Glimmer of hope as inflation eases in October

An unexpected drop in inflation to 6.9 per cent in October has suggests cost-of-living pressures – and interest rates – will peak earlier and lower than expected.

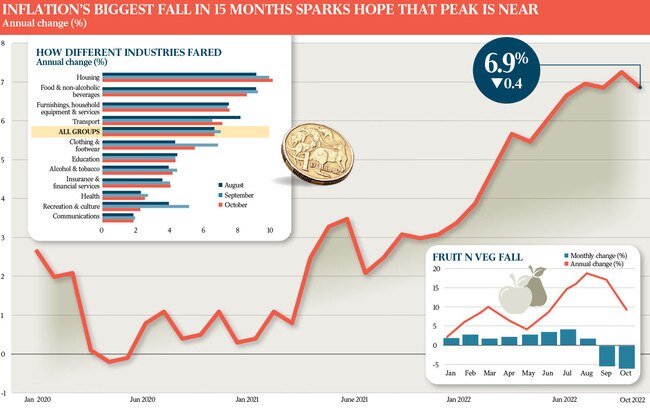

An unexpected drop in inflation from 7.3 per cent to 6.9 per cent in October has offered a glimmer of hope that cost-of-living pressures – and interest rates – will peak earlier and lower than expected.

While consumer price growth remained high in October, it was well down on the 7.6 per cent forecast by economists, as better growing conditions took some of the sting out of fruit and vegetable prices and school holidays ending brought travel costs back to earth.

Despite some cost pressures easing, the monthly Australian Bureau of Statistics consumer price index provided ample evidence of the cost-of-living squeeze on households.

Fruit and vegetable prices declined 6.3 per cent in the month but were still up 9.4 per cent on a year earlier, the figures showed. Overall, food costs fell slightly, increasing by 8.9 per cent over the year to October, down from an annual rate of 9.6 per cent in the month before.

Holiday travel costs dropped 6.4 per cent in the month after a school holiday-fuelled 9.1 per cent jump in September, the ABS said.

In parliament, Jim Chalmers “cautiously welcomed” the figures, but said “inflation is still too high and still hurting households, and (it’s) still the No. 1 challenge facing our economy”.

“There are reasons to be carefully optimistic that we are getting near the inflationary peak, but we’re not there yet,” the Treasurer said.

Australians paid 11 per cent more for fuel in October than in September as the 22c special tax discount came to an end.

Petrol prices were nearly 12 per cent higher than a year earlier.

Rents continued to climb, with the annual increase lifting to 3.5 per cent from 2.9 per cent in the month before, as record low vacancy rates put the squeeze on tenants.

Alongside groceries and petrol, construction costs were the other major driver of annual inflation in October.

The price of building a new home was up 20 per cent over the year, relatively steady from the previous month amid ongoing strong demand and a shortage in materials and labour.

KPMG chief economist Brendan Rynne said “overall, this set of numbers will provide a degree of comfort to the RBA, which is expecting inflation to peak at around 8 per cent at the end of this year”.

Following seven months of consecutive rate hikes, there are signs the most aggressive monetary policy tightening in a generation is beginning to have an impact, after October retail trade figures on Monday showed sales fell for the first time this year.

Dr Rynne said there was not enough evidence of easing price pressures to prevent another rate rise to 3.1 per cent when the Reserve Bank board meets next Tuesday.

“The focus will now turn to wage growth in a historically tight labour market.

“If wage growth remains contained, then the RBA will feel it is in a good position to bring inflation back within its target range without instigating an economic downturn,” Dr Rynne said.

ANZ senior economist Catherine Birch agreed that the central bank would deliver another hike next week.

“Still, this will likely see the board next week consider the possibility of pausing in December,” Ms Birch said.

Economists cautioned that the ABS’s relatively new monthly inflation gauge does not track the entire basket of goods and services that make up the consumer price index, and has proved more volatile than the longstanding quarterly measure.

The October report did not include an update of the prices of key services, such as utilities like electricity, restaurant meals, hairdressers, insurance and other financial services.

Dr Rynne said “the impact of the winding back of state government income support measures targeted at household energy bills, coupled with rising energy costs, is yet to be fully reflected in the data”.

RBA officials over recent weeks have talked up the potential for a “pause” in rate increases, but have said they will be guided by the data and would also be prepared to accelerate the pace of policy tightening if required.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout