Early withdrawals from superannuation funds to surpass $36bn

About 3.3 million Australians have applied to access their super, and 1.4 million of those have done so twice.

Australians’ superannuation withdrawals under the COVID-19 early access scheme are on track to reach $36bn by the end of the year.

The revelation comes as the Morrison government’s Retirement Income Review warns that “superannuation is not intended to solve every financial problem experienced in working life”.

Australian Prudential Regulation Authority data shows withdrawals reached $35.2bn by mid-November –— equivalent to about half of the money spent on JobKeeper so far. Some 3.3 million Australians have applied to access their super through the scheme, and 1.4 million of those have done so twice.

The APRA figures show cumulative super withdrawals have slowed to a weekly pace of just 0.6 per cent since mid-October. Assuming the same rate between now and the end of the year, a little over $36bn will have been drained from the nation’s pool of superannuation savings by the time the scheme closes on December 31. The early release of super scheme started in April and allows two withdrawals of up to $10,000 — one in 2019-20, and another in this financial year.

The policy has been sharply criticised by Labor and Industry Super, which have accused the government of harming workers’ ability to support themselves in retirement. Former prime minister Paul Keating said this week Scott Morrison’s reluctance to commit to lifting the compulsory super contribution rate from 9.5 per cent showed the government wanted “to kill superannuation”.

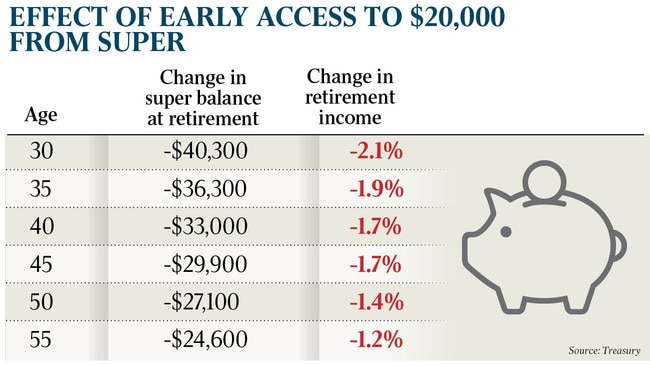

Last week’s Retirement Income Review calculated that withdrawing $20,000 (the upper limit for the early release scheme) from super would leave a 30 year-old with $40,300 less in savings by the time they stopped work, and lower their retirement income by 2.1 per cent.

The impact reduced the older the applicant. A 55-year-old would suffer a $24,600 hit to their savings come retirement, which would leave their income 1.2 per cent lower than would have otherwise been the case.

The measure has provided a massive boost to households’ balance sheets as Australians have dipped into their forced super savings to meet pressing financial obligations through the pandemic, but also as a precautionary cash buffer.

A household survey conducted by the Australian Bureau of Statistics in October showed one in eight Australians with superannuation had applied for early access. When asked their main actual or intended use of the money, 25 per cent said paying household bills, while 23 per cent reported paying their mortgage or rent.

The Retirement Income Review found that genuine need underpinned the bulk of early-release applications.

“People requesting early release of their superannuation aligned with the age groups most affected by unemployment in the early months of the COVID-19 pandemic,” it said.

The Retirement Income Review was not asked to — and did not — provide specific recommendations on how to improve the superannuation system. But it broadly approved of the existing, pre-pandemic, early-access rules for financial hardship.

“Offering prudent and limited access to superannuation prior to retirement is consistent with the objective of balancing living standards pre- and post-retirement,” the report said.

“Early access allows the system to respond to financial pressures people may face while still facilitating saving for retirement. Equally, superannuation is not intended to solve every financial problem experienced in working life. Shifting the balance too far in that direction would compromise its main objective of providing retirement income.”