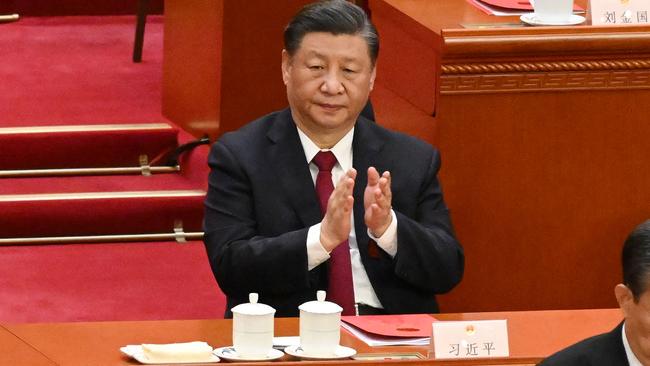

China’s coal flurry breaks Xi Jinping energy pledge

China has accelerated its construction of coal-fired power stations, breaking a promise made by Xi Jinping to phase out coal, and raising serious doubts the new plants will back up wind and solar.

China has accelerated its construction of coal-fired power stations, breaking a promise made by Xi Jinping to phase out coal, and raising serious doubts that the new plants will be used mainly to back up high levels of intermittent wind and solar as has been claimed.

Fresh analysis of global coal developments comes as the Intergovernmental Panel on Climate Change will release its synthesis report on Monday that brings together all its work on climate change science and political response over the past eight years.

Findings in the IPCC report are expected to add new tensions to negotiations over the federal government’s signature climate policy, the Safeguards Mechanism, in which the Greens have called for a ban on future coal and gas developments.

Consideration of the IPCC report has run overtime and caused tensions among scientists but is expected to emphasis the world is eating up its carbon budget and has only a slim chance of avoiding warming of 1.5C.

The report was due to be finished in time for the COP27 meeting in Egypt last November but will now be a centrepiece of the COP28 talks in the United Arab Emerates.

New technologies that suck carbon dioxide from the atmosphere are increasingly seen as being essential to offset emissions from human activity, including burning fossil fuels.

Analysis of new coal-fired electricity capacity globally by independent British-based climate think tank E3G shows how China, the world’s biggest emissions nation, is accelerating the expansion of its coal fleet.

The second half of last year saw the largest increase in pre-construction capacity in China. As a result, China now accounts for 72 per cent of global planned capacity, up from 66 per cent in July.

Beyond China, 18 per cent of the remaining planned coal capacity is in the five countries with the next-largest project pipelines (India, Turkey, Indonesia, Laos and Mongolia). The final 10 per cent is thinly spread across 27 countries, 13 of which have only a single project under consideration.

According to the report, there are no new coal projects under consideration anywhere in either North America or the EU for the first time, while no new coal plants have entered into construction across the OECD/EU since 2019. The remaining proposed projects in Australia, Japan and Turkey are all unlikely to proceed.

Old plants are being reactivated in Europe, however, in response to the squeeze on gas supplies following Russia’s invasion of Ukraine.

India and Indonesia were the only countries other than China to have increased their new coal-power project pipeline in the second half of last year, but by small amounts comparison to China.

E3G says the surge in China’s coal project pipeline, particularly over the course of 2022, is at odds with President Xi’s 2021 pledge to “strictly control” coal power.

Energy security concerns have been escalated to the top of Chinese policymakers’ priorities since the power shortages in 2021.

China’s central government has also set up a $US31bn program for so-called “clean and efficient” coal and mandated an increase in coal production to 300 million tonnes, in order to rebuild coal stocks after the energy crunch.

Many of the plants permitted last year have been justified on the basis that they are “supporting grid stability” or “supporting intermittent renewables”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout