Blackout fears mount ahead of Eraring closure

Australia is struggling to build enough renewables and the closure of the nation’s biggest coal plant is worrying the market, Tomago Aluminium warns.

The premature exit of coal stations from the power grid before enough replacement generation is developed will hike the risk of blackouts and price surges, Australia’s largest energy users have warned.

New renewable energy generation projects are being rushed through development but Australia is struggling to build enough zero emission energy sources quickly enough to compensate.

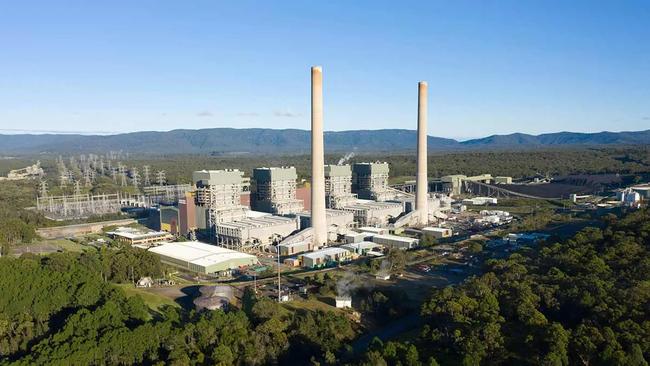

The closure of the country’s biggest coal plant – Origin Energy’s Eraring coal station in NSW which could shut its doors up to seven years early in 2025 – is concerning the market according to Tomago Aluminium, the nation’s largest smelter and biggest single consumer of power.

“It is important not just to navigate the destination but also the transition process,” Tomago chairman David Fallu told The Australian.

“We need to be open minded about the future of Eraring and see it as an opportunity to support the transition pathway rather than having a legislative timetable in mind.”

Greg Everett, chief executive of Delta Electricity which operates a rival coal plant to Eraring at Vales Point, said Australia is on course to be materially short of sufficient capacity.

“I don’t believe the system can operate securely if Eraring closes. Not all of Eraring needs to be there but there is some ongoing requirement,” Mr Everett told The Australian.

“People had an expectation about the pace of transformation and that has not happened. In the end, there is a system requirement that is just maths and physics and these don’t have an ambition. The maths will force the issue.”

Josh Stabler, managing director of consultancy Energy Edge, said the closure of Eraring will cause the most strain on the system in winter 2026, the first peak demand period Australia will endure without the country’s largest coal power plant.

“In an ideal world you would not turn off Eraring until Snowy 2.0 is ready. Snowy is not going to be until ~2029 and if Eraring closes then Australia will be under the serious threat that it will not have enough capacity to meet the evening peak in winter 2026,” said Mr Stabler.

Origin is on course to be acquired by Canadian private equity giant, Brookfield and EIG and the consortium insists it has no plans to delay the closure of Eraring.

That leaves the ball in the court of newly installed NSW energy minister Penny Sharpe, who has said the government will ensure reliable supply, leaving ajar the possibility that the state will strike a so-called closure contract to keep Eraring open.

Closure contracts have been used in some parts of the country. EnergyAustralia said it would close Yallourn in 2028 after striking a deal with the Victorian government to give Australia’s second most populous state enough time to develop sufficient generation capacity. The financial terms of that contract have never been revealed.

Mr Stabler said such an option was the most likely, and the market is already positioning for it.

“You would expect to see the futures price show the impact of the exit of Eraring, but this has not happened. This means, traders do not believe that Eraring will exit,” Mr Stabler told The Australian.

Australia’s historical reliance on coal to generate the bulk of its electricity is rapidly waning as the country moves to decarbonise. The fossil fuel still accounts for just over two-thirds of Australia’s electricity generation, but nearly all coal power stations are likely to be closed by 2035.

Eraring is Australia’s largest coal power generator, supplying about a quarter of NSW’s energy needs. Origin has said it will build a large-scale battery at the site, but energy executives said Australia is unlikely to have sufficient capacity to replace Eraring’s 2880-megawatt function.

Coal power stations are baseload providers, operating on demand and around the clock. Renewable energy is less predictable and so Australia will need to build more than the capacity of retiring coal power stations to ensure reliable supplies.

The generation profile of wind and solar generation also complicates planning. Wind will typically generate more electricity overnight, and solar will only generate during the day when the sun is shining, and analysts said the exit of Eraring will cause particular strain during the evening peak hours, between 5pm and 7pm.

To meet that demand, Australia will need a significant expansion in storage capacity, either batteries of pumped hydro, or gas – which typically operates as a so-called peaker.

Batteries remain prohibitively expensive, though costs are falling, and much-needed critical mineral components have also curtailed installations.

Pumped hydro is seen as the most feasible option. The nation-building project Snowy Hydro 2.0 could easily provide enough dispatchable capacity to replace Eraring, but the pumped hydro project has been beset by delays and is not expected to be online until 2029.

Gas can be turned on and off quickly, supplementing renewable energy, but Australia is experiencing tight east coast supplies and recent federal government intervention has seen a spate of new developments shelved.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout