MYEFO: New jobs drive budget recovery

Ten-week surge delivers $15.9bn improvement in federal government’s bottom line.

A 10-week economic surge has delivered a $23.9bn improvement in the federal government’s bottom line over the next four years, as booming iron ore prices drove up tax receipts and a strong post-COVID labour market recovery left fewer Australians on JobKeeper payments.

As NSW recorded a growing cluster of cases in Sydney’s northern beaches, Josh Frydenberg said families were “approaching Christmas with optimism and hope” while newly appointed Finance Minister Simon Birmingham said Australia’s experience showed that “health and economic success go hand in glove.”

Two-and-a-half months after the October 6 budget forecast a 1.5 per cent contraction in 2020-21, the mid-year economic and fiscal outlook showed a marked improvement, with Treasury expecting real GDP to instead expand by 0.75 per cent. Growth in 2021-22 was forecast at 3.5 per cent, down on the 4.75 per cent projected in the budget.

Higher tax receipts from iron ore sales and 650,000 fewer than expected JobKeeper recipients also helped slash the 2020-21 deficit by $15.9bn. The budget deficit is now estimated to hit a peacetime record of $197.7bn in 2020-21 — or 9.9 per cent of GDP — against the previous forecast of $213.7bn.

The Treasurer said the update showed the economy was rebounding strongly. “Australians are back spending, and they are back working, and they are back moving freely across the nation,” Mr Frydenberg said.

Senator Birmingham said the budget update told a “story of resilience” but warned “there is no room for complacency”.

“Australia’s health and economic resilience is stronger than almost any comparable nation,” he said.

The key change in assumptions from the October 6 budget was an update to Western Australia’s border restrictions, which had been expected to remain until after the state election next March.

The MYEFO documents, however, said it was assumed that there were no state border restrictions in place throughout 2021.

Treasury maintained its presumption that “localised outbreaks of COVID-19 occur but are contained” and that a vaccine would be widely available by the end of 2021, but flagged that health and vaccine outcomes “could be substantially different to the forecasts”.

The MYEFO papers projected government payments to be $6.5bn less in 2020-21, and receipts $9.4bn better.

The budget update included new spending on a range of initiatives, including a $1bn boost to the aged care sector, and $1.5bn over this and the next financial year to secure 61 million doses of a potential vaccine, taking the total number of potential vaccine doses purchased to 114.8 million.

The budget update also included the previously announced additional $3.2bn to extend the JobSeeker supplement to March.

The estimated underlying cash deficit for 2023-24 was trimmed to $66bn, from $66.9bn in the budget. Net debt was “broadly consistent” with the budget forecasts, expected to be at 34.5 per cent of GDP by June 2021, before peaking at 43 per cent in mid-2024.

Underpinning the improved MYEFO budget forecasts was the recent surge in the iron ore price to nearly $US160 ($211) a tonne, swelling miners’ profits and government coffers. Wary of tying the budget’s fortunes to volatile commodity prices, Treasury maintained its conservative estimate that the iron ore price would fall to $US55 a tonne, but delayed this target by three months to the September quarter.

“With confidence returning and Australians getting back to their normal lives, we are placed better than virtually any other nation in the world to emerge stronger on the other side of COVID-19,” Mr Frydenberg said.

Deloitte Access Economics partner Chris Richardson said there was a good chance that the 2021-22 budget in May could show further “turbocharged” improvements in the bottom line, particularly should iron ore continue to trade at lofty levels over coming months.

“The bulk of the increase in debt (as a result of the pandemic) is not stimulus — it’s weakness in the economy,” Mr Richardson said. “If you keep COVID controlled and stimulus holds us together, then you can actually save some really large dollars.”

ANZ economist and budget specialist Cherelle Murphy said the strong potential for continued economic outperformance in coming months could drive the 2020-21 deficit down towards $190bn by the May budget.

The Morrison government has spent $138bn of the $251bn in direct fiscal support measures. Ms Murphy said the spending was “really doing its job and, if anything, is going to get us out of here (the downturn) better than we thought”.

As labour force statistics on Thursday showed that Victoria’s reopening helped drive the key jobless measure down to 6.8 per cent in November, from 7 per cent a month before, MYEFO revealed that Treasury now expected the unemployment rate to peak at 7.5 per cent during the March quarter, rather than at 8 per cent by the end of this year.

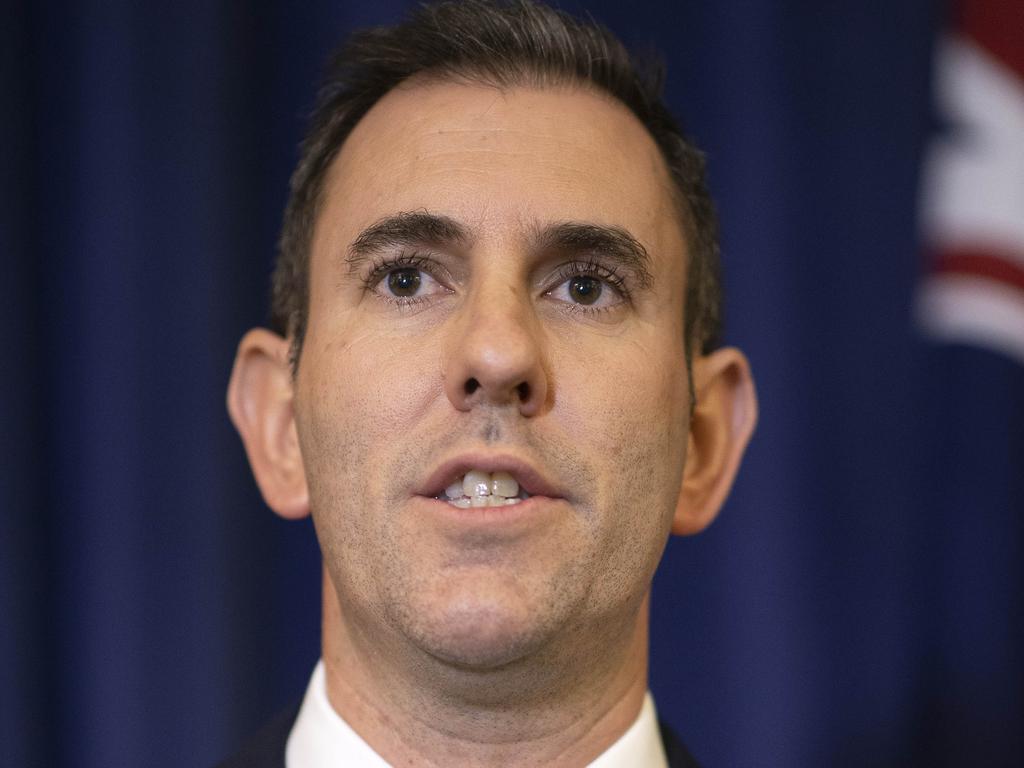

Opposition Treasury spokesman Jim Chalmers said the mid-year update contained “no new measures to tackle the jobs crisis”.

“The economy still hasn’t rebounded strongly enough or quickly enough for the 2.2 million Australians who are looking for work or more work right now,” Mr Chalmers said.

“Instead of a plan to deal with flat wages, high unemployment, small business closures and big businesses cutting jobs, Australians are getting a wasted recovery which is leaving too many people behind.”

As Mr Frydenberg shifts his focus to next year’s budget, with preparations beginning next month, business and industry groups called on the government to embrace major tax, industrial relations and skills reforms to drive Australia’s post-pandemic economic resurgence.

Business Council of Australia chief executive Jennifer Westacott said that while resources exports were shoring up the economy, “the challenge is far from over”.

“We have a competitive head start, so let’s build on that and set the country up for the future,” Ms Westacott said.

“The government has softened the blow of the worst of the pandemic; now it’s time for the private sector to take over the heavy lifting.”

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout