Customer-facing firms in lockdowns suffering cashflow crunch

Small customer-facing businesses in locked-down states are suffering through the most severe cash crunch since last year’s national shutdown.

Small customer-facing businesses in locked-down states are suffering through the most severe cash crunch since last year’s national shutdown.

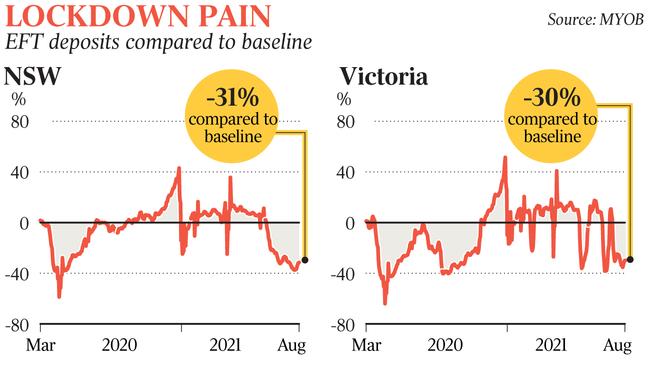

Anonymised data from MYOB, based on transaction data from thousands of the software provider’s clients over the week to September 6, shows electronic fund deposits into NSW and Victorian small businesses are tracking 30 per cent below pre-Covid levels versus roughly level or slightly above leading into the reinstatement of restrictions as a result of the Delta outbreak.

In the ACT – where health restrictions for a time stopped a wide variety of companies from even providing delivery and click and collect services – deposits are running at only half of pre-pandemic levels. That is as large a hit as during the worst of the initial shutdowns in April 2020.

In contrast, NSW and Victorian small businesses are still shy of the roughly 50 per cent drop in cashflows at the peak of the 2020 Covid recession, although the southern state is experiencing a similar level of disruption as during the second wave around August last year.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the small business sector was the “canary in the coalmine”, in that the first signs of lasting damage from Delta restrictions would emerge at the small end of town.

“They (small businesses) usually have the least reserves in terms of assets and liquidity they can call on (and) they tend to be operating on small margins and tight budgets,” he said.

The ACCI boss said surveys by the Australian Bureau of Statistics showed small firms – with fewer than 20 employees – typically had about 80 days’ cash reserves.

With the Greater Sydney lockdown now in its 12th week, and with another month at least of harsh restrictions until authorities project they will reach vaccination rates consistent with an easing of social distancing measures, Mr McKellar said “the real risk now is we will have a level of attrition in the small business sector, and we could well see some businesses from here struggle to reopen”.

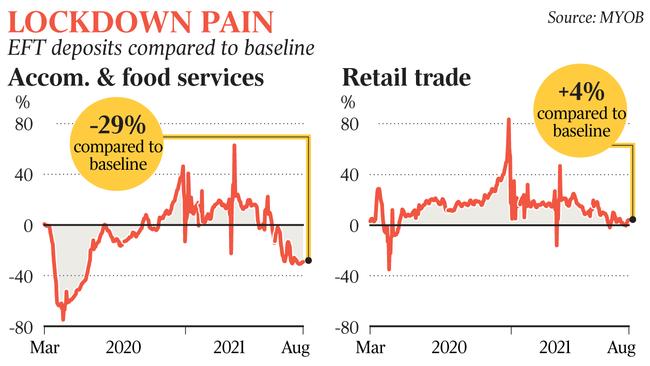

Andrew Baines, general manager of financial services at MYOB, said the data pointed to a “two-speed economy” for small businesses, with health restrictions dealing a massive blow to customer-facing industries in NSW, the ACT and Victoria.

Outside jurisdictions in lockdowns, conditions are booming. Cashflow for Queensland, West Australian and Northern Territory small businesses are holding at about 30 per cent above pre-pandemic levels, the MYOB data revealed.

Mr McKellar said the impact on small businesses was “uneven”, depending on the firm’s capacity to operate through lockdowns. “If you aren’t the sort of business (that) can do click and collect, then you are in all sorts of trouble,” he said.

Despite the obvious impact of Delta on many small business owners, Westpac chief executive Peter King in recent testimony to a parliamentary committee said there were signs of resilience.

He said his bank had extended $70m in loan repayment relief to small businesses during the Delta outbreak – a fraction of the $10bn peak during last year’s national shutdown – and that “small businesses are showing particular resilience” during the recent round of restrictions.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout