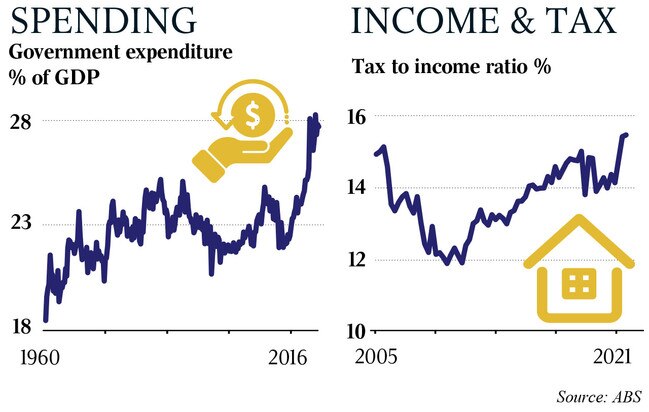

After fluctuating around 23 per cent of GDP over a number of decades, total government spending – including the states and territories – now sits at around 28 per cent of real national output.

Mr Aird said while the pandemic triggered a sharp lift in ongoing expenditure, public spending as a share of the economy had been on the rise since 2015.

“Total public spending as a share of the economy has been rising and was rising pre-pandemic and is now around a record high,” he said.

“Even though we had an improvement in the fiscal position, government spending was growing faster than the economy – financed by bracket creep.”

Bracket creep is where average incomes increase over time, pushing more individuals into higher marginal tax brackets – a tax increase by stealth.

The total income tax as a proportion of total household income has trended higher, from about 13 per cent, to 15.5 per cent as at June of this year.

“Taxpayers are being charged more to pay for the extra spending as a share of the economy,” Mr Aird said.

The 2021-22 budget, delivered in May 2021, announced a major increase in ongoing federal expenditure, including a major increase in aged-care funding, costed at $18bn over the forward estimates, alongside an additional $13bn for the National Disability Insurance Scheme, and a further $2.3bn for mental health.

Labor’s cheaper childcare package will start from July 2023, and at a $5.4bn cost will lift the maximum childcare subsidy rate to 90 per cent for the first child in care for all families earning up to $530,000.

The Albanese government has ambitious goals to increase spending on key social services, including an “aspiration” towards universal childcare provision. The government’s support to pay aged-care workers as much as 25 per cent more will see the commonwealth spending an extra $5bn a year.

Ahead of the October 25 budget, Jim Chalmers is coming under increasing pressure to take decisive action to put the commonwealth’s finances to a more sustainable footing.

The Treasurer said “Australians are paying the price for a decade of missed opportunities and a trillion dollars of debt without an economic dividend to show for it”.

“Australians know we can’t make up for nine years of neglect in only a few months – it will take time to tackle the structural problems in our economy and our budget, but the work has begun.”

The Coalition’s three-stage income tax reform package was designed to return some of this bracket creep, with the final and most expensive third stage aimed at middle and higher income households.

The Albanese government has refused to defend this legislated third stage, which kicks in from mid-2024 and will come at a cost of at least $184bn over eight years. But Anthony Albanese has remained committed to it as part of its pre-election promise.

An unanticipated terms of trade boom has delivered a windfall corporate profit tax take since the last budget, and the ongoing strength in the economy has delivered more jobs and higher income tax.

Treasury’s pre-election budget update had the deficit at $78bn in the most recent financial year. The actual result could come in at half that, thanks to the surge in the prices for key exports such as coal and liquefied natural gas.

The budget predicts a narrowing of the long term budget deficit, from about 3 per cent of GDP to under 1 per cent of GDP in a decade’s time. But economists warn it is more likely two to three times that size. Rich Insight principal Chris Richardson has estimated that the government needs to find ongoing savings of as much as $60bn.

E61 senior research manager Adam Triggs said Australia had for more than a decade relied on a wave of commodity booms to hide a growing structural deficit, and that high inflation and rising rates added urgency to much-needed reform to boost productivity.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout