Companies hit as interest rate hikes start to take effect

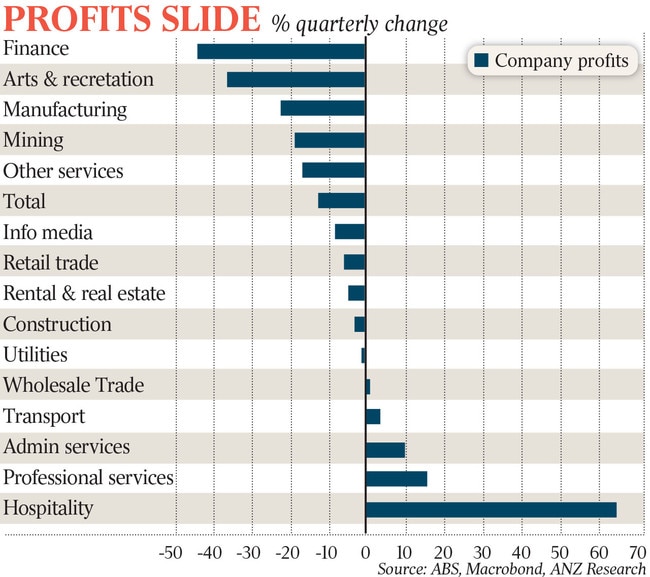

Soaring inflation, a jump in wages and cooling mining earnings help drive a 12 per cent collapse in company profits – the biggest fall since 1994.

Soaring inflation, a jump in wages bills and cooling mining earnings helped drive a 12 per cent collapse in company profits in the three months to September – the biggest fall since at least 1994.

Ahead of what economists expect will be the eighth consecutive Reserve Bank rate hike on Tuesday, the quarterly business data from the Australian Bureau of Statistics revealed an unexpectedly sharp and broadbased reversal in private sector revenue.

As profits fell across a broad cross-section of corporate Australia – from financial services, to manufacturing, retail and construction – Jim Chalmers warned Australia’s economy wasn’t “immune from the impact of a global energy crisis and high and persistent inflation, which has triggered blunt responses from central banks around the world”.

“Added to this, China is currently experiencing its largest Covid outbreak to date, which will put further strain on global supply chains and increases uncertainty heading into the new year,” the Treasurer said.

“Our economic plan has been carefully designed to deal with the inflation challenge in our economy and to avoid putting upward pressure on interest rates – this was confirmed on the weekend by a global ratings agency locking in our AAA rating,” Dr Chalmers said.

“We are absolutely focused on doing what we responsibly can to ease cost-of-living pressures in ways that don’t add to inflation, and to build a more resilient economy so we are better able to withstand these global and domestic shocks into the future.”

Days after employer groups suffered a bruising loss in their fight against sweeping workplace changes that will reintroduce multi-employer bargaining, ANZ senior economist Felicity Emmett said the latest ABS report suggested profits were “getting squeezed at the moment”.

“Perhaps businesses haven’t been able to fully pass on the increases in costs that they’ve had,” Ms Emmett said.

With soaring energy prices heaping further pressure on businesses, the ABS figures showed total wages and salaries paid in the quarter were up 11 per cent on a year earlier – the largest increase since 2007 – as more Australians got jobs and employers paid higher wages and offered incentives to attract and retain staff, even as their operating profits shrank.

Over the September quarter, wages jumped by 2.9 per cent.

NAB economist Taylor Nugent said quarterly rates of growth of this magnitude had not been seen since the height of the mining boom in 2007.

With employment largely unchanged over the three months to September, there was a 2.6 per cent increase in total wage income per worker, ANZ said, outpacing the 1.8 per cent quarterly lift in the CPI.

Volatility in commodity prices in the September quarter pared back booming mining profits, as did weather-related disruptions to coal exports.

Miners’ gross operating profits were 19 per cent lower than in the June quarter, but were still 13 per cent up on a year earlier, thanks to ongoing high demand for key exports such as iron ore, LNG and coal.

But non-mining company gross operating profits were also down a surprisingly large 4 per cent, with falls across most industries, the seasonally adjusted ABS figures showed.

Financial services profits slumped by 43 per cent, the seasonally adjusted data showed, while retail profits fell by 5.6 per cent and construction profits by 2.5 per cent.

Hospitality earnings, however, surged by 64 per cent over the three months to September as Australians continued to ramp up travel in the wake of two years of Covid disruptions.

While total worker income growth was ahead of inflation in the September quarter, over the year the average wage per employee climbed by 4.6 per cent – still well short of the 7.3 per cent inflation rate.

Early evidence of company profit margins coming under pressure comes as the Reserve Bank prepares to deliver more pain for indebted households and firms, with economists expecting the cash rate to climb to 3.1 per cent, from 2.85 per cent now.

The Reserve Bank cash rate was 0.1 per cent in April.

Despite this year’s collapse in household confidence and property prices, amid the fastest monetary policy tightening in a generation, Australians have continued to spend freely and national accounts figures on Wednesday are anticipated to show the economy grew strongly in the three months to September.

But CBA head of fixed income Martin Whetton said more up-to-date data provided growing evidence that the central bank’s efforts to cool demand were starting to bear fruit.

“The data is starting to roll over, and that’s exactly the narrative (RBA governor Philip Lowe) has been talking about: at some point: rate hikes will start to show themselves,” Mr Whetton said.

Official rate rises can take up to three months to be reflected in actual repayments on variable mortgages, and the Australian Bureau of Statistics’ cost-of-living indexes showed household interest bills jumped by 25 per cent in the September quarter.

Dr Chalmers said he knew these were “harsh and heavy times for Australian households”.

“While we don’t second guess the actions of our own central bank, the governor has flagged further rate rises and the market expects another increase this week,” he said.

Financial markets anticipate a further two RBA hikes next year, and that the cash rate will peak at about 3.5 per cent in the third quarter of 2023.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout