Gloom sets in on threat of rate hike, says Westpac survey

Two-thirds of Australians expect rate hikes in the coming 12 months, and more than one in four believe rates will climb by more than a percentage point.

Two-thirds of Australians expect rate hikes in the next 12 months, and more than one-quarter believes rates will climb by more than a percentage point, according to a new survey.

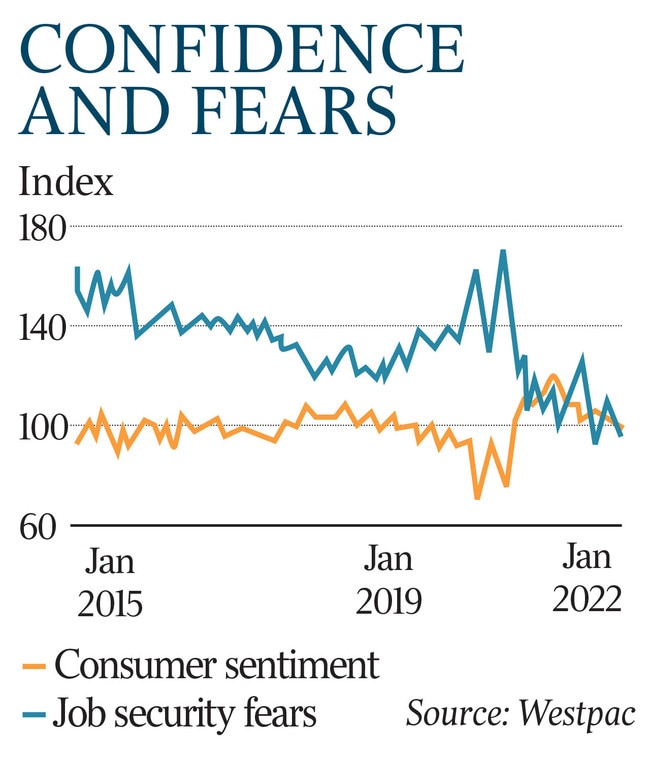

Fears of higher interest rates and cost-of-living pressures weighed on household confidence in early February, with the latest Westpac survey revealing a further dip in sentiment despite waning Omicron case numbers and talk of unemployment heading to near 50-year lows.

The bank’s confidence index eased from 102.2 points in January to 100.8 points – “barely in optimistic territory” – according to a survey conducted over the week to February 6.

Westpac chief economist Bill Evans said it was surprising households were more downbeat than a month earlier, given the improving health situation and evidence of a booming jobs market.

While questions gauging views on the economy showed a lift in sentiment from a month earlier, those asking about confidence in the state of households’ finances now and in the future deteriorated.

Mr Evans said “the most likely explanations for these elevated pressures on finances relate to Omicron-related disruptions to activity and earnings at the start of the year, the rising cost of living, and the prospect of rising interest rates”. A sharp lift in petrol prices – up 15 per cent in two months – in particular would have weighed on confidence, he said.

“Meanwhile, there is a firming expectation among consumers that interest rates are set to rise,” Mr Evans, who predicts the Reserve Bank will lift rates to 0.25 per cent in August, said.

RBA governor Philip Lowe last Wednesday conceded that a jump in inflation over the final three months of last year made it “plausible” the central bank would hike rates in 2022.

“The proportion of respondents expecting an increase in mortgage rates over the next 12 months lifted from 55 per cent in January to 66 per cent in February, with over one in four consumers now expecting rates to rise by more than a percentage point,” Mr Evans said. “This is the most pessimistic consumers have been about the interest rate outlook since August 2011, although on that occasion rate hikes actually failed to materialise.”

While confidence may have declined, a gloomier consumer has not prevented a rebound in spending as the health situation has improved.

ANZ senior economist Adelaide Timbrell said total spending on ANZ cards was 18 per cent higher in the week to February 5 than over the first week of the year, “pointing to a recovery as Omicron case numbers decline”.

That spending increase outstripped growth in the same period over the previous two years, Ms Timbrell said.

“This suggests this year’s figure is not just seasonal,” she said.

A booming economy and jobs market helped drive confidence around economic conditions over the coming 12 months and next five years higher by about 2 per cent in February, but both indices were still about 10 per cent lower than a year earlier.

In contrast, gauges of job security fears fell to nearly record lows in the latest survey.

There was further evidence of a hot labour market on Wednesday, with National Skills Commission data showing recruitment activity pushed firmly higher in January.

Online job advertisements climbed 4 per cent to 259,000, the NSC data showed, the most since September 2008.