A-list Perth broker Andrew Frazer accused of insider trading, points finger at former business partner

Andrew Frazer has denied allegations of insider trading and has, in turn, accused his former business associate of relying on forged documents.

A prominent stockbroker has been accused by his estranged business associate of a string of breaches of the Corporations Act, amid an increasingly acrimonious fight over his purchase of a luxury mansion in Perth’s wealthiest suburb.

Internal broker documents obtained by The Australian accuse Andrew Frazer – a broker who has enjoyed close ties to billionaire Andrew Forrest and a host of Perth’s A-list – of insider trading and multiple breaches of ASX disclosure requirements.

Mr Frazer has emphatically denied the allegations, and has in turn accused his former business associate, Lazarus Capital Partners founder Dale Klynhout, of selling shares without his authorisation and relying on forged documents in their legal battle.

The account through which many of the trades in question were made is registered under the name of Mr Frazer’s mother, Valerie, who is listed as residing at the Peppermint Grove trophy home bought by Mr Frazer in July 2021 for more than $10m.

That Georgian-style six-bedroom, six-bathroom property – described as one of the most opulent homes in Perth – is now at the centre of an ongoing court battle between Mr Frazer and Sydney-based Lazarus Capital Partners, which extended him a $3.34m loan to help him settle that purchase.

Lazarus Capital Partners had loaned that money at a time when it was working in association with Mr Frazer, who rebranded his Perth-based business as Lazarus Corporate Finance.

Amid the ongoing fight by Lazarus Capital Partners to try to recoup those funds, the group prepared a market surveillance review that alleges Mr Frazer authorised multiple share trades under his mother’s name in two ASX-listed companies of which he was a director.

The review alleges Mr Frazer bought shares in ASX-listed Triton Minerals on the eve of the company’s November 2021 announcement of a significant offtake agreement with a Chinese partner for its Ancuabe graphite project in Mozambique.

According to the review, Mr Frazer, the executive director of Triton at the time, then allegedly instructed a broker at Lazarus to sell the shares at a profit shortly after the announcement.

He also allegedly bought and sold hundreds of thousands of dollars worth of shares in tungsten miner Almonty Industries in the months after it was listed on the ASX. Mr Frazer is a director of Almonty and also acted as the lead manager in the company’s IPO.

ASX rules require directors to disclose any change in their interests in their companies, but no such disclosures were made by Mr Frazer.

The review also accused him of holding more than 5 per cent of the total shares in exploration minnow Auris Minerals without disclosing that position to the market. The Corporations Act requires shareholdings of 5 per cent or more in a listed company to be publicly disclosed.

The trades in Triton and Almonty were, according to the market surveillance review, allegedly made through an account in the name of Interstate Investments. ASIC records show Interstate is wholly owned by Mr Frazer’s 83-year-old mother, Valerie Frazer.

But the Lazarus report alleges it was Mr Frazer who gave instructions for the trades, both over the phone and via text message.

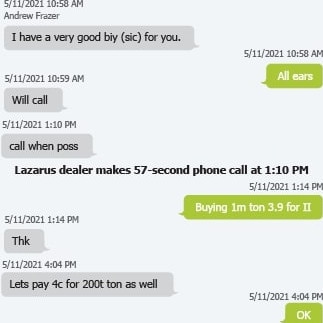

Copies of messages obtained by The Weekend Australian show Mr Frazer allegedly texted a Lazarus dealer on Friday, November 5, 2021, telling him “I have a very good biy (sic) for you”.

Later that day, after a phone call between Mr Frazer and the Lazarus dealer, the dealer sent him a message confirming that he was buying 1 million Triton shares for Interstate.

A few hours later, Mr Frazer allegedly sent a text to the dealer telling him to pay 4c a share for another 200,000 Triton shares.

The following Tuesday, Triton announced it had signed a binding offtake agreement with Chinese graphite products specialist Yichang Xincheng Graphite Co. The stock then hit as high as 5.2c, its highest price since March that year, with Interstate selling its shares that day for a net profit of just over $7500. Multiple other message chains allegedly show Mr Frazer instructing the Lazarus dealer to buy and sell shares in Almonty for the Interstate account.

The market surveillance report also accuses both Mr Frazer’s Lazarus Corporate Finance account and the Interstate Investments account of each holding more than 5 per cent of the total shares in Auris Minerals in March 2020, without either entity publicly disclosing that position.

In a response to questions, Mr Frazer denied all the allegations in the market surveillance report and said his business association with Lazarus Capital Partners ended when Mr Klynhout allegedly sold shares owned by Mr Frazer’s Lazarus Corporate Finance and his clients without his authorisation.

He accused Mr Klynhout of justifying his actions by relying on a fraudulent prime brokerage agreement.

“The signature on the prime brokerage agreement produced by Mr Klynhout was not my signature, the signature was a forgery and Mr Klynhout knew it was a forgery,” Mr Frazer said.

Mr Klynhout, he said, had changed the trading records of Mr Frazer’s Lazarus Corporate Finance by rebooking its share trades with other entities.

He said the trading issues raised in the market surveillance review were part of an effort by Mr Klynhout to gain leverage in their ongoing court battle.

He also noted Mr Klynhout did not raise any concerns about the alleged breaches during his time as a director of Mr Frazer’s Lazarus Corporate Finance.

“My association with Mr Klynhout was highly unsatisfactory and Mr Klynhout cannot be trusted,” Mr Frazer said.

Mr Klynhout told The Australian Mr Frazer had not disclosed his directorships of Triton and Almonty during the time they were both directors of Mr Frazer’s Lazarus Corporate Finance.

He said Mr Frazer’s allegations of a forged prime brokerage agreement and the unauthorised sale of shares belonging to Mr Frazer and his clients related to the triggering of a margin call over Mr Frazer’s holdings when share prices tanked at the outbreak of the war in Ukraine.

“Mr Frazer traded on margins, he fell into a margin call, and we had no choice but to force liquidate,” he said.

“The resulting disaster is that we are left owing over $4.5m to this day.”

The Australian Securities & Investments Commission has been notified of the alleged breaches detailed in the market surveillance report. A spokesman for the watchdog said ASIC was aware of the matter but was unable to comment.

Mr Frazer has long been one of Perth’s highest-profile brokers. He is the former son-in-law of barrister and former West Australian governor Malcolm McCusker and has formerly held senior roles at firms including Morgan Stanley, Patersons Securities, Hartleys and Azure Capital.

In 2009, his old friend Andrew Forrest purchased Mr Frazer’s boat and a holiday house in the state’s southwest when the global financial crisis hit the stockbroker hard. Mr Frazer also had to sell his original Peppermint Grove home around that time.

In more recent years, he has operated under a variety of banners including GMP Securities, Somers & Partners, Pinnacle and, most recently, RM Capital.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout