Global hit won’t stop spending: Treasurer Jim Chalmers

Australia will not be spared the coming global downturn, Jim Chalmers has warned, as he heads to Washington leaving his budget open to changes.

Australia will not be spared the coming global downturn, Jim Chalmers has warned, as he heads to Washington leaving his budget open to changes to account for the deteriorating outlook.

But the Treasurer, who will meet central bankers and finance ministers in the US, ruled out putting the brakes on runaway spending growth in areas such as the NDIS and aged care, confirming the budget would not predict an Australian recession.

Before leaving for Washington on Tuesday, Dr Chalmers warned that Australia would not be “completely spared” from a third global downturn in 15 years following the global financial crisis in 2008 and the pandemic induced economic shock.

The Treasurer, however, confirmed the budget would not predict an Australian recession.

“We have a lot going for us in Australia,” he said, including “incredibly low unemployment”, high commodity prices, and “relatively solid growth”. “So we start from a better position than most of our peers,” he said.

Dr Chalmers said the deteriorating global situation, combined with rising inflation at home and persistent structural spending pressures on the budget, were the three most important factors framing the October 25 budget.

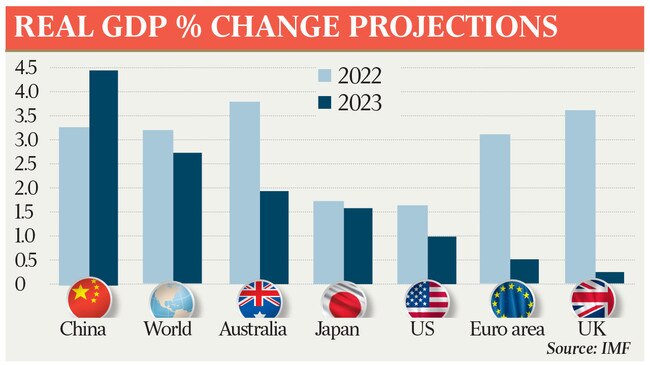

As the International Monetary Fund warned a “global cost of living crisis” would send a third of the world’s economy backwards in this year or the next, Dr Chalmers prepared Australia for “tough” budgetary decisions and committed to prioritising “responsible cost-of-living relief” that did not add fuel to the inflationary fire.

“I want people to understand that no matter what we have going for us in this country, we won’t be completely spared a global economic downturn,” Dr Chalmers said.

He warned a sharply worse global outlook would have “implications” for Treasury’s growth and unemployment forecasts, even with the expected boost to the budget bottom line from the export boom in coal, iron ore and liquefied natural gas.

“The point that we’ve tried to make is that even with another substantial contribution from high commodity prices, that will not go anywhere near making up for these persistent structural spending pressures on the budget,” he said.

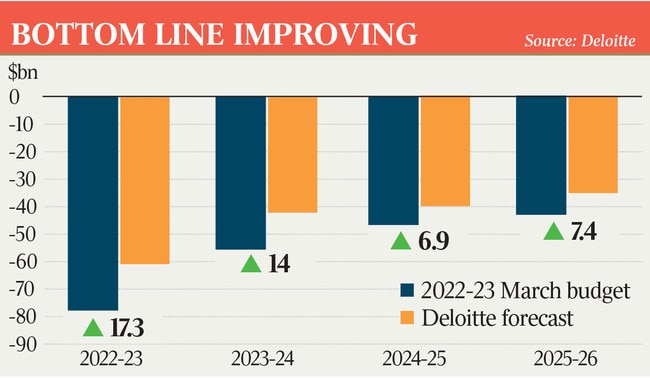

As the Treasurer warned of harder times to come, Deloitte Access Economics predicted the budget would reveal a $114.4bn upgrade in revenue over the coming four years, including an additional $80.6bn from higher company tax receipts as commodity prices soared and $17bn via more income tax driven by stronger employment.

The underlying cash deficit would come in at $60.7bn in 2022-23, against the $78bn deficit predicted in the March budget, Deloitte estimated, and there would be a $14bn improvement in the expected 2023-24 deficit, to $42.5bn.

Deloitte partner Stephen Smith said the massive forecast revenue upgrade was “the good news – for now”, but that it would still not be enough to offset the growing spending demands in key areas.

Dr Chalmers has nominated the key spending pressures on the budget as defence, health care, aged care, the NDIS and the rising cost of servicing the debt accumulated through the pandemic to pay for emergency support.

Mr Smith told The Australian: “Global storm clouds are darkening pretty quickly. This will be the last budget for some time with an unexpected write-up for revenue.”

In the firm’s flagship pre-budget report, Mr Smith also backed the stage three tax cuts. He said the three-step personal income tax reforms legislated with Labor’s reluctant backing under the former government had always been “decent policy”, but that the benefits had been lost in the recent public debate about whether they should be scrapped.

“While the outlook now looks more challenging, the budget bottom line has actually improved markedly from the expectation provided in Treasury’s pre-election economic and fiscal outlook,” he said. “Taken together, that may not necessarily provide the basis to undo an election commitment.” Mr Smith said taking an increasing share of workers’ pay packets through income tax was not an efficient way to finance the structural spending blowouts, echoing similar comments from the OECD chief economist this week.

“Even with the stage three tax cuts in place, Australia is on track to levy the highest average rate of personal income tax on record in the coming years,” Mr Smith said.

This government or future governments will face pressure to broaden the tax base by increasing the GST, considering a carbon tax, and addressing generous tax concessions for property investors and in superannuation “which cost the budget billions of dollars”, he said. Hours ahead of flying out to the US capital, Dr Chalmers said “we already know that we can expect substantial downgrades to the global growth outlook in the budget”. “If that requires some tweaking over the course of the next few days (then) that would be normal for the Treasury to update their costings all the way up to when we have to finalise the budget,” he said.

Dr Chalmers said the budget he delivered in two weeks’ time would not be “fancy”.

With Deloitte estimating an ongoing $40bn deficit, Dr Chalmers said “the budget will trim wasteful spending and it will do that with an eye to making some room for these persistent structural pressures on the budget”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout