Worst of inflation behind us, says Jim Chalmers

Rising household costs have slowed consumer spending by more than expected, suggesting the end of the Reserve Bank’s aggressive rate hikes may be only months away.

Rising household costs, including a 25 per cent jump in mortgage interest bills, have slowed consumer spending by more than expected, suggesting the end of the Reserve Bank’s aggressive rate hikes may be only months away.

Jim Chalmers says the worst of the inflation shock should be behind us as falls in the buying power of wages and a dip in household savings took the steam out of the economy in the final three months of the year, offset by a boost to national income from exports.

Rising living costs and a weakening labour market are fuelling fears of a recession, with the central bank still confident its nine increases in official interest rates since May can cool demand, beat inflation and achieve the “soft landing” that economists claim is a narrowing possibility.

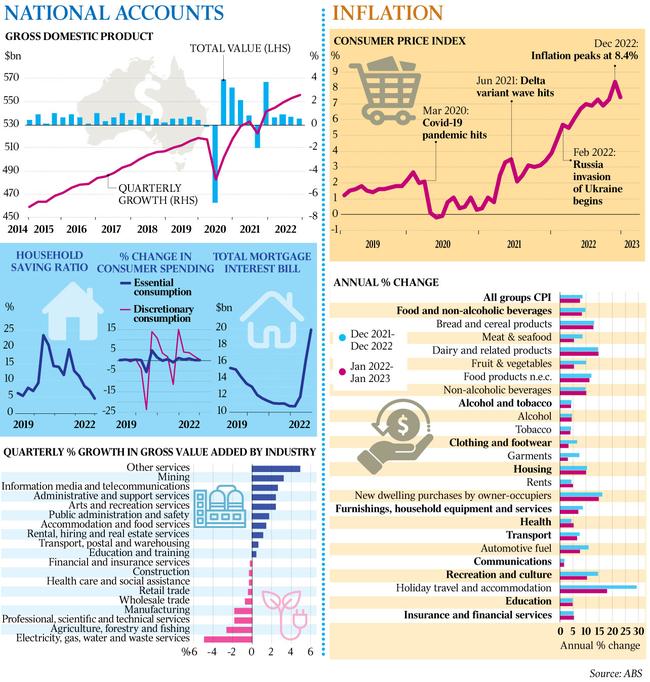

As the Treasurer foreshadowed “substantial challenges” in the year ahead, real GDP in the December quarter lifted by a “soft” 0.5 per cent, down from 0.7 per cent in the previous quarter and well below forecasts for a 0.8 per cent increase.

That left the economy 2.7 per cent larger than a year earlier, seasonally adjusted national accounts figures from the Australian Bureau of Statistics on Wednesday showed.

Booming exports of commodities and tourism alongside the return of international students underpinned growth through the three months, helped only marginally by a disappointingly weak rise in consumption in the quarter as the post-lockdown spending boom ran out of puff.

Australians funded spending by saving markedly less in the quarter as high prices bit into budgets, with the household saving to income ratio dropping again, from 7.1 per cent to 4.5 per cent. That was the lowest since September 2017 and well below the pre-pandemic average of 6 per cent.

Dr Chalmers said the national accounts “show the story of 2022 (and) the unfolding story of 2023 will be a story of some substantial economic challenges – we can’t pretend them away”.

“Interest rates are biting,” he said. “Higher inflation has been biting in our economy. And we’re not immune from global conditions either.

“I’m confident that we can get through this and I’m confident that the worst of inflation is behind us, rather than ahead of us,” Dr Chalmers said.

The Reserve Bank predicts growth will slow to 1.6 per cent in this year and the next.

Westpac chief economist Bill Evans said “the national accounts are depicting an economy where the pressures from rising interest rates and falling real wages are weighing more heavily on household spending than expected at this stage of the cycle”.

“Inflation remains too high but there are signs that despite tight labour markets, wage pressures are easing – exerting even more pressure on the household sector through persistent falls in real wages,” he said.

The comments came as the ABS’s monthly measure of annual inflation dropped from 8.4 per cent to 7.3 per cent in January, buoying hopes that the once-in-a-generation inflationary surge peaked in late 2022.

Despite evidence that tighter monetary policy is putting the brakes on activity, economists expect the RBA to hike rates for the 10th consecutive meeting next Tuesday from 3.35 per cent to 3.6 per cent – and then deliver a further two increases to 4.1 per cent by May.

The eight RBA rate hikes between May and December, which sent the cash rate from 0.1 per cent to 3.1 per cent, flowed through to a 23 per cent jump in mortgage interest payments in the December quarter.

Households dedicated a record $19.9bn to paying interest on home loans in the three months – $3.7bn more than in the September quarter and $9.1bn – or 85 per cent – more than a year earlier.

CBA head of Australian economics Gareth Aird said because of lags in the pass-through of RBA hikes to mortgage interest payments, only about half of last year’s rate rises were flowing through to households at the end of 2022. “Interest both charged and paid will continue to rise very quickly in 2023 as about half of the ultra low fixed-rate mortgages expire,” he said, adding this fixed rate “cliff” would affect about 875,000 households.

“Further rate hikes will lift the portion of household disposable income used to service a mortgage. On our calculations, total mortgage payments, which comprise principal and interest, will rise to a record high as a share of household income over 2023.”

ANZ senior economist Felicity Emmett said the lack of wage pressures was “the most surprising aspect” of the national accounts.

Non-farm earnings per hour – the RBA’s favourite measures of wider labour costs – was flat, leaving annual growth of 2.9 per cent – well below the central bank’s forecast of 4.7 per cent.

Inflation measures reflecting actual household personal consumption in the quarter also eased to 1.5 per cent in December, from 2.1 per cent in September.

“While these data are now dated and don’t fully reflect the impact of the 325bp of cash rate increases since May 2022, they show inflationary pressures and growth have likely peaked,” Ms Emmett said.

“While more timely data will dominate the RBA’s consideration around interest rates, the data raise the risk that the RBA may feel able to pause in its tightening cycle earlier than we currently expect.”

Nominal GDP – before the impact of climbing prices – lifted by a solid 2.1 per cent in the quarter, underlining the continued strength in tax revenue flowing into government coffers.

Before inflation, gross household income grew by 1.6 per cent, but real household disposable income contracted by a substantial 2.2 per cent as real wages went backwards.

In real terms, net trade contributed 1.1 percentage points to GDP in the December quarter, as exports lifted by 1.1 per cent, while imports dropped by 4.3 per cent.

Domestic final demand, however, was unchanged through the three months, as private investment fell by 1.7 per cent, partially offset by the 0.3 per cent increase in consumption.

Government spending also helped offset the drop in private investment, the ABS data showed.

The official monthly inflation figures showed the fastest moving prices over the year to January were a 9.8 per cent jump in housing costs, an 8.2 per cent leap in food prices, and a 10 per cent climb in the cost of recreation activities.

Rents were up 4.8 per cent in the year to January, the ABS data showed.

Holiday travel and accommodation prices surged by 18 per cent in the year to January.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout