Controversial superannuation reforms pass parliament

Australians to be ‘stapled’ to one superannuation account through multiple jobs after the Morrison government’s super reforms passed parliament.

Australians will be “stapled” to one superannuation account through multiple jobs and major retirement funds will face regular performance tests after the Morrison government’s super reforms passed parliament on Thursday.

The government’s superannuation victory will give consumers more power to compare superannuation funds and force a “best financial interest test” on all decisions made by the big funds.

Labor and industry superannuation funds denounced the passage of the Your Future, Your Super legislation, saying it would trap 2.6 million Australians in underperforming funds.

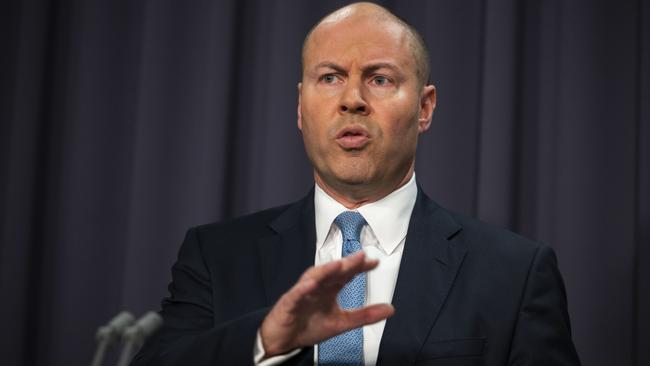

Josh Frydenberg, who struck the final deal to get the legislation through parliament this week, said the new measures would save workers more than $17bn.

“The reforms will prevent the creation of unintended multiple super accounts when employees change jobs, saving billions in fees for members,” the Treasurer said on Thursday.

“With more than $3 trillion in superannuation, super funds must now act in the best financial interests of their members. “

The package is designed to reform the $3.1 trillion retirement system in three ways. It will require APRA to conduct an annual performance test for MySuper products – and other funds as specified – as a way to address underperformance.

Where a product has failed the performance test for two consecutive years, the trustee would be prohibited from accepting new beneficiaries into that product.

If a fund fails the test, it will be forced to inform customers of its underperformance.

Consumers will also be able to go to a new YourSuper online tool to compare funds.

Super funds, which have been criticised by Liberal MPs over their financial links to the trade union movement, will also be forced to pass a best financial interest test on decisions and be more transparent about how contributions are spent.

The most controversial aspect of the package is its attempt to deal with the issue of Australians accruing multiple super accounts as they change jobs – at least on an ongoing basis – by “stapling” a member’s account to them as they move between employers.

Superannuation Minister Jane Hume said the “stapling” would not stop workers from being able to switch funds and was designed to stop “backroom deals” between employers and unions. “Inaction would result in $280m worth of unnecessary costs being created for members,” she said.

“The reforms will correct one of the original sins of the superannuation system – the proliferation of unintended multiple accounts. This design flaw has ripped off members with multiple sets of fees and insurance premiums, and was clearly ignored for many years to benefit funds at the expense of members. Importantly, it stops employers cutting backroom deals with unions to create new accounts in their default fund for employees who already have one.”

After negotiations with the crossbench, Mr Frydenberg amended the final legislation to start the stapling of super funds on November 1 this year – after the first performance tests.

Labor voted against the government’s super package and shadow cabinet secretary Jenny McAllister called the package “shoddy” and against workers’ interests. “(This package) has the potential to disadvantage three million Australians by as much as $240,000 at retirement, a consequence of shoddy drafting, shoddy policy work and an ideological obsession with supporting (the government’s) mates in the financial services sector.”

Industry Super Australia chief executive Bernie Dean said: “The government was forced to drop a number of ideological proposals and to improve the performance tests for funds, but sadly it stopped short of protecting workers from losing their savings.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout