Act on gas now or businesses will fail, Labor warned

Anthony Albanese has been warned factories will close unless a new price cap is slapped on gas producers, as energy ministers prepare to discuss an intervention in the electricity sector.

Anthony Albanese has been warned factories will close unless a new price cap is slapped on gas producers “in the next few weeks”, as energy ministers prepare to discuss a major intervention into the electricity sector to provide relief for households.

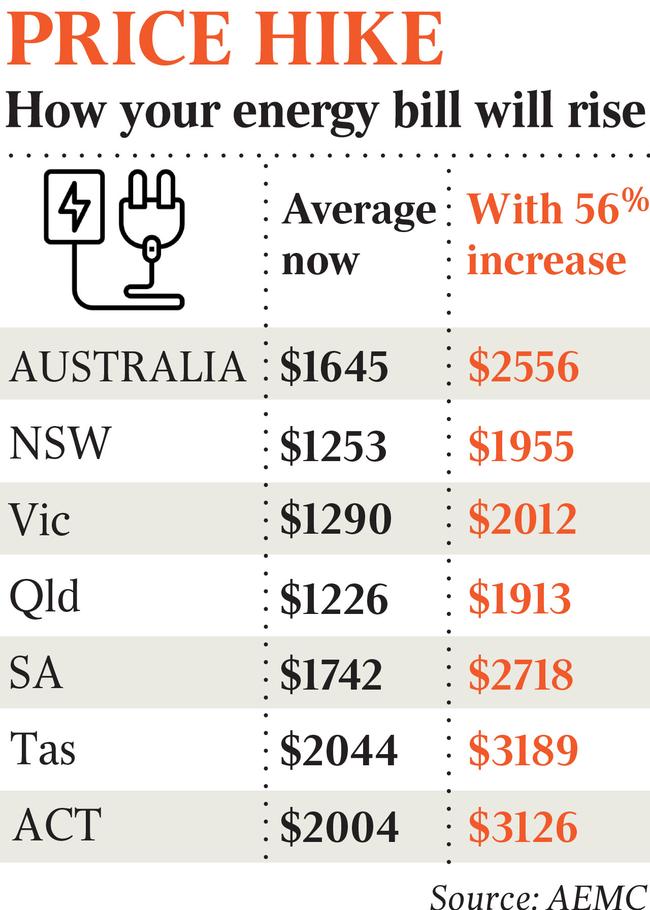

The average annual household electricity bill is set to blow out by nearly $1000 a year – with households to pay more than $2500 a year for power compared to $1645 at the end of last year – if Tuesday’s budget projections of a 56 per cent increase in electricity prices come to pass.

Australian Workers’ Union national secretary Daniel Walton said the raft of budget measures to bring the price of gas down did not go far enough, with more immediate action needed to protect thousands of blue-collar jobs.

“There’s now zero space for delay,” he said. “A number of big manufacturing gas contracts are ending on 31 December and I know the offers they’re getting today are higher than they were before the heads of agreement (between the government and gas producers) was introduced.”

Mr Walton said the government’s plan to reform the gas export trigger and strengthen the code of conduct would take too long to bear fruit.

“So if we don’t get action in the next few weeks, we are going to see factories close. It’s that simple,” he said.

The Australian understands the AWU is planning on leading a delegation of unions, manufacturers and consumer groups in Canberra next month to lobby the government to cap the price of gas, with wholesale prices expected to remain double their average prior to Russia’s invasion of Ukraine.

Energy Users Association chief executive Andrew Richardson, who represents manufacturing businesses, also backed a price cap on gas. “It needs to be on the table,” Mr Richardson said. “Unless something happens pretty quickly, then we are in dire straits.”

Wholesale gas prices were capped at $40 a gigajoule under emergency market conditions in June, but the push from the AWU aims to bring in lower and ongoing caps for domestic customers.

The spot price in east coast markets was between $15 and $20 on Wednesday, up from about $10 a gigajoule in February.

A report by the Australia Institute shows the value of LNG exports increased from $30.5bn in 2020-21 to $70.2bn in 2021-22.

“This $40bn dollar increase occurred with virtually no increase in the cost of production,” it states.

Energy Minister Chris Bowen is expected to discuss options for government intervention in the electricity market at a meeting with state and territory counterparts on Friday. This would likely include working to expedite transmission projects to bring more renewables into the system.

On Monday, Dr Chalmers said there could be a need for tougher regulations on energy companies and did not rule out a new price cap. He also said the government would consider energy supplements in the May budget.

“I don’t want to narrow this or pre-empt what we might be able to do here, and it involves a bit of work with other colleagues and with other levels of government,” he told 3AW radio when asked if the government was looking at capping power prices.

“We’ve made it very clear that we would consider a broader range of options than might have been considered in the past, and that’s because the situation brought about by the war in Ukraine is going to be put substantial pressure on our electricity prices, and therefore on Australians right around the country.

“So if there’s more that we can do, we’ll obviously consider it.”

East coast electricity prices are capped at $15,000 a megawatt hour. According to the Australian Energy Market Operator’s latest quarterly market report, released on Thursday, September quarter wholesale prices fell only slightly from record highs in the previous period, with spot prices averaging $216. This is more than three times the price being paid at the same time in 2021.

Budget figures predicting a sharp rise in household power prices over the next year are mirrored in AEMO’s outlook for wholesale energy prices, with the operator noting futures trading suggests that the closure of AGL’s Liddell coal-fired plant ahead of the peak of winter energy demand is likely to spike costs again in 2023.

Futures contracts reflected higher energy prices in winter than at peak summer loads, the AEMO report states.

“This indicates a market view that winter 2023 energy costs will be higher than the summer period. This reflects the scheduled closure of the remaining Liddell units early in the second quarter of 2023, spot price outcomes in 2022 to date, as well as concerns around ongoing high international energy commodity costs,” the report adds.

Domestic gas prices peaked in early July, according to AEMO’s latest quarterly report, with Sydney spot prices hitting a high of $59.49 a gigajoule, more than five times their September quarter average of $11.16 in 2021.

The government is facing a growing push from energy experts and crossbench MPs to slap a windfall profits tax on coalminers and gas producers and use the revenue to subsidise electricity bills.

Grattan Institute director of energy Tony Wood and Victoria Energy Policy Centre director Bruce Mountain said the government should consider the controversial policy to provide relief for consumers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout