Business leaders warn the nation to hold its nerve against the Omicron strain of Covid-19

The new Omicron strain of Covid-19 threatens to derail a powerful economic recovery.

Business leaders are warning an “over-reaction” to the threat posed by the new Omicron strain of Covid-19 would be devastating for an economy only starting to recover from the nation’s recent round of lockdowns.

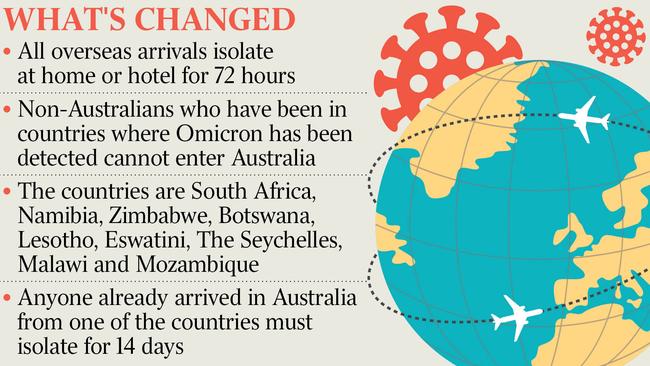

As thousands of returned Australians went into isolation for three days to limit the risk of an Omicron outbreak spreading from southern Africa on to our shores, the emergence of a new Covid-19 variant threatened to derail a powerful recovery, economists said.

Australian Industry Group chief executive Innes Willox said federal and state authorities should take a targeted approach against Omicron or risk “devastating” businesses desperate for stability after nearly two years of disruptions.

“While some caution is understandable, the response to any new and inevitable variant needs to be targeted, proportionate and take into account the nearly 90 per cent of us are vaccinated and tired of lockdowns and border closures,” Mr Willox said.

“We are just getting our economy back on its feet, but investment and confidence are still uncertain. An over-reaction both in terms of timing and proportionality around shutting Australia off from the world, and state from state, would be devastating.”

National accounts figures on Wednesday will provide a final reckoning of Delta’s immense damage to the economy through the September quarter.

The figures will form the basis for a mid-year budget update that the government hopes will offer an optimistic outlook for the economy heading into an election that must be held by May.

Scott Morrison on Sunday called the new variant concerning, but said there were still too many questions about it to prompt rash decisions. “We’ve always said there will be new variants. This is the nature of the pandemic – Australia is in the strongest position as we possibly can be to deal with these sorts of issues,” he said.

“This is not like it was back in February and March of 2020. We now have good knowledge, good advice, the uncertainties are not like they used to be, we have good systems.”

Josh Frydenberg said the nation was well-placed to withstand the emergence of the new strain, which has triggered travel bans around the world on visitors from nations in Africa’s south and the reimposition of mandatory mask wearing in Britain.

“Australia’s economic recovery is well under way, with more than 350,000 jobs coming back since the start of September,” the Treasurer said. “With more than 86 per cent of Australians being double vaccinated, Australia is well positioned to deal with the ongoing threats from Covid-19.”

The official confirmation of a new strain sent shockwaves through financial markets leading into the weekend, and Asian stock exchanges on Monday are expected to record their worst day of trade since March. Futures traders were anticipating a 100-point, or 1.4 per cent, plunge in Australia’s benchmark S&P/ASX 200 index when it opens.

Judo bank economic adviser Warren Hogan said Wall Street’s session on Monday night, Australian time, would be “critical” to determining whether the initial sell-off turns into a blip or the start of a correction that could reach 10 per cent before it is done.

“Markets are nervous, and when share prices are at such stratospheric levels, any disruption can cause volatility,” Mr Hogan, a former ANZ chief economist, said.

With Treasury set to finalise its set of forecasts ahead of the mid-year economic and fiscal outlook in less than three weeks, any renewed outbreak could force the Morrison government to reframe its budget settings to focus on pandemic support, rather than pre-election spending.

“Wednesday’s GDP figures is the foundation for MYEFO,” Mr Hogan said. “Everything runs off the GDP numbers, and if the Omicron issue has deteriorated, that might force them (Treasury) to have a more downbeat view.”

Despite new restrictions on international arrivals, NSW Premier Dominic Perrottet on Sunday said his state’s reopening plan from December 15 remained on track.

Just weeks before the nation’s summer of tennis is due to start, Tennis Australia boss Craig Tiley said planning for the Australian Open was going ahead despite new border rules. “We’re still waiting. I’ve been talking to the government … there’s still a lot of unanswered questions around this (new variant),” he told the Nine Network on Sunday.

Anthony Albanese said authorities needed to ensure foreign students got back to Australia despite the new strain, while saying states would need to be “very cautious”. “That’s important for our economy and for our engagement with the world,” the Opposition Leader said.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar described the 72-hour quarantine on overseas arrivals implemented in NSW, Victoria and the ACT as “a sensible precaution”. But Mr McKellar also warned that “with international and domestic border closures finally reopening, business cannot afford to take a backwards step”.

“State and federal leaders must stick to the national plan to get Australia back open, and to stay open,” he said. “Continuing to drive up the vaccination rate and encouraging everyone to get a booster shot is the best way to protect the population, rather than imposing further restrictions.”

The Reserve Bank’s expectation for 5.5 per cent growth through next year comes with the caveat that there are no further material outbreaks and associated health restrictions.

The central bank’s economists have analysed the potential impact of a “downside” scenario involving a new strain that forces the reinstatement of stay-at-home orders, saying in that instance unemployment could stay at 4.75-5.5 per cent for the entire forecast period. With estimates of full employment sitting at about 4 per cent, such an outcome would eliminate any chance of a rate hike before 2024.

Economists, however, said Australia’s high vaccination coverage should limit the need for harsh lockdown measures.

The experience gained by policymakers, households and businesses of living through previous outbreaks should make the country better prepared to deal with a major outbreak, they said.

Leading economist Saul Eslake said while it was early days in a rapidly developing situation, in his view the worst-case scenario was that the country experiences a “rerun of Delta”.

Even in the absence of new lockdowns, “premiers in the states with the lowest vax rates will use it as a reason to keep their borders closed for longer”, Mr Eslake said. That would mean “the agony for the tourism sector and for universities would be prolonged”.

That said, “we have had a very strong economic recovery with our international borders still closed, and we can obviously still do that,” he said.

Treasury has estimated Delta drove a contraction in real GDP of about 3 per cent over the three months to September, a $15bn blow that would leave quarterly national output at $490bn and the economy about $7bn smaller than before the pandemic.

While the Delta recovery has since proved swifter than anticipated, it remains incomplete.

Unemployment lifted to 5.2 per cent in October after pushing below 5 per cent in June before Delta – although the jobs figures preceded the removal of restrictions in NSW, Victoria and the ACT.

Retail sales data showed a solid bounce in October to levels recorded ahead of the recent lockdowns as households regained their freedom. But the post-Delta retail recovery has been uneven and masks some lingering hurt: spending in department stores, cafes and restaurants, and clothing and footwear stores still well below June levels.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout