First-home buyers’ loan scramble

First-home buyer scheme may be expanded after more than 40 per cent of places filled in less than four weeks.

The federal government is considering expanding its popular first-home buyer loan scheme ahead of the October budget after more than 40 per cent of the 10,000 available places were filled in less than four weeks.

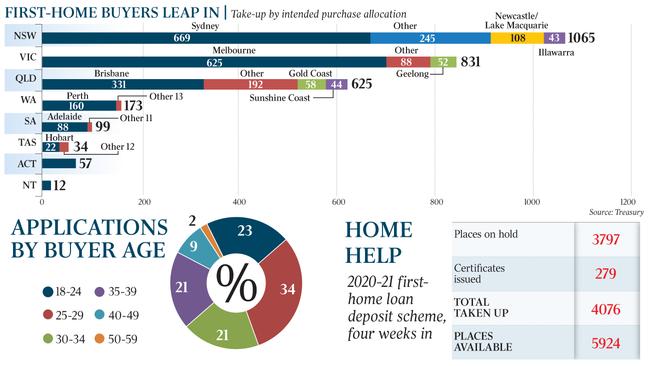

National Housing Finance and Investment Corporation figures released on Thursday show that, since July 1, 4076 places have been reserved or processed under the First Home Loan Deposit Scheme. The rapid take-up of the scheme’s allocated places, which helps applicants purchase a home with a deposit of as low as 5 per cent, will buoy the real-estate industry, which has been hard-hit by falling property prices, depressed rents and poor auction clearance numbers during the COVID-19 pandemic.

The loan guarantee scheme, processed through the National Australia Bank, Commonwealth Bank and 25 smaller lenders, processed 10,000 applications between January 1 and June 30 with 10,000 more places made available in the current financial year.

Ahead of the NHFIC update, the Australian Bureau of Statistics released data on Wednesday showing residential rents dropped 1.3 per cent in the three months to the end of June, the biggest fall since at least 1972.

CoreLogic figures also showed capital-city home values fell across the nation this month, down by 1 per cent in Melbourne and by 0.8 per cent in Sydney.

As the property market navigates a new wave of coronavirus lockdowns and restrictions, Housing Minister Michael Sukkar said the First Home Loan Deposit Scheme had been “critical in driving first-home buyer confidence”.

Mr Sukkar told The Australian the government was “committed to doing all we can to help Australians get into a home of their own sooner”.

“By delivering our loan guarantees, we are helping Australians cut years off the time it takes to save, as first-time buyers can now purchase a home with a deposit of as little as 5 per cent,” Mr Sukkar said. “The data shows buyer confidence is being maintained with the recently released tranche of guarantees being eagerly secured.”

The Australian understands the surge in applicants is likely to trigger an expansion of the loan guarantee program ahead of the October budget. The Morrison government has already moved to shore up the property market, headlined by its $688m HomeBuilder program to stimulate major renovations.

That package, aimed at boosting the construction sector, provides a $25,000 grant to build a new home or substantially renovate an existing home. As of this week, almost 42,000 Australians had registered for HomeBuilder, including more than 23,000 in Queensland and Victoria.

The first-home buyer scheme, which started on January 1, is a federal guarantee of the difference between what the first-home buyer has saved and the 20 per cent deposit threshold lenders usually require before issuing a loan without costly insurance.

NHFIC analysis of first-home buyer take-up of the scheme shows houses remain the most popular choice for first-time property market entrants ahead of apartments and townhouses.

As of Monday, 279 applications had been approved and a further 3797 places put on hold, with the average income of applicants at $57,668 for singles and $96,094 for couples, well below the scheme’s $125,000 and $200,000 salary caps.

Under the scheme, the government guarantee remains in place until the loan is refinanced, the property is sold or the principal balance reduces to less than 80 per cent of the property’s purchase value.

State governments have also moved, with NSW announcing this week that, from Saturday, it would waive stamp duty for first-home buyers on homes valued at up to $800,000. The change is expected to benefit more than 6000 first-home buyers.

Brodie Veness and Hannah Lennon-Mather purchased their first home earlier this year, at the beginning of the pandemic, in the southwestern Sydney suburb of Elderslie.

Ms Lennon-Mather, 24, said the couple had taken advantage of government incentives including the earlier NSW stamp duty concession. “(We were) worried we were going to pay too much and that talk of a recession would cause prices to drop,” she said.

“But, actually, it has been good and our interest rate has come down.”

Ratings agency Moody’s said this week that the impact of a stamp duty pause in NSW would deliver a significant boost to the state’s property market.

Moody’s vice-president Saranga Ranasinghe said the construction sector, in particular the Stockland Group, would benefit from the stamp duty freeze.

“Stockland is the largest master planned communities builder in Australia and caters to the owner-occupier segment of the market, where around 49 per cent of sales are made to first-home buyers,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout