Australia’s jobless rate falls to 3.5pc amid rising interest rates, high inflation

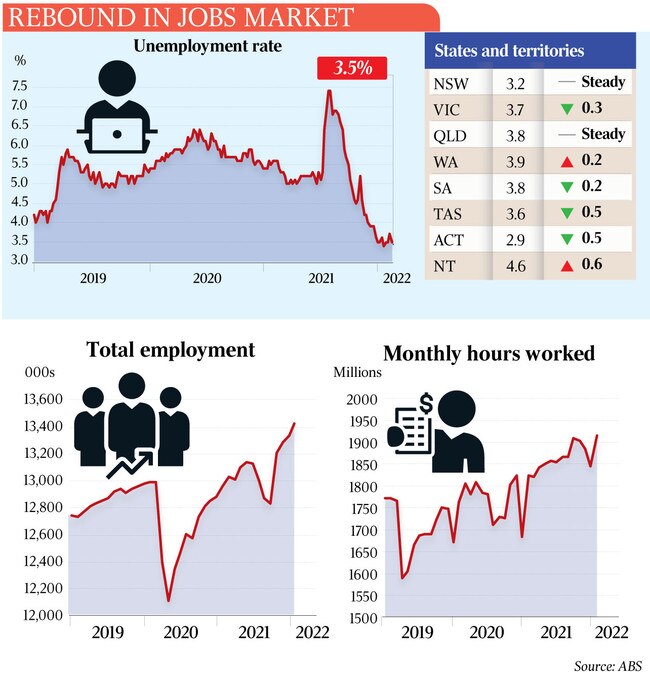

An RBA rate hike next month now looks more likely after the jobs market rebounded in February and the unemployment rate dropped to 3.5 per cent from 3.7 per cent.

Growing signs of fragility in the global banking system may not be enough to prevent a rate hike in April, after “red-hot” jobs growth in February pushed the unemployment rate down to 3.5 per cent and near its 50-year lows recorded late last year.

Employed Australians jumped by 65,000 last month, seasonally adjusted data from the Australian Bureau of Statistics showed, as an anticipated labour market recovery following a summer of job losses proved stronger than expected.

The solid jobs report added to the case for an 11th straight interest rate rise when the Reserve Bank board meets on April 4, economists said, even as giant lender Credit Suisse said it would borrow up to $80bn from the Swiss central bank to stave off concerns over its ability to meet its liabilities.

Amid wild volatility in bond markets and steep losses on the ASX on Wednesday, traders were betting there would be no further RBA hikes, and even a rate cut by July. Analysts were less convinced, with Capital Economics economist Marcel Thieliant describing Wednesday’s employment numbers as “red hot”.

“February’s strong labour force figures will prompt the Reserve Bank of Australia to press ahead with another 25-basis-point hike at its April meeting despite mounting signs of strain in the global banking system,” he said.

Full-time employment increased by 74,900, offset by a 10,300 drop in the number of people employed part-time, ABS data showed.

Underemployment, which measures those with jobs who are trying to get more hours, moved from 6.2 per cent to 5.8 per cent.

EY chief economist Cherelle Murphy said any “signs of weakness in December and January are gone, with more Australians working than ever before, and the number of hours worked also at a record high”.

“For the Reserve Bank, these very important data provide evidence that employers are hiring and there are still upside risks to wages,” EY chief economist Cherelle Murphy said, adding that the nation’s economic fundamentals remained “solid” despite rates climbing from 0.1 per cent in May to 3.6 per cent now.

“With one unemployed person to a job vacancy, there will be ongoing competition for workers for some time yet. This has a number of implications for the household sector but the most important is that for the Reserve Bank, Australian households are, on average, well placed to afford higher mortgage repayments,” she said.

RBA governor Philip Lowe last week raised the prospect of a pause to back-to-back rate hikes at the April 4 board meeting, but said that depended on a run of soft data, including a downbeat labour market report for February.

After NAB’s business survey this week showed little evidence of a meaningful drop in inflationary pressures, the new ABS figures showed the under-utilisation rate, which combines the unemployment and underemployment rates, dropped by 0.5 percentage points to 9.4 per cent.

ABS head of labour statistics Bjorn Jarvis said “the low under-utilisation rate, along with strength in hours worked demonstrates the continued tightness in the labour market”.

Unemployment at 3.5 per cent remains around 50-year lows – testament to the ongoing strength in the labour market despite aggressive rate hikes since May last year.

Employment dropped in both December and January, but economists said unusually strong seasonal factors through the holiday period explained the unexpected weakness and analysts had predicted a recovery in February.

With a higher than usual number of Australians starting new jobs, the workforce participation rate ticked 0.1 percentage points higher to 66.6 per cent.

Despite the ongoing strength in the labour market, an RBA research paper released on Wednesday said the expiry of 880,000 fixed-rate mortgages would expose more vulnerable households to substantially higher monthly repayments.

“The large and discrete increase borrowers with fixed-rate loans have faced or will soon face, in their mortgage payments is one of the factors expected to contribute to slower household consumption in the period ahead,” it said.

“It could ultimately increase the potential for financial stability risks if many borrowers default on their loans … or reduce their consumption to the extent unemployment increases significantly and other borrowers facing unemployment struggle to service debts.”