Debt-hit states told to rein in spending

More than 40 per cent of states’ revenue sources vulnerable to decline that would contribute to $15bn slump this quarter.

States face a $45bn debt blowout over the next few months that will push combined state and federal government debts above $1.2 trillion — or 60 per cent of GDP — by 2022, according to new analysis that warns states to rein in expenses or lose their AAA credit ratings.

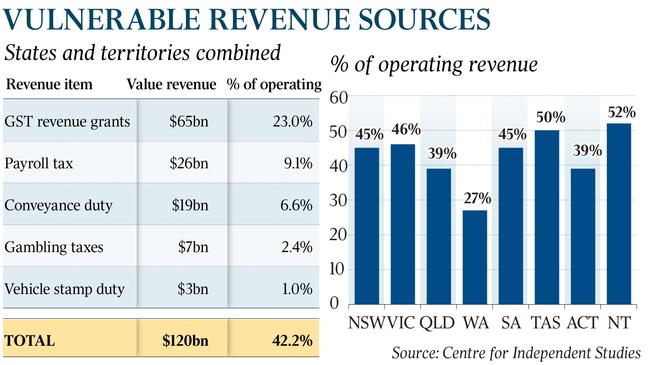

More than 40 per cent of states’ revenue sources — including GST receipts, and property and gambling taxes — were vulnerable to a “severe decline” that would contribute to a $15bn slump in their combined revenue this quarter, and a further $30bn before the year’s end, the Centre for Independent Studies finds in a new report.

“That’s on an optimistic basis,” said Robert Carling, the report’s author, who said total debts across both tiers of government could climb to $1.35 trillion once non-financial corporations such as the NBN and state-owned electricity and water utilities were included.

The states’ revenue shortfall is the biggest contributor to a deterioration that would include about $10bn in extra stimulus and about $4.5bn in extra money to boost health systems, the report says. “The impact of the pandemic will both add to expenses and, more severely, sap various major sources of revenue, at least for a time,” Mr Carling added, pointing out that GST revenues of about $65bn last year, highly vulnerable to a sharp drop in household consumption, made up almost a quarter of state revenues.

“Much will have to go right over the next several years if individual states are not to see their credit ratings downgraded, their policy options become much more constrained by their debt burdens, and their exposure to future shocks and the challenges of population ageing elevate,” he said.

Among the eight jurisdictions, Tasmania and the Northern Territory were the most vulnerable, having 50 per cent or more of their revenues in the “vulnerable” category, while Western Australia was the least vulnerable, with just 27 per cent.

“WA receives relatively little GST revenue, allows very little gambling, already had depressed levels of real estate activity before the crisis, and relies more than other states on mining royalties, which have been little affected by shutdown,” the report says.

While federal government finances had been steadily improving since the pandemic, most states’ net operating balances — which strip out capital investment — had already been deteriorating and total state debt was poised to roughly triple to $150bn over the three years to 2022.

“Frequent calls for more spending on infrastructure to stimulate the economy seem to have missed the point that an infrastructure boom is already happening,” Mr Carling said, pointing to “pressure on available construction resources and major cost overruns”.

Mr Carling, a former senior NSW Treasury official, found total government net debt — state and federal — would rise from 22 per cent to 40 per cent by 2022, and in gross terms from 43 per cent to 60 per cent, equivalent to about $1.2 trillion.

“From zero 10 years ago, general [state] government net debt is heading for a level more than 60 per cent of revenue, and broader non-financial public sector net debt is rising from 35 per cent to almost 90 per cent of revenue,” the report says.

The analysis singles out Victoria and Queensland for increasing their public sector headcounts by 10 per cent, adjusted for population, over three years.

“Given the recent history of rapid expenditure growth in Victoria, it should not be difficult to achieve a slowdown, but that same history warrants scepticism about the assumed degree of future restraint,” Mr Carling said.

NSW and Victoria, with the two biggest housing markets, were the most vulnerable to declines in stamp duty. “Property stamp duty — a notoriously volatile source of state revenue — is certain to fall steeply, mainly in response to a fall in the volume of turnover but also as prices weaken,” the analysis said, noting it made up $19bn or 6.6 per cent of state revenue.

Rating agencies S&P and Fitch have already warned the federal government it could lose its AAA credit rating. The report came as the NSW government moved to freeze the pay of its 410,000 public sector workers, and the federal government berated states for keeping borders closed without sufficient medical reason.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout